The significant rise in demand for highly secure solutions for transmitting private documents and information between enterprises and legal authorities is majorly driving the virtual data room market growth. Additionally, the virtual data room (VDR) offers businesses a secure platform that enables them to communicate and keep sensitive customer information including contract details, deal discussions, and bidding information from one location to another. Major companies are reporting an increase in their revenue owing to the booming adoption of VDR solutions. For instance, according to BOX's annual report published in 2023, the revenue generated per year has significantly increased from USD 770.77 million in 2020 to USD 990.87 million in 2022, thereby signifying a 28.5% increase.

Further, various companies are focusing on product development leading to market expansion. AvePoint launched Confide, a virtual data room, in January 2022 to help businesses manage their requests for sensitive data and collaborate more securely. The only virtual data room that offers the highest level of security and initiation efficiency is Confide, which is fully integrated with Microsoft 365 and hosted on the user's cloud tenancy. For instance, Telefonica Tech opened the new Virtual Data Centre (VDC) node in Ashburn, Virginia.

Virtual data room market drivers

Rising utilization in mergers & acquisitions is contributing to the virtual data room market expansion

Organizations are concentrating on organizing and securely keeping essential data due to the constant increase in data volume and rise in data sources. The creation of strong platforms on which merger and acquisition (M&A) may be managed with ease is made possible by the development of sophisticated features such as access security, document security, and user interface of virtual data rooms. Additionally, virtual data room providers encrypt their customers' private information using 256-bit and 512-bit algorithms. As a result, BFSI institutions utilize the advantages of VDRs for everyday business operations and employ them as corporate repositories and information exchange tools, which supports market expansion.Virtual Data Room Market Geographical Outlook

North America is witnessing exponential growth during the forecast period.The increasing demand for technologies for securing critical data storage and transferring is fueling the market growth for virtual data rooms in the country. Additionally, the presence of companies such as Vault Rooms Inc., Citrix Systems Inc., and ShareVault in the country is also one of the reasons behind the market growth in the United States. The need for virtual data rooms is also increasing in banking and financial institutes for file storing and data transmission, the massive banking and financial activities in the USA are giving an edge for market growth.

Moreover, the increasing number of product launches by companies in the U.S. is also one of the driving factors for virtual data rooms. For instance, Telefonica Tech set up their Virtual Data Centre in Ashburn, Virginia which is designed particularly to assist businesses in moving their workload to a cloud environment that will keep their data safe, easy to access, and secure along with accessibility.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The virtual data room market is segmented and analyzed as follows:

By Offering

- Software

- Services

By Enterprise Size

- Small

- Medium

- Large

By End-User Industry

- BFSI

- Retail

- Government

- Healthcare

- Communication and Technology

- Others

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Citrix (Vista Equity Partners)

- Intralinks (SS&C Technologies)

- iDeals Virtual Data Room

- Drooms GmbH

- EthosData Virtual Data Room

- SecureDocs (Onit)

- Box

- ShareVault

- Digify

- Ansarada

- Datasite Global Corporation

- Clinked

- Firmex

- OneHub

- DocSend

- Citrix (Vista Equity Partners)

- Intralinks (SS&C Technologies)

- iDeals Virtual Data Room

- Drooms GmbH

- EthosData Virtual Data Room

- SecureDocs (Onit)

- Box

- ShareVault

- Digify

- Ansarada

- Datasite Global Corporation

- Clinked

- Firmex

- OneHub

- DocSend

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | December 2024 |

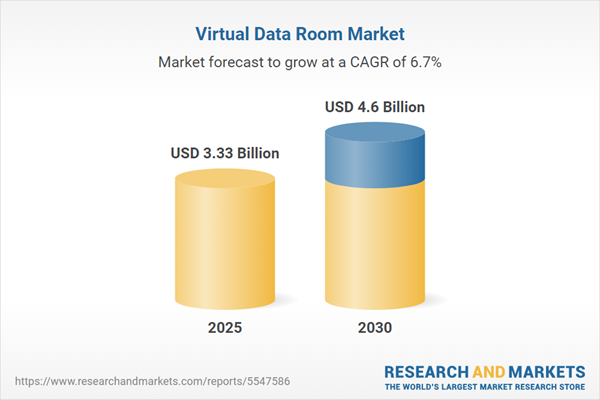

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 3.33 Billion |

| Forecasted Market Value ( USD | $ 4.6 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |