Medical device testing refers to the process of inspecting the design and production efficiency of various active and non-active medical equipment. It involves prototype, biocompatibility, chemistry, microbiology and sterility testing, package validation, electrical, mechanical and functional safety assessments and software testing. These tests are conducted for cardiovascular, neuro and orthopedic devices, dental implants and material components. The service providers also offer in-house or outsourced testing, inspection and certification services to the consumers. These services ensure that the device is reliable and safe to use in clinical or emergency settings. As a result, medical device testing finds extensive applications across hospitals, clinics and other healthcare and diagnostic centers.

The increasing penetration of emerging markets by medical device manufacturers is facilitating the testing demand to comply with a diverse array of regulatory environments across multiple jurisdictions. Additionally, the rising complexity of devices, including multi-component systems and software-integrated devices, which calls for intricate testing protocols, is acting as another growth-inducing factor. Furthermore, the ongoing competitive pressure, which drives companies to achieve certifications and standards that distinguish them from competitors, is favoring the market growth. Besides this, the widespread testing adoption as a proactive risk management strategy to safeguard companies from paying high litigation costs arising from device malfunction or failures is supporting the market growth. Moreover, the surge in global healthcare expenditure, which amplifies the demand for quality-assured medical devices, is positively influencing the market growth.

Medical Device Testing Market Trends/Drivers

The imposition of strict regulatory requirements

The evolving landscape of regulatory requirements is a prominent factor driving the market growth. Organizations across the globe have set forth stringent standards to maintain the safety and efficacy of medical devices. Furthermore, complying with such standards and regulations is not merely an administrative obligation but a strict measure that directly impacts public health. In addition, these requirements help to ensure that no device reaches the market without passing through a rigorous series of tests that verify its safety, effectiveness, and overall quality. Apart from this, the failure to meet these requirements can result in financial penalties, legal repercussions, and irreversible damage to the manufacturer’s reputation. As a result, regulatory compliance is a significant focus for any company in the medical device sector, leading them to allocate substantial resources to testing.The significant technological advancements

The significant pace of technological advancements in the medical device industry is a prominent factor contributing to the market growth. Devices are becoming more intricate, encompassing a variety of functionalities from real-time monitoring to artificial intelligence (AI)-driven diagnostics. This complexity is facilitating the demand for specialized testing services that ensure its efficacy, safety, and reliability. Furthermore, the advent of wearable technology, telemedicine, and personalized medicine, which incorporates complex algorithms, data storage capabilities, and even user interface components, is fueling the demand for a specific set of tests to ensure their robustness and reliability. Additionally, the development of novel testing methodologies that can keep pace with the complexity of emerging technologies is acting as another growth-inducing factor.The growing emphasis on patient safety

Patient safety serves as a critical driver for the medical device testing market. Healthcare institutions and consumers are becoming increasingly aware of the implications of device malfunctions. The impact of a defective medical device can be devastating, ranging from incorrect diagnosis to potentially life-threatening complications. Medical device testing plays a critical role in ensuring patient safety as it provides an added layer of assurance, reducing the likelihood of device-related incidents. Furthermore, the heightened importance of medical device testing due to the imposition of strict regulation by governments and regulatory bodies regarding patient safety is supporting the market growth. Besides this, patients themselves are becoming more informed and are beginning to demand higher standards of care. As a result, medical device producers are facing increasing pressure to invest in rigorous and extensive testing protocols.Medical Device Testing Industry Segmentation

This report provides an analysis of the key trends in each segment of the global medical device testing market report, along with forecasts at the global, regional and country levels for 2025-2033. The report has categorized the market based on service, type, testing type, device class, and device type.Breakup by Service

- Testing Services

- Inspection Services

- Others

The report has provided a detailed breakup and analysis of the market based on service. This includes testing services, inspection services, and others. According to the report, testing services represented the largest segment.

Testing services are dominating the market as medical device manufacturers must adhere to rigorous standards set by regulatory agencies, which necessitates comprehensive testing services to ensure compliance. Additionally, the increasing complexity of medical device design, integrating hardware, software, and sometimes bio-components, requires a broad range of specialized testing services. Furthermore, comprehensive testing is essential for mitigating risks associated with device malfunctions, which could lead to patient harm and legal consequences for manufacturers. Besides this, possessing a thoroughly tested product can serve as a competitive advantage, allowing manufacturers to differentiate themselves in a crowded market based on quality and reliability.

Breakup by Type

- In-House

- Outsourced

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes in-house and outsourced. According to the report, in-house represented the largest segment.

In-house testing allows manufacturers to maintain strict control over their intellectual property, reducing the risk of information leaks that could occur when outsourcing to third-party services. Additionally, manufacturers have the flexibility to develop customized testing protocols that are tailored specifically to their devices, enabling more precise and relevant evaluations. Besides this, conducting tests in-house often results in quicker turnaround times, allowing for faster iterations and shorter time-to-market for new products. Moreover, possessing an in-house testing facility provides greater control over the quality of testing procedures and equipment, ensuring consistency and reliability in results. Apart from this, in-house testing allows for easier integration of testing data with other internal systems, such as design and manufacturing, facilitating a more cohesive product development process.

Breakup by Testing Type

- Biocompatibility Testing

- Chemistry Testing

- Bio-Burden Determination

- Anti-Microbial Activity and Sterility Testing

- Others

A detailed breakup and analysis of the market based on testing type has also been provided in the report. This includes biocompatibility testing, chemistry testing, bio-burden determination, anti-microbial activity and sterility testing, and others. According to the report, anti-microbial activity and sterility testing accounted for the largest market share.

Anti-microbial activity and sterility testing are dominating the market as it is a non-negotiable aspect of medical devices that come into contact with the human body. Any microbial contamination could lead to severe infections, making anti-microbial and sterility testing critical for patient safety. Furthermore, the imposition of stringent guidelines for sterility and anti-microbial properties by regulatory bodies is acting as another growth-inducing factor. Besides this, all categories of medical devices, from surgical instruments to implantable devices, require sterility. Hence, the applicability of this testing type is vast, driving its dominance in the market. Moreover, the rising demand for sterility and anti-microbial testing owing to the heightened awareness and concern about healthcare-associated infections (HAIs) is contributing to the market growth.

Breakup by Device Class

- Class I

- Class II

- Class III

A detailed breakup and analysis of the market based on the device class has also been provided in the report. This includes class I, class II, and class III. According to the report, class II represented the largest segment.

Class II devices make up a large proportion of the medical devices produced and used. Their sheer volume drives a higher demand for testing services. Furthermore, they are often more complex than Class I devices, which necessitates a broad range of testing services, such as mechanical, electrical, and biocompatibility tests. Additionally, Class II devices carry moderate risks and, therefore, require more comprehensive testing compared to low-risk Class I devices, thus increasing the demand for specialized testing services. Besides this, the class II segment is a hotbed for technological innovation, which continually introduces new types of devices or updates to existing ones. Moreover, they have prolonged contact with patients, which imposes additional requirements for safety and effectiveness testing.

Breakup by Device Type

- Implantable Medical Devices

- Non-Active Medical Devices

- In-Vitro Diagnostic Medical Devices

- Ophthalmic Medical Devices

- Others

Implantable medical devices often fall under the highest risk classification in regulatory frameworks due to their critical role in patient health. This necessitates rigorous and extensive testing to ensure safety and efficacy. Furthermore, the complexity of implantable devices, which often feature electronic components, biocompatible materials, and even software, requires a broader range of testing services. Moreover, implantable medical devices are designed to function over extended periods, sometimes for a lifetime. This long-term application requires exhaustive durability and reliability testing.

Non-active medical devices, such as surgical instruments, catheters, and syringes, are produced in higher volumes, which drives a substantial need for testing. Furthermore, they are used across various healthcare settings, including hospitals, clinics, and home care, making their market considerably large and diverse. The wide range of applications calls for versatile testing protocols. Additionally, non-active medical devices are subject to stringent regulatory guidelines concerning material safety, sterility, and mechanical reliability, which necessitates comprehensive testing.

Breakup by Region

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America has one of the most stringent regulatory environments that are pushing companies to invest heavily in comprehensive evaluation processes. This regulatory stringency naturally elevates the demand for advanced testing services. Furthermore, the region is a hub for technological innovation, housing numerous high-tech companies, research institutions, and startups focusing on medical devices. The fast-paced development of new technologies necessitates equally advanced testing services, creating a thriving market. Additionally, North America accounts for a significant proportion of global healthcare spending. The substantial investment in healthcare infrastructure and medical technology feeds into the need for extensive and specialized medical device testing.

Asia-Pacific is experiencing rapid economic growth, which translates into increased healthcare expenditure. This surge in healthcare spending fuels the need for a diverse array of medical devices and, consequently, their testing. Furthermore, the region is undergoing significant expansion in healthcare infrastructure, including hospitals and clinics, which creates a burgeoning demand for certified medical devices and testing services. Additionally, the imposition of various policies by regional governments to strengthen medical device regulations is propelling the market growth.

Competitive Landscape

Top market players are developing cutting-edge testing technologies, such as automation and artificial intelligence (AI) algorithms, that increase testing efficiency and reliability. Furthermore, they are establishing new testing facilities or forming partnerships with local entities to broaden their geographical reach. Additionally, leading companies are working closely with regulatory agencies to ensure that their testing protocols meet or exceed current standards. Apart from this, they are offering specialized testing services, such as biocompatibility testing, electrical safety testing, and mechanical testing, to cater to the diverse needs of clients. Moreover, major players are obtaining international certifications and accreditations to enhance their credibility and build trust among consumers. Along with this, they are adopting a more customer-focused approach, offering tailored solutions that meet the specific needs of individual clients, including after-service support and consultancy.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- American Preclinical Services LLC

- Charles River Laboratories International Inc.

- Element Materials Technology

- Eurofins Scientific LLC

- Intertek Group Plc

- North American Science Associates Inc.

- Pace Analytical Services LLC (LAB Holdings Inc.)

- SGS SA

- Sterigenics U.S. LLC (Sotera Health LLC)

- Toxikon Corporation

- TÜV Rheinland Aktiengesellschaft

- TÜV SÜD Aktiengesellschaft

- WuXi AppTec.

Key Questions Answered in This Report

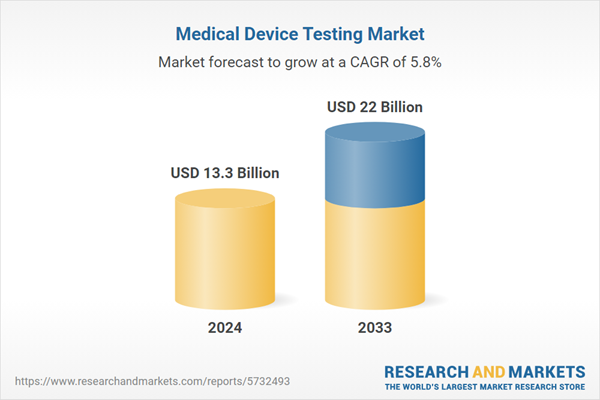

1. What was the size of the global medical device testing market in 2024?2. What is the expected growth rate of the global medical device testing market during 2025-2033?

3. What are the key factors driving the global medical device testing market?

4. What has been the impact of COVID-19 on the global medical device testing market?

5. What is the breakup of the global medical device testing market based on the service?

6. What is the breakup of the global medical device testing market based on the type?

7. What is the breakup of the global medical device testing market based on the testing type?

8. What is the breakup of the global medical device testing market based on the device class?

9. What are the key regions in the global medical device testing market?

10. Who are the key players/companies in the global medical device testing market?

Table of Contents

Companies Mentioned

- American Preclinical Services LLC

- Charles River Laboratories International Inc.

- Element Materials Technology

- Eurofins Scientific LLC

- Intertek Group Plc

- North American Science Associates Inc.

- Pace Analytical Services LLC (LAB Holdings Inc.)

- SGS SA

- Sterigenics U.S. LLC (Sotera Health LLC)

- Toxikon Corporation

- TÜV Rheinland Aktiengesellschaft

- TÜV SÜD Aktiengesellschaft

- WuXi AppTec.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 13.3 Billion |

| Forecasted Market Value ( USD | $ 22 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |