This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

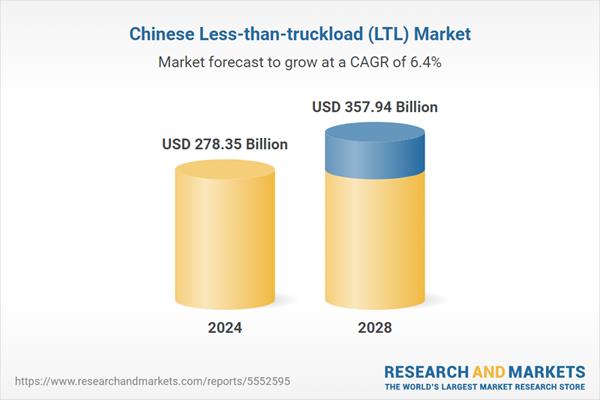

China Less-than-truckload (LTL) market is anticipated to reach US$357.94 billion in 2028, growing at a CAGR of 6.49% during the period spanning 2024-2028. The growth in the market has been driven by factors like rising consumption rate, rising penetration of B2C heavy-goods e-commerce, mounting urban population, omni-channel and delayering of trade distribution, and just in time manufacturing. The market is expected to face certain challenges such as high cost and capital & time intensive. To overcome these challenges, the market would witness some key trends like replacement of regional carriers with express freight networks, technological developments, evolution of commerce landscape and supply chain, and increasing sustainability in LTL transportation.

China Less-than-truckload (LTL) market by component can be segmented as follows: Direct Line & Local Freight Operators and Express Freight Networks. In 2023, the dominant share of the market was held by Direct Line & Local Freight Operators. Further, China’s express freight network market can be divided into two models: Freight Partner Platform Model and Direct Model. In 2023, the dominant share of the market was held by Freight Partner Platform Model.

Scope of the report

- The report provides a comprehensive analysis of the China Less-than-truckload (LTL) market.

- The market dynamics such as growth drivers, market trends and challenges are analyzed in-depth.

- The competitive landscape of the market, along with the company profiles of leading players (SF Holdings, Co.Ltd., ANE Cayman Inc., ZTO Express, Deppon Logistics, Yimidida, Yunda Express) are also presented in detail.

Key Target Audience

- Freight Companies

- LTL Operators

- Logistic Services Providers

- End Users (Consumers)

- Investment Banks

- Government Bodies & Regulating Authorities

Please note: 10% free customization equates to up to 3 hours of analyst time.

Table of Contents

Companies Mentioned

- S.FHoldings Co., Ltd.

- ANE Cayman Inc.

- ZTO Express (Cayman) Inc(ZTO Freight)

- Deppon Logistics Co., Ltd

- Yunda Express

- Yimidida

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 72 |

| Published | March 2024 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value ( USD | $ 278.35 Billion |

| Forecasted Market Value ( USD | $ 357.94 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | China |

| No. of Companies Mentioned | 6 |