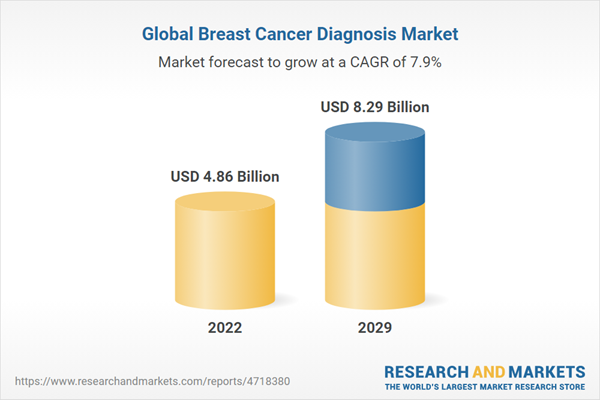

Breast cancer is defined as a malignant tumor formed in the tissues of the breast and has emerged as the leading cancer among women across the globe. The doctors carry out several tests to diagnose the site of initiation as well as to know if the cancer has metastasized to other body parts or not. The breast cancer market is expected to show robust growth during the given forecast period, which may be attributed to the rising prevalence of breast cancer across the globe.

Furthermore, various initiatives are being implemented by governments and organizations worldwide to spread awareness and assist in the early diagnosis of breast cancer, which is anticipated to propel the market's growth during the forecast period. Technological advancements, such as the introduction of hybrid imaging techniques, are also expected to augment the market’s growth in the coming years.

Market Drivers:

The rising prevalence of breast cancer worldwide is anticipated to drive the market.

The cases of breast cancer have been increasing constantly all over the globe, which has led to an increased need for its diagnosis and treatment. According to the WHO, 2.3 million females were diagnosed with breast cancer in 2020, with the number of deaths accounting for 685 thousand. Furthermore, it has surpassed lung cancer in terms of the number of new cases per year and accounts for 11.7% of the total cancer cases worldwide.The World Cancer Research Fund International and the WHO state that the incidence of breast cancer has increased by 20% globally between 2008 and 2020, while mortality has increased by 14%. The cases of breast cancer are projected to continue surging in the coming years as well, which is anticipated to propel the global breast cancer diagnosis market growth during the forecast period. The American Cancer Society estimates that the number of newly diagnosed cases of invasive breast cancer in the United States will be 281,550 in women, and 2,650 cases will be diagnosed among men. Furthermore, as per the American Cancer Society, an estimated death of 44,000 people, including 43,600 women and 530 men, is projected to occur in the year 2021.

Government initiatives for increasing breast cancer diagnosis pose to surge in the market growth.

The governments of countries around the world have been concerned regarding the continuous spread of breast cancer, which can hurt a country's economic condition as well. As a result, governments are launching new initiatives to tackle the rising incidence of breast cancer by increasing awareness and providing aid for early diagnosis.The Australian government runs the "BreastScreen Australia Program", a joint initiative of the Australian and state and territory governments. The program aims to diagnose breast cancer at an early stage and consequently reduce illness and death from breast cancer. In May 2021, the Australian government announced that its federal budget would include more than $100 million for breast and cervical cancer screening programs.

In February 2021, the European Commission presented its "Europe's Beating Cancer Plan", which aims to improve cancer prevention, treatment, and care in the European Union. One of the four key action areas of the plan includes the target of ensuring that 90% of the EU population who qualify for breast cancer screenings, among a few other cancer types, are offered screening by 2025.

Various other initiatives are being launched by governments worldwide that are anticipated to increase the diagnosis of breast cancer and, hence, are projected to propel the market growth in the coming years.

The North American region holds a significant market share.

Geographically, the North American region is anticipated to hold a significant market share owing to its high incidence rate of breast cancer. According to the WHO, North America has an age-standardized (world) incidence rate of 89.4 per 100,000, which is only behind “Australia & New Zealand” and “Western Europe”.Furthermore, a highly developed healthcare system and high awareness among the population are some of the other prominent factors behind the market dominance in North America. The Asia-Pacific region is anticipated to witness substantial growth due to the rising incidences of breast cancer in the region, coupled with various initiatives implemented by the governments to spread awareness and for early detection of breast cancer.

Key Developments:

- June 2023-Paige, a global leader in digital pathology solutions and clinical AI applications, launched its expanded Paige Breast Suite. The suite included Paige Breast Detect, Paige Breast Neoplasm, Paige Breast Mitosis, Paige Breast Lymph Node, and HER2Complete, designed to improve diagnostic efficiency and confidence in breast cancer diagnosis. The suite also includes an AI-powered tool for mitotic counting, a critical element of breast cancer diagnosis. Paige Breast Detect and Neoplasm enable pathologists to prioritize the review of cases and is a clinical-grade and meets regulatory standards.

- May 2023-Pfizer and Thermo Fisher Scientific partnered to enhance local access to next-generation sequencing (NGS)-based testing for lung and breast cancer patients in over 30 countries. The collaboration aims to provide faster gene analysis, enabling healthcare providers to select the right therapy for each patient. Thermo Fisher identify local labs using NGS technology and ensure they have the necessary infrastructure, trained staff, and quality control measures. Pfizer explore affordable patient access and raise healthcare provider awareness about advanced testing benefits.

- May 2023-Hologic praised the USPSTF's recent breast cancer screening guidelines, stating that increasing access to screening is crucial for early detection and saving lives. The company commends the change, recommending women begin screening at age 40, as approximately 60,000 breast cancers are diagnosed in women under 50. Hologic acknowledges that Black women are 40% more likely to develop aggressive cancers at younger ages and die from breast cancer than white women.

- February 2023-HALO Precision Diagnostics introduced the HALO PathWay™ for early breast cancer detection at its Chico, California Breast Care Center. This innovative approach uses advanced imaging, population-based analytics, and genetic testing to provide personalized care. The first of its kind in the US, it aims to save lives by detecting disease in stage 1 or 2 when minimally invasive therapies are available. HALO also has a state-of-the-art genetic testing laboratory in southern California.

Market Segmentation:

By Diagnostic Techniques

- Imaging

- Biopsy

- Laboratory Tests

By Cancer Type

- BRCA Breast Cancer

- ER & PR Breast Cancer

- HER 2 Breast Cancer

- EGFR Mutation Test Breast Cancer

- Others

By End-User

- Hospitals and Clinics

- Cancer Research Centers

- Diagnostic Laboratories

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Italy

- Belgium

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Australia

- New Zealand

- Others

Table of Contents

Companies Mentioned

- Abbott

- Hologic Inc.

- F. Hoffmann-La Roche Ltd

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Koninklijke Philips N.V.

- Siemens AG

- Fujifilm Holdings Corporation

- Myriad Genetics

- Carestream Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | April 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 4.86 Billion |

| Forecasted Market Value ( USD | $ 8.29 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |