Next-generation sequencing (NGS) is a parallel sequencing technology that determines the sequence of nucleotides in a section of the deoxyribonucleic acid (DNA). It involves various procedures, such as sequencing by synthesis (SBS) and ion semiconductor, single-molecule real-time (SMRT), and nanopore sequencing. It is a cost-effective solution that assists medical professionals in achieving precise results with high accuracy and speed. It also facilitates research in the fields of clinical diagnostics, personalized and genetic medicines, and agriculture and animal studies. At present, it is utilized in pharmacogenomics to escalate the drug delivery process.

Next-Generation Sequencing (NGS) Market Trends:

The growing global geriatric population and the rising prevalence of various chronic medical disorders, such as cancer, cardiovascular, and neurological disorders, represent one of the key factors positively influencing the market. It can also be attributed to the growing use of genetic maps for guiding scientists to analyze the genes that are responsible for medical conditions. In addition, the widespread adoption of liquid biopsies in cancer diagnostics and the increasing utilization of NGS technologies to introduce non-invasive cancer biomarkers for real-time cancer monitoring and detection are creating a positive market outlook. In line with this, continuous technological innovations in sequencers, such as the integration of cloud-computing systems for enhanced data security and management, are strengthening the market growth. Apart from this, continuous financing by governments of various countries to improve healthcare infrastructure is providing a thrust to the market growth. Furthermore, increasing investments by leading players in research and development (R&D) activities for molecular biology, technical engineering, and sequencing chemistry is offering a favorable market outlook.Next Generation Sequencing Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global next generation sequencing (NGS) market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on sequencing type, product type, technology, application, and end-user.Breakup by Sequencing Type:

- Whole Genome Sequencing

- Targeted Resequencing

- Whole Exome Sequencing

- RNA Sequencing

- CHIP Sequencing

- De Novo Sequencing

- Methyl Sequencing

- Others

Breakup by Product Type:

- Instruments

- Reagents and Consumables

- Software and Services

Breakup by Technology:

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Single-Molecule Real-Time Sequencing

- Nanopore Sequencing

- Others

Breakup by Application:

- Biomarker and Cancer

- Drug Discovery and Personalized Medicine

- Genetic Screening

- Diagnostics

- Agriculture and Animal Research

- Others

Breakup by End-User:

- Academic Institutes & Research Centers

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Agilent Technologies, Becton Dickinson and Company, 10x Genomics, BGI Group, Eurofins Scientific, F. Hoffmann-La Roche AG, Illumina Inc., Genewiz, Macrogen, Oxford Nanopore Technologies, Pacific Biosciences, PerkinElmer, Thermo Fisher Scientific, Qiagen N.V., GenapSys Inc., etc.Key Questions Answered in This Report

1. How big is the next generation sequencing (NGS) market?2. What is the expected growth rate of the global next-generation sequencing (NGS) market during 2025-2033?

3. What are the key factors driving the global next-generation sequencing (NGS) market?

4. What has been the impact of COVID-19 on the global next-generation sequencing (NGS) market?

5. What is the breakup of the global next-generation sequencing (NGS) market based on the sequencing type?

6. What is the breakup of the global next-generation sequencing (NGS) market based on the product type?

7. What is the breakup of the global next-generation sequencing (NGS) market based on technology?

8. What is the breakup of the global next-generation sequencing (NGS) market based on the application

9. What is the breakup of the global next-generation sequencing (NGS) market based on the end-user?10. What are the key regions in the global next-generation sequencing (NGS) market?

11. Who are the key players/companies in the global next-generation sequencing (NGS) market?

Table of Contents

Companies Mentioned

- Agilent Technologies

- Becton Dickinson and Company

- 10x Genomics

- BGI Group

- Eurofins Scientific

- F. Hoffmann-La Roche AG

- Illumina Inc.

- Genewiz

- Macrogen

- Oxford Nanopore Technologies

- Pacific Biosciences

- PerkinElmer

- Thermo Fisher Scientific

- Qiagen N.V.

- GenapSys Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 126 |

| Published | January 2025 |

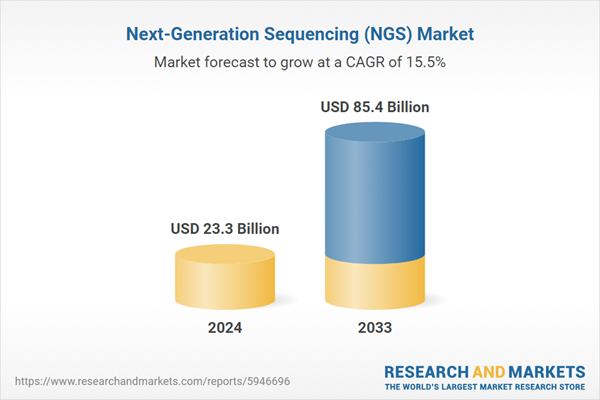

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 23.3 Billion |

| Forecasted Market Value ( USD | $ 85.4 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |