10% Free customization

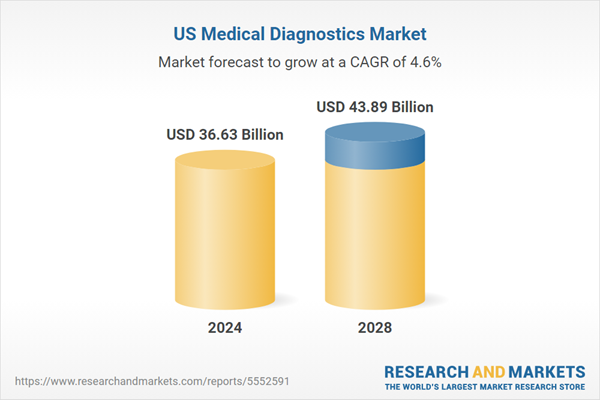

The U.S. medical diagnostics market is anticipated to reach US$43.89 billion in 2028, witnessing growth at a CAGR of 4.62%, over the period 2024-2028. The factors such as increasing geriatric population, growing burden of chronic diseases, escalating penetration of electronic health record (EHR) systems, hike in healthcare expenditure and expanding urbanization would drive the growth of the market. However, the market growth would be challenged by dearth of trained laboratory technicians, high cost of high end molecular diagnostics and in vitro diagnostics devices and challenging premarket approval (PMA) & IVD labelling requirements. A few notable trends include surging adoption of healthcare related devices like wearables, emergence of various pandemic diseases, rising integration with Artificial Intelligence and growing awareness for personalized medicine. This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The U.S. medical diagnostics market has been segmented on the basis of type, product type and end-users. In terms of type, the market can be bifurcated into in-vitro diagnostics and in-vivo diagnostics. The U.S. in-vitro diagnostics market is further divided on the basis of product type and application. Depending on the product type, the U.S. medical diagnostics market can be segmented into reagents, instruments and software & services. Whereas, the market can be split into hospitals, diagnostic centers and Physician Office Labs (POLs) & others, on the basis of end-users.

The fastest growing regional market was Southern U.S., owing to the rising susceptibility of the population to various chronic and infectious diseases, growing adoption of automation in reference laboratories and hospitals, increasing patient awareness about personalized medicine and shifting preference towards point-of-care (POC) testing.

Scope of the report

- The report provides a comprehensive analysis of the U.S. medical diagnostics market segmented on the basis of type, product type, end users and region.

- The major regional and country markets (Southern, Mid-Western, Western and North Eastern U.S.) have been analyzed.

- The market dynamics such as growth drivers, market trends and challenges are analyzed in-depth.

- The company profiles of leading players (Roche Holding AG, Abbott Laboratories, Danaher Corporation, Becton, Dickinson and Company, Quest Diagnostics Inc., and BioMerieux SA) are also presented in detail.

Key Target Audience

- Diagnostic Service Providers

- Diagnostic Products Manufacturers and Distributors of IVD Products

- Hospitals, Public Labs, Diagnostic Centers and Other Stakeholders

- Organizations, Forums and Alliances related to Medical Diagnostics

- Healthcare and Medical Consultants

- Government Bodies & Regulating Authorities

Please note: 10% free customization equates to up to 3 hours of analyst time.

Table of Contents

1. Market Overview

2. Impact of COVID-19

3. The U.S. Market Analysis

4. Regional Market Analysis

5. Market Dynamics

6. Company Profiles

List of Charts

List of Tables

Companies Mentioned

- Roche Holding AG

- Abbott Laboratories

- Danaher Corporation

- Becton, Dickinson and Company

- Quest Diagnostics Inc.

- BioMerieux SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 73 |

| Published | March 2024 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value ( USD | $ 36.63 Billion |

| Forecasted Market Value ( USD | $ 43.89 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 6 |