Rubber gloves are used across several industry verticals as safety equipment that protects the user as well the object they are working on. Growing healthcare and safety concerns coupled with rising government and industry regulations are expected to drive the market for rubber gloves during the forecasted period. Healthcare and food processing are prime rubber glove end-users, due to high healthcare risk and demand for safety and cleanliness. Robust production is also expected to drive market growth.

Rubber Gloves Market Geographical Outlook

The Asia-Pacific region dominates the market for rubber glove production owing to the region is a hub of natural rubber.

Based on geography, the global rubber gloves market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific regions. The Asia-Pacific region is the largest producer of natural rubber and hence natural rubber gloves. Database of ANRPC states that Thailand, Indonesia, and Malaysia combined produce around 70% of the global rubber and also are key exporters. Malaysia and Indonesia are two dominating natural rubber glove producers in the world. Rising rubber production accompanied by growth in the glove production industry is expected to drive the market during the forecast period.Europe and the North American regions dominate in the production of Synthetic gloves. Germany is a key synthetic glove producer. These regions are also the key rubber glove consumers, owing to strict government laws linked with healthcare and safety accompanied with higher adaption.

Rubber Gloves Market Segmentation Analysis

The medical rubber glove market is expected to show robust growth owing to surging surgeries around the globe.

Based on grade, the global rubber glove market is segmented into medical grade and industrial grade. The medical-grade rubber glove market is projected to grow at a significant pace during the forecast period, owing to rising surgeries around the globe. With the growing advent of diseases and increasing health and body consciousness, medical and cosmetic surgeries are on a rise. Data from the American Society of Plastic Surgeons shows that cosmetic surgeries in the region have surged from 1.790 million in 2017 to 2.314 million in 2020. Furthermore, with growing chronic diseases, especially cases of cardiovascular diseases, and rising stent and bypass surgeries to reduce the impact of cardiovascular diseases is expected to drive the market growth.Rubber Gloves Market Growth Factor

The rise in glove adoption across numerous industry verticals for maintaining safety and cleanliness has increased the demand for rubber gloves in the industry. Furthermore, increasing plastic waste concerns and commitment to zero plastic consumption in the European region will also support the market.One of the prime reasons which are projected to drive significant growth in the global rubber glove market is the implementation of laws and regulations across numerous industry verticals that promote usage of gloves during operation in order to maintain cleanliness and safety. The growing advent of chronic disease coupled increasing risk of spread of harmful disease through touch is expected to increase market adoption of gloves, hence driving the market. Furthermore, increasing plastic waste concerns and commitment of zero plastic consumption by 2050 in the European region to improve the environment is projected to support the market for rubber gloves.

Some of the Major Companies in the Rubber Gloves Market

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Latexx Partners Berhad

The rubber gloves market is analyzed into the following segments:

By Material

- Natural

- Synthetic

By Type

- Powdered

- Powder-free

By Grade

- Medical Grade

- Industrial Grade

By End Users

- Healthcare

- Automotive

- Food Processing

- Construction

- Oil and Gas

- Chemicals

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germane

- United Kingdom

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia-Pacific

- India

- China

- Japan

- Thailand

- Indonesia

- Malaysia

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Cardinal Health

- Riverstone Holdings Limited

- TOWA CORPORATION

- RUBBEREX

- Honeywell International Inc.

- Longcane Industries Sdn. Bhd.

- DIPPED PRODUCTS PLC

- UG Healthcare Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | May 2025 |

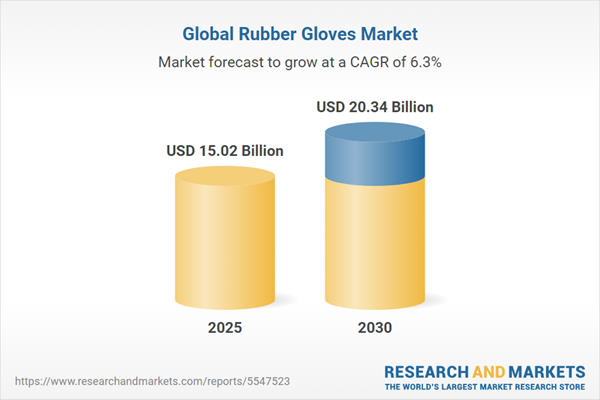

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 15.02 Billion |

| Forecasted Market Value ( USD | $ 20.34 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |