Growing use of bearings in motors coupled with the demand for automotive electrification and government initiatives to support the manufacturing sector, and increasing demand for bearings in energy-efficient cars are anticipated to boost the market growth. Also, bearings are used in all kinds of machines and equipment, such as household appliances, aerospace & defence equipment, farm machines, and automobile parts, among others. These wide range of applications is also estimated to boost market growth. Despite the driving factors the climactic uncertainties, high initial investments, and potential job loss are estimated to hinder the market growth.

Growth Influencers:

Growing use of bearing in motors and the demand of automotive electrification

Modern automotive, such as the cars, are focused towards achieving a better total cost of ownership, maximum vehicle uptime, as well as utilization. Bearings constitute to one of the most important components for the enhancing the performance of all the rotating parts. They also assist in in achieving lower system noise. Also, the modern bearings are far more refined as well as technologically advanced as compared to the traditional bearings. There use in the manufacturing of modern powertrains, which are fuel-efficient as well as lead to lesser emissions is rapidly increasing. Hence, growing use of bearing in motors and the demand of automotive electrification is expected to boost the market growth.

Government initiatives to drive the manufacturing industry

Indian government has supportive policies and regulations for ensuring manufacturing of safe products. For instance, the regulatory framework in the country is supported by 3 government institutions - the Bureau of Indian Standards, the Ministry of Heavy Industries & Public Enterprises, and the Ministry of Labour & Employment. India also has supportive policies, such as the National Capital Goods Policy 2016 and the National Policy on Safety, Health & Environment at Workplace 2009, among others. Such policies and institutions help in setting standards & compliance on health, safety, & environment. Furthermore, they also help to increase domestic production, promote exports, mandatory standardization of machines & equipment by adopting ISO, technology improvement, reduce sub-standard imports through standardization, and skill development. All these factors support the manufacturing sector, hence boosting the market growth.

Segments Overview:

The India bearings market is segmented into product, size, material, and application.

By Product,

- Ball Bearings

- Deep Groove Ball Bearings

- Self-Aligning Ball Bearings

- Angular-Contact Ball Bearings

- Thrust Ball Bearings

- Roller Bearings

- Tapered Roller Bearings

- Spherical Roller Bearings

- Cylindrical Roller Bearings

- Needle Roller Bearings

- Mounted Bearings

- Linear Bearings

- Slide Bearings

- Jewel Bearings

- Frictionless Bearings

The roller bearing segment accounted for the largest market share of more than 40% in 2021 owing to their ability to rotate at high speed and with great precision. Within this segment, the needle roller bearings segment is expected to witness the highest growth rate of around 13.2% over the projected period owing to their rising demand in various industries. Within the ball bearings segment, the deep groove ball bearings held the largest market share of around 40% in 2021, due to their high demand, owing to their minimal surface contact and ability to reduce friction.

By Size,

- 30 to 40 mm

- 41 to 50 mm

- 51 to 60 mm

- 61 to 70 mm

- 70 mm and above

The 30 to 40 mm segment held the largest market share of about 11% owing to its increasing demand for various industrial applications. The 41 to 50 mm segment is estimated to hold a market opportunity of more than USD 370 million during 2021 and 2027 owing to their use in automotive sector.

By Material,

- Specialty Steel Alloys

- Plastic

- Ceramics

The specialty steel alloys segment is expected to generate a market size of about USD 3,000 million by 2027 owing to its high usage currently for the manufacturing of various types of bearings.

By Application,

- Automotive

- Industrial

- Aerospace

- Agriculture

- Machine Tools

- Mining

- Railways

- Others

The automotive segment holds more than 45% of the market share in 2021 owing to the growing automotive industry as well as increasing usage of a variety of bearings in the sector. Within the industrial segment, the agriculture sector witness the fastest growth rate of around 12.9% during the forecast period owing to the growing use of machines in the agriculture sector in India. The machine tools segment accounted for the largest market share of around 28% owing to their growing demand in the aerospace industry and high adoption of precision bearings.

Competitive Landscape

Key players operating in the India bearings market include SKF, Schaeffler India Limited, Timken India Ltd., THB Bearings Co. Ltd, NRB Bearings Limited, National Engineering Industries Ltd (NEI), Menon Bearings Ltd, ISB Industries Private Limited, JTEKT India Limited, NTN Corporation, and Other Major Players.

Major 5 players in the market hold about 70% of the market share. These companies are engaged in strategic initiatives, such as partnerships, mergers & acquisitions, and product launches, among others. For instance, in November 2021, SKF extended the product life as well as performance of its mounted tapered roller bearing by adding a superior seal to it. With this, the company created a new product which is able to survive contaminated environment for over 600 hours, i.e., 10 times more than any of its competitors’ product.

The India bearings market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the India bearings market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The India bearings market report answers questions such as:

- What is the market size and forecast of the India bearings Market?

- What are the inhibiting factors and impact of COVID-19 on the India bearings Market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the India bearings Market?

- What is the competitive strategic window for opportunities in the India bearings Market?

- What are the technology trends and regulatory frameworks in the India bearings Market?

- What is the market share of the leading players in the India bearings Market?

- What modes and strategic moves are considered favorable for entering the India bearings Market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- SKF

- Schaeffler India Limited

- Timken India Ltd.

- NRB Bearings Limited

- National Engineering Industries Ltd (NEI)

- ISB Industries Private Limited

- JTEKT India Limited

- NTN Corporation

- THB Bearings Co. Ltd

- Menon Bearings Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | January 2022 |

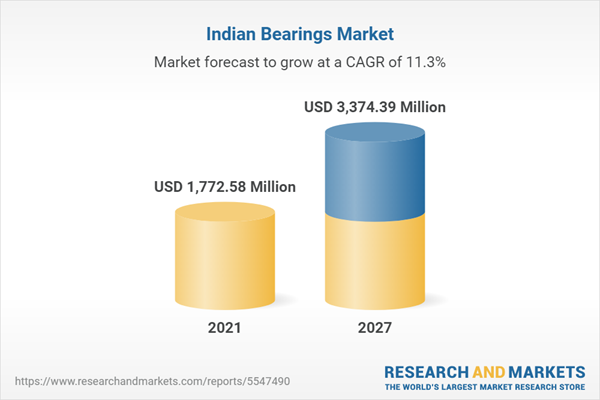

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 1772.58 Million |

| Forecasted Market Value ( USD | $ 3374.39 Million |

| Compound Annual Growth Rate | 11.3% |

| Regions Covered | India |