Sodium silicate, also known as water glass, refers to an inorganic compound consisting of silicon, sodium, oxygen, and water. Its synthesis process involves the melting of silica sand and sodium carbonate at high temperatures. Sodium silicate exhibits high alkalinity, solubility in water, and adhesive nature. It is widely used in detergents, paper, textiles, construction activities, water treatment, soil stabilization, fire protection, and adhesive products. Sodium silicate is a cost-effective, versatile, and environmentally friendly product that provides string bonding capabilities and resistance to acid and water.

The widespread product utilization as a coagulant in water purification and wastewater treatment to remove impurities is contributing to the market growth. Furthermore, increasing product adoption as an adhesive and binding agent in automotive manufacturing to maintain vehicle integrity and enhance overall performance is boosting the market growth. Additionally, the growing product demand owing to its cost-effectiveness, making it an attractive option for applications in various industries, such as construction and consumer goods, is positively influencing the market growth.

Moreover, the innovation in technology, which has led to new applications of sodium silicate, including advanced coatings and encapsulation, is strengthening the market growth. Other factors, including rising product utilization in the packaging industry, increasing product application in paper manufacturing, and widespread adoption of sodium silicate in personal care products, are anticipated to drive the market growth.

Sodium Silicate Market Trends/Drivers:

The rapid industrialization activities

The rapid industrialization, particularly in sectors, such as detergents, textiles, and construction, is a primary driver for the market growth. In line with this, sodium silicate’s unique properties, such as its adhesive nature and high alkalinity, make it an essential ingredient in various industrial applications. Furthermore, it is widely used as a builder in the detergent industry, which enhances the cleaning efficiency of surfactants, providing both economical and functional benefits.Additionally, the growing product adoption in the textile industry for bleaching and dyeing processes, where it functions as a stabilizer for hydrogen peroxide, is contributing to the market growth. Moreover, the growing product application in the construction industry as a binding agent in cement and concrete to enhance material strength and durability is positively influencing the market growth.

The implementation of stringent environmental regulations

The escalating focus on environmental sustainability and the implementation of stricter regulations have created a surge in demand for environmentally friendly products, including sodium silicate. In line with this, it is a non-toxic and biodegradable product that is derived from abundant natural resources, which aligns well with the global push toward sustainability.Furthermore, governments and organizations worldwide are endorsing products that minimize harm to the environment, which has led to a shift in both industrial practices and consumer behavior. Sodium silicate, being compliant with most ecological norms, has become a go-to ingredient in various applications. Its utilization instead of potentially harmful alternatives reflects a growing commitment to responsible consumption and manufacturing, aligning with broader environmental objectives.

The increasing urbanization and infrastructural development

The rapid pace of urbanization and infrastructure development, particularly in emerging economies, has significantly contributed to the growth of the sodium silicate market. In line with this, the growing need for construction materials that are both resilient and cost-effective is boosting the market growth. Sodium silicate finds extensive applications in concrete and cement as a setting and strengthening agent, thus making it a valuable component in building projects.Additionally, its use in soil stabilization, which aids in preparing the ground for construction, thus reducing the risk of structural failures, is positively influencing the market growth. Moreover, the increasing number of large-scale projects, such as highways, bridges, and urban housing, which necessitate substances that can resist the wear and tear of daily use, is facilitating the demand for sodium silicate.

Sodium Silicate Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global sodium silicate market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, grade, form, application and end user.Breakup by Type:

- Liquid

- Solid

Liquid dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes liquid and solid. According to the report, Liquid represented the largest market segment.Liquid sodium silicate is dominating the market as it can be easily mixed, applied, or incorporated into various products and processes. This ease of handling and application makes it a convenient choice for manufacturers. Furthermore, it offers remarkable versatility, finding uses in a diverse array of industries, such as construction, detergents, textiles, and water treatment.

Additionally, the production and handling of liquid sodium silicate is more economical compared to its solid counterparts, which aids in attracting businesses looking to optimize production costs. Moreover, it provides better performance characteristics, such as improved adhesion, stabilization, or coagulation, which contributes to its dominance in the market.

Breakup by Grade:

- Neutral

- Alkaline

Alkaline dominates the market

The report has provided a detailed breakup and analysis of the market based on the grade. This includes neutral and alkaline. According to the report, Alkaline represented the largest market segment.Alkaline grade sodium silicate is dominating the market as it is extensively used in the detergent industry, where its high alkalinity acts as a buffering agent and enhances the cleaning properties of detergents. Furthermore, its alkaline nature makes it suitable for water treatment processes, where it aids in adjusting pH levels and works as a coagulant in wastewater treatment. Additionally, the production process for alkaline grade sodium silicate is relatively economical, appealing to industries looking for cost-efficient raw materials. Moreover, its alkaline properties assist in cement hardening and concrete setting, which aligns with the booming construction activities globally.

Breakup by Form:

- Crystalline

- Anhydrous

Crystalline dominates the market

The report has provided a detailed breakup and analysis of the market based on the form. This includes crystalline and anhydrous. According to the report, crystalline represented the largest market segment.Crystalline sodium silicate is dominating the market as it is used in controlled-release applications, such as in agriculture for slow-release fertilizers, which ensures that nutrients are provided to plants over an extended period, thus enhancing efficiency. Furthermore, it can be manufactured to have a higher purity level compared to other forms, which is essential for applications in industries, such as pharmaceuticals, where stringent quality standards must be met. Additionally, crystalline sodium silicate is preferred in applications where environmental impact is a consideration because its solid form aids in reducing the risk of spills and contamination.

Breakup by Application:

- Detergent

- Paints

- Adhesives

- Catalyst

- Refractories

- Tube Winding

- Others

Detergent dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes detergent, paints, adhesives, catalyst, refractories, tube winding, and others. According to the report, detergent represented the largest market segment.Detergent is dominating the market as the alkaline nature of sodium silicate acts as a buffering agent, which aids in enhancing the cleaning properties of detergents. Furthermore, its cost-effectiveness allows manufacturers to formulate economically attractive detergent products. Apart from this, sodium silicate acts as a water softener in detergents, which aids in removing minerals, such as calcium and magnesium. Moreover, the biodegradable and non-toxic nature of sodium silicate aligns with the growing emphasis on environmentally responsible products, thus contributing to its preference in detergent formulations.

Breakup by End User:

- Pulp and Paper

- Construction

- Automotive

- Others

Sodium silicate is widely used in the pulp and paper industry due to its unique properties that cater to various aspects of paper manufacturing and treatment. It aids in the detachment and removal of ink particles from the paper fibers, facilitating the recycling process. Furthermore, sodium silicate acts as a stabilizing agent for other chemicals used in pulp and paper processing, ensuring that the overall chemical environment remains consistent and effective.

Sodium silicate is widely used in the automotive industry as an adhesive for bonding various parts together, such as metal and glass, due to its strong and durable adhesive properties. Furthermore, it aids in creating robust seals in engine components and other parts to prevent leaks and enhance performance. Moreover, sodium silicate adds corrosion resistance to various automotive parts, safeguarding them from rust and degradation.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market, accounting for the largest sodium silicate market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market segment.The Asia Pacific is dominating the sodium silicate market due to the significant growth in various industries, including detergents, pulp and paper, automotive, construction, and chemicals. Furthermore, the rising domestic consumption of consumer products, such as detergents and cleaning agents, where sodium silicate is an essential ingredient, is boosting the market growth. Additionally, the imposition of favorable policies by the regional governments supporting industrial growth through subsidies and incentives is positively influencing the market growth.

Apart from this, the region's abundance of raw materials required for the production of sodium silicate, such as silica sand, which further supports manufacturing and helps in keeping production costs relatively low, is favoring the market growth. Moreover, Asia Pacific has strategically positioned itself as an export hub for chemicals, including sodium silicate, owing to its competitive pricing and production capabilities.

Competitive Landscape:

The top sodium silicate companies are channeling investments into research and development (R&D) to innovate new applications, improve existing processes, and create more efficient and environmentally friendly production methods. Furthermore, they are expanding into new markets through acquisitions, mergers, joint ventures, and strategic partnerships to diversify their presence and tap into emerging opportunities. Additionally, several market players are adopting greener manufacturing processes and developing products that align with environmental regulations and consumer demands for eco-friendly products.Moreover, companies are increasing production capacity through the rapid modernization of their facilities or the construction of new plants, which allows them to meet growing global demands. Apart from this, leading players are offering specialized and tailored products to meet the specific needs of automotive, construction, detergent, and other industries.

The report has provided a comprehensive analysis of the competitive landscape in the global sodium silicate market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- BASF SE

- CIECH S.A.

- Evonik Industries AG

- Kiran Global Chem Limited

- Merck KGaA

- Nippon Chemical Industrial Co. Ltd.

- Occidental Petroleum Corporation

- PPG Industries Inc.

- PQ Corporation

- Sinchem Silica Gel Co. Ltd.

- Solvay S.A.

- Tokuyama Corporation

- W. R. Grace and Co.

Key Questions Answered in This Report:

- What was the size of the global sodium silicate market in 2024?

- What is the expected growth rate of the global sodium silicate market during 2025-2033?

- What are the key factors driving the global sodium silicate market?

- What has been the impact of COVID-19 on the global sodium silicate market?

- What is the breakup of the global sodium silicate market based on the type?

- What is the breakup of the global sodium silicate market based on the grade?

- What is the breakup of the global sodium silicate market based on the form?

- What is the breakup of the global sodium silicate market based on the application?

- What are the key regions in the global sodium silicate market?

- Who are the key players/companies in the global sodium silicate market?

Table of Contents

Companies Mentioned

- BASF SE

- CIECH S.A.

- Evonik Industries AG

- Kiran Global Chem Limited

- Merck KGaA

- Nippon Chemical Industrial Co. Ltd.

- Occidental Petroleum Corporation

- PPG Industries Inc.

- PQ Corporation

- Sinchem Silica Gel Co. Ltd.

- Solvay S.A.

- Tokuyama Corporation

- W. R. Grace and Co.

Table Information

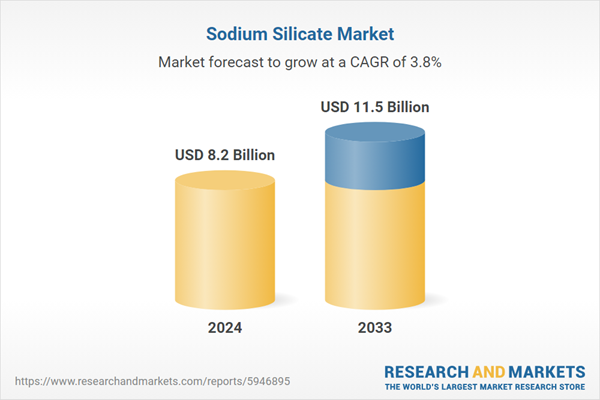

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 8.2 Billion |

| Forecasted Market Value ( USD | $ 11.5 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |