Vertical Cavity Surface Emitting Laser (VCSEL) Market Analysis:

- Major Market Drivers: The vertical cavity surface emitting laser market is mainly driven by the rising demand for high-speed data communication and energy efficient data transmission solutions. VCSELs are highly sought after semiconductor laser diode that are used in various applications because of their low power consumption, high efficiency, and ability to support large scale integrations into dense circuit configurations. Growth in consumer electronics sector mainly in smartphones and wearable technologies necessitates advanced optical sensors and 3D imaging solutions that is powered by VCSELs. These factors are propelling vertical cavity surface emitting laser market growth.

- Key Market Trends: The vertical cavity surface emitting laser market is marked by several key trends that are contributing to its market growth. The rapid adoption of vertical cavity surface emitting laser in consumer electronics for various applications such as facial recognition and augmented reality is one of a significant trend. In line with this, advancements in automotive technologies mainly for autonomous driving systems are propelling the demand for VCSEL- based LiDAR sensors. Furthermore, the ongoing innovation in data communication technologies where vertical cavity surface emitting lasers are indispensable for enabling high speed and energy efficient optical data transmission. These trends show the growing integration of VCSELs across multiple high-tech sectors thereby contributing to the vertical cavity surface emitting laser market growth.

- Geographical Trends: Geographically, the vertical cavity surface emitting laser market is experiencing a significant growth in regions like North America and Asia Pacific. North America leads because of its strong technological advancements and the presence of major tech companies that are investing in vertical cavity surface emitting lasers. Asia Pacific is rapidly catching up, mainly driven by the expansion of consumer electronics and automotive manufacturing in countries like China, South Korea, and Japan. Additionally, Europe’s focus on automotive safety and energy efficient technologies significantly contributes to the regional demand of VCSELs emphasizing it significant position in the global market.

- Competitive Landscape: Some of the major market players in the vertical cavity surface emitting laser industry include ams AG, Broadcom Inc., II-VI Incorporated, Inneos LLC, IQE Plc, Leonardo Electronics US Inc., Lumentum Operations LLC, Teledyne FLIR LLC (Teledyne Technologies Incorporated), The TRUMPF Group, TT Electronics Plc, Vertilas GmbH, Vertilite Inc.among many others.

- Challenges and Opportunities: The vertical cavity surface emitting laser market is poised for growth mainly driven by the rising demand in applications like data communication, 3D sensing and consumer electronics. However, challenges such as technical complexities in manufacturing at scale and maintaining high performance and diverse environmental conditions persist. Opportunities lies in the innovations that enhance efficiency and reduce overall costs thereby potentially expanding vertical cavity surface emitting laser applications into new sectors like automotive and healthcare. Thus, balancing innovation with reliability is important for capitalizing on vertical cavity surface emitting laser market.

Vertical Cavity Surface Emitting Laser (VCSEL) Market Trends/Drivers:

Increased Product Demand in Data Communication and Centers

The rising global demand for higher bandwidth and faster data communication is a prominent driver for the global vertical cavity surface emitting laser market growth. As the digital era matures, businesses and individuals are leaning more toward cloud computing, online streaming, and real-time data analytics, which naturally require robust data infrastructure. According to an article published by Forbes, 99 % of all United States households pay for at least one or more streaming devices. In particular, data centers, which are the backbone of an interconnected world, are seeking components that can facilitate swift and efficient data transfer.They have proven to be effective in achieving short-reach optical fiber connections commonly found in data centers due to their high modulation speed, low power consumption, and efficient thermal dynamics. With data traffic rising exponentially in the coming years, the product demand in data centers is propelling vertical cavity surface emitting laser market growth.

Evolution of Advanced Sensing Technologies

As the world moves towards a more connected and intelligent ecosystem, there's a growing emphasis on advanced sensing technologies. Applications, such as facial recognition, augmented reality (AR), 3D sensing, and advanced driver-assistance systems (ADAS) in vehicles require precise and rapid sensing capabilities. In 2024, Adtran and Vertilas announced the introduction of the industry's first 100Gbit/s PAM4 single-mode vertical-cavity surface-emitting laser (VCSEL) technology, which significantly reduces power consumption in optical engines and modules. This innovation is designed to meet the demands of intra-data center operations and AI/ML workloads, offering unprecedented efficiency and scalability up to 1.6Tbit/s.Along with this, VCSELs have emerged as a preferred choice in these applications due to their superior beam quality and the ability to form arrays for parallel processing. For instance, in facial recognition, they facilitate the illumination required for capturing detailed 3D profiles. As more devices and systems integrate these sophisticated sensing technologies, the product demand is accelerating.

Compactness and Cost-Effectiveness of VCSELs

One of the hallmarks of VCSEL technology is its compactness and scalability. In confluence with this, traditional edge-emitting lasers often require complex alignment, which can be a bottleneck in miniaturizing devices. Sony has been developing Vertical-Cavity Surface-Emitting Laser (VCSEL) technology for optical communication applications, focusing on multi-mode VCSELs with wavelengths in the 850nm band. The company is balancing high-speed characteristics and high reliability in its optical communication VCSEL products. In contrast, these semiconductor lasers are inherently suitable for dense array integration, allowing for the development of smaller, yet more powerful components.This is particularly beneficial in applications like wearable devices, where space is at a premium. Additionally, they can be tested before dicing and packaging, which enhances yield and brings down the cost per unit. This combination of compactness and cost-effectiveness presents a strong case for industries to transition to VCSEL-based components. Therefore, it is positively influencing the market.

Vertical Cavity Surface Emitting Laser (VCSEL) Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global vertical cavity surface emitting laser (VCSEL) market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, material, wavelength, application, and end use industry.Breakup by Type:

- Multi-mode VCSEL

- Single-mode VCSEL

Multi-mode VCSEL dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes multi-mode VCSEL and single-mode VCSEL. According to the report, multi-mode VCSEL represented the largest segment.Multi-mode VCSEL type plays a pivotal role in shaping technological advancements and market demand. They have garnered significant attention due to their ability to transmit data over short distances at high speeds, making them ideal for data centers and other high-bandwidth applications. The increasing adoption of cloud computing, IoT devices, and 5G infrastructure has fueled the demand for efficient data transmission solutions, further propelling the growth of this segment.

Additionally, advancements in manufacturing processes have led to cost reduction, making multi-mode variants more accessible to a broader range of applications. As the demand for faster and more reliable data communication continues to rise, the multi-mode type is expected to maintain its prominence as a vital component in the global industry, driving innovation and enhancing the overall efficiency of modern communication systems.

Breakup by Material:

- Gallium Arsenide

- Gallium Nitride

- Indium Phosphide

- Others

Gallium arsenide dominates the vertical cavity surface emitting laser market share

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes gallium arsenide, gallium nitride, indium phosphide, and others. According to the report, gallium arsenide represented the largest segment.The gallium arsenide material stands as a significant market driver in the global industry due to its exceptional properties and capabilities. It serves as the foundation for VCSELs, offering superior electron mobility and direct bandgap characteristics, enabling efficient light emission at desired wavelengths. These attributes make gallium arsenide an ideal semiconductor material for these lasers, allowing for high-performance optical devices with enhanced power efficiency and reliability. The ever-growing product demand in diverse applications, such as 3D sensing, facial recognition, and automotive LiDAR systems, further bolsters the need for gallium arsenide-based semiconductor laser variants.

As industries increasingly rely on advanced optical technologies for data communication and sensing applications, gallium arsenide remains at the forefront, driving innovation and contributing to the continuous growth of the global industry. Manufacturers and researchers continue to explore new avenues to optimize gallium arsenide's properties, solidifying its position as a key market driver and paving the way for future breakthroughs in this domain.

Breakup by Wavelength:

- Red (650-750 nm)

- Near-infrared (750-1400 nm)

- Shortwave-infrared (1400-3000 nm)

Near-infrared (750-1400 nm) dominates the market

The report has provided a detailed breakup and analysis of the market based on the wavelength. This includes red (650-750 nm), near-infrared (750-1400 nm), and shortwave-infrared (1400-3000 nm). According to the report, near-infrared (750-1400 nm) represented the largest segment.The near-infrared (NIR) wavelength range of 750-1400 nm serves as a vital market driver in the global market, primarily due to its wide-ranging applications and inherent advantages. NIR VCSELs offer unique benefits, including high penetration through various materials, low dispersion in optical fibers, and reduced scattering, making them highly desirable for applications in telecommunications, data communications, and optical sensing. With the accelerating demand for high-speed data transmission and data centers, NIR semiconductor lasers have become instrumental in supporting high-bandwidth communication networks.

In addition, their implementation in consumer electronics, medical devices, and automotive LiDAR systems has further fueled the market demand. As industries continually seek enhanced performance and efficiency in optical devices, the versatility and advantages of NIR wavelength semiconductor laser variants have propelled their prominence. Technological advancements and ongoing research continue to optimize their performance and reliability, further solidifying their role as a crucial market driver and affirming their position as a leading choice in the VCSEL industry.

Breakup by Application:

- Sensing

- Data Communication

- Industrial Heating

- Laser Printing

- LiDAR

- Pulse Oximetry

- Others

Sensing dominates the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes sensing, data communication, industrial heating, laser printing, LiDAR, pulse oximetry, and others. According to the report, sensing represented the largest segment.Sensing applications have emerged as strong market drivers in the vertical cavity surface emitting laser (VCSEL) industry, due to the growing demand for high-precision and reliable sensing technologies across various sectors. They offer several key advantages that make them highly suitable for sensing applications. Their ability to emit light with high directionality and narrow spectral linewidth enables accurate and efficient detection of specific wavelengths, making them ideal for spectroscopic and gas sensing applications. Additionally, these semiconductor lasers can be modulated at high frequencies, allowing for rapid and precise measurements in time-sensitive applications, including distance sensing and 3D imaging.

Moreover, the integration of VCSELs with other sensing technologies, such as photodiodes and microelectromechanical systems (MEMS), further enhances their performance and expands their potential applications in industrial, automotive, consumer electronics, and healthcare sectors. As industries continue to seek innovative sensing solutions, VCSEL-based sensing technologies are expected to maintain their position as crucial market drivers.

Breakup by End Use Industry:

- Telecom

- Mobile and Consumer

- Automotive

- Medical

- Aerospace and Defense

- Others

The mobile and consumer end-use industry has emerged as a prominent market driver in the industry, fueled by the increasing demand for advanced features and functionalities in smartphones, tablets, and other consumer electronic devices. They have revolutionized mobile technology by enabling facial recognition systems, 3D sensing for augmented reality applications, and precise gesture recognition, enhancing user experiences and device security.

As consumers seek faster and more efficient data transmission, VCSELs have become essential components in high-speed optical communication technologies, including fiber-optic data links and Li-Fi. In addition, the adoption of VCSELs in proximity sensors, optical mice, and barcode scanners has further solidified its position in the consumer electronics market.

On the other hand, the telecom end-use industry serves as a crucial market driver in the global industry, primarily driven by the escalating demand for high-speed and reliable data transmission solutions. VCSELs have become integral components in telecommunications networks, enabling high-bandwidth data communication in optical fiber systems. Their ability to modulate data at gigabit speeds and beyond has revolutionized the telecommunications sector, facilitating the rapid transfer of vast amounts of data over long distances with minimal signal degradation. As 5G infrastructure continues to expand and evolve, VCSELs play a vital role in supporting the increased data rates and low-latency requirements of next-generation wireless networks.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest vertical cavity surface emitting laser (VCSEL) market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific region stands as a significant market driver in the vertical cavity surface emitting laser (VCSEL) industry, due to its robust economic growth, technological advancements, and a burgeoning demand for cutting-edge optical technologies. As the region continues to witness rapid industrialization and urbanization, there is an increasing need for high-speed data communication, advanced sensing solutions, and consumer electronic devices. VCSELs, with their versatile applications in data centers, telecommunications, sensing, and consumer electronics, have become instrumental in addressing these demands.

Moreover, the Asia Pacific region is home to numerous leading semiconductor manufacturers and technology companies, fostering a competitive landscape that drives innovation and research in VCSEL technology. Additionally, government initiatives and investments in 5G infrastructure and other emerging technologies further fuel the demand for VCSELs, which are vital components in these advanced systems.

Competitive Landscape:

The global vertical cavity surface emitting laser (VCSEL) market is experiencing significant growth due to the escalating investments in R&D to improve the performance, efficiency, and reliability of their laser devices. They work on enhancing output power, reducing power consumption, and optimizing manufacturing processes to drive down costs. Along with this, the emergence of new applications, such as facial recognition, gesture sensing, automotive LiDAR, and medical applications is positively influencing the market. In addition, several VCSEL manufacturers collaborate with other companies, research institutions, and industry players to leverage complementary expertise and expand their reach into different sectors and markets.Therefore, it is significantly supporting the market. Apart from this, some companies in the VCSEL market are opting for vertical integration by manufacturing their own semiconductor materials or acquiring companies in the VCSEL supply chain. This approach helps ensure better control over the production process and quality of components., further impacting the market. Moreover, the introduction of customization and tailored solutions, enabling clients to have laser devices optimized for their unique applications is contributing to the market.

The report has provided a comprehensive analysis of the competitive landscape in the global vertical cavity surface emitting laser (VCSEL) market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- ams AG

- Broadcom Inc.

- II-VI Incorporated

- Inneos LLC

- IQE Plc

- Leonardo Electronics US Inc.

- Lumentum Operations LLC

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- The TRUMPF Group

- TT Electronics Plc

- Vertilas GmbH

- Vertilite Inc.

Key Questions Answered in This Report:

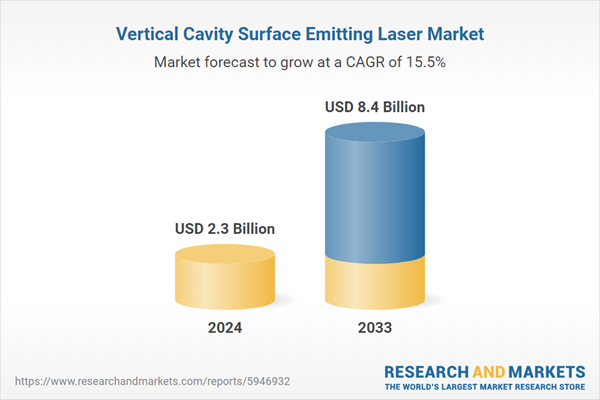

- What was the size of the global vertical cavity surface emitting laser (VCSEL) market in 2024?

- What is the expected growth rate of the global vertical cavity surface emitting laser (VCSEL) market during 2025-2033?

- What are the key factors driving the global vertical cavity surface emitting laser (VCSEL) market?

- What has been the impact of COVID-19 on the global vertical cavity surface emitting laser (VCSEL) market?

- What is the breakup of the global vertical cavity surface emitting laser (VCSEL) market based on the type?

- What is the breakup of the global vertical cavity surface emitting laser (VCSEL) market based on the material?

- What is the breakup of the global vertical cavity surface emitting laser (VCSEL) market based on the wavelength?

- What is the breakup of the global vertical cavity surface emitting laser (VCSEL) market based on the application?

- What are the key regions in the global vertical cavity surface emitting laser (VCSEL) market?

- Who are the key players/companies in the global vertical cavity surface emitting laser (VCSEL) market?

Table of Contents

Companies Mentioned

- ams AG

- Broadcom Inc.

- II-VI Incorporated

- Inneos LLC

- IQE Plc

- Leonardo Electronics US Inc.

- Lumentum Operations LLC

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- The TRUMPF Group

- TT Electronics Plc

- Vertilas GmbH

- Vertilite Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 8.4 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |