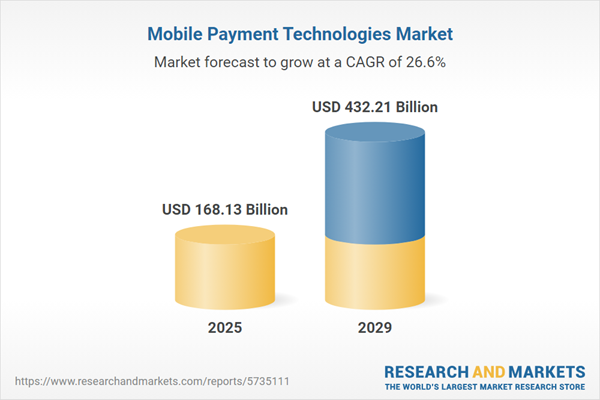

The mobile payment technologies market size has grown exponentially in recent years. It will grow from $135.03 billion in 2024 to $168.13 billion in 2025 at a compound annual growth rate (CAGR) of 24.5%. The growth in the historic period can be attributed to smartphone penetration, digital wallets, consumer convenience, security measures, contactless payments.

The mobile payment technologies market size is expected to see exponential growth in the next few years. It will grow to $432.21 billion in 2029 at a compound annual growth rate (CAGR) of 26.6%. The growth in the forecast period can be attributed to contactless payments continue to rise, emerging markets adoption, iot integration, qr code payments. Major trends in the forecast period include biometric authentication, blockchain and cryptocurrency, retailer-specific apps, iot payments.

Government initiatives aimed at promoting a cashless economy are a key driver for the growth of the mobile payment technologies market. A cashless economy is one in which financial transactions are conducted through digital payment methods rather than physical currency. In this context, governments and central banks around the world are implementing various initiatives to transition toward a cashless economy, which, in turn, fuels the growth of the mobile payment technologies market. For example, in September 2023, CTMfile, a payment technologies company based in the Netherlands, reported that Japan recorded an unprecedented $830 billion (111 trillion yen) in cashless payments in 2022.

Mobile payment technologies fall under the governance of the Payment Services Directives (PSD2), a regulatory framework that extends its jurisdiction throughout the European Union (EU) and the European Economic Area (EEA). This directive is primarily focused on fostering a more unified and harmonized payment landscape within Europe while actively encouraging non-banking entities to participate in this sector, thereby intensifying competition. PSD2 also places a strong emphasis on enhancing the security and safety of payments, leading to increased customer protection and data security. Consequently, these regulatory measures are expected to be a significant driver in the ongoing expansion of the mobile payment technologies market, ensuring a smooth and secure payment experience for both customers and payment service providers.

The integration of the Internet of Things (IoT) with mobile payments is an emerging trend in the mobile payment technologies market. IoT refers to a network of interconnected computing devices, digital and mechanical machines, or people that can transfer data over a network without the need for human-to-human or human-to-computer interaction. Incorporating IoT into mobile payment technologies enhances the payment experience for both consumers and merchants, ensuring smoother and more efficient transactions. As IoT-based mobile payments offer increased convenience and security, more people are adopting mobile payment technologies. For example, in September 2024, PayPal launched its PayPal Complete Payments platform in China. This platform is designed to streamline payment and receivables processes for businesses of all sizes and facilitate cross-border transactions. It includes features like fast fund settlements, reporting and analytics, risk management, and fraud detection.

Key players in the mobile payment technologies market are dedicated to pioneering innovative technologies like PIN on mobile to deliver dependable services to consumers. PIN on mobile, also known as PIN on Consumer-Off-The-Shelf (COTS) devices, is a payment authentication method enabling customers to enter their PIN on a merchant's mobile device. An example of such innovation is evident in the March 2023 launch of Axis Bank's 'MicroPay,' a distinctive 'PIN on Mobile' solution. This solution transforms a retailer's smartphone into a Point-of-Sale (POS) terminal, streamlining digital payments and enhancing the customer experience. With MicroPay, merchants can accept various payment methods, including cards, UPI, and QR codes, at a reasonable cost, leveraging mobile technology and PIN entries on smartphones. This secure card reader allows customers to enter their PIN directly on the merchant's smartphone via Bluetooth connectivity.

In March 2022, RAZORPAY, a comprehensive financial solutions provider based in India, acquired IZealiant Technologies for an undisclosed sum. Through this acquisition, RAZORPAY aims to bolster banks with robust technological infrastructure, enriching the end-user payment experience. IZealiant Technologies, based in India, specializes in providing software solutions to financial institutions. This strategic move reflects the industry's pursuit of enhancing technological capabilities and improving the overall payment experience for users, positioning RAZORPAY to offer advanced services to financial institutions.

Mobile payments refer to the technology or software that enables payments to be made within the boundaries of financial regulations using mobile phones. This technology allows users to pay for goods and services, transfer money, and manage accounts through various methods. Mobile payments offer a convenient, fast, and secure alternative to traditional payment options such as cash or cards.

The payment solutions encompass several types, including point-of-sale (PoS) for in-store and remote transactions. The PoS, the point of customer payment in retail, includes various solutions like near-field communication (NFC), soundwave-based, magnetic secure transmission (MST) payments, and in-store methods such as mobile wallets and quick response (QR) code payments. Remote payment options cover internet payments, SMS transactions, direct carrier billing, and mobile banking. The applications of mobile payment technologies span across retail, e-commerce, healthcare, BFSI (Banking, Financial Services, and Insurance), and enterprise sectors.

The mobile payment technologies market research report is one of a series of new reports that provides mobile payment technologies market statistics, including mobile payment technologies industry global market size, regional shares, competitors with a mobile payment technologies market share, detailed mobile payment technologies market segments, market trends and opportunities, and any further data you may need to thrive in the mobile payment technologies industry. This mobile payment technologies market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the mobile payment technologies market include PayPal Holdings Inc., Mastercard Incorporated, Bharti Airtel Limited, Google LLC, Apple Inc., First Data Corporation, American Express Company, Vodacom Group Limited, Millicom International Cellular S.A., Mahindra Comviva Technologies Limited, Orange S.A., Dwolla Inc., Worldpay Inc., One97 Communications Limited, AT&T Inc., Safaricom Limited, MTN Group Limited, Econet Wireless Zimbabwe Limited, Visa Inc., BlueSnap Inc., PayU Holdings Pvt. Ltd., Bank of America Corporation, Amazon.com Inc., Citrus Payment Solutions Pvt. Ltd., Stripe Inc., SIX Payment Services AG, Paysafe Group Limited, Wirecard AG, Novatti Group Limited, Vodafone Group Plc, Microsoft Corporation, Samsung Electronics Co. Ltd., Square Inc., Ant Group Co. Ltd., Tencent Holdings Limited, Discover Financial Services, JPMorgan Chase & Co.

The Asia-Pacific was the largest region in the mobile payment technologies market in 2024. Asia-Pacific is expected to be the fastest-growing region in the mobile payment technologies industry report during the forecast period. The regions covered in the mobile payment technologies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the mobile payment technologies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The mobile payment technologies market includes revenues earned by entities by technologies, which can be used as a method of payment that does not involve cash or cheques but allows consumers to make immediate payments using portable electronic devices such as smartphones or tablets. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Mobile Payment Technologies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on mobile payment technologies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for mobile payment technologies ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The mobile payment technologies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Solutions: Point-of Sale (POS); in-Store Payments; Remote Payments2) By Remote Payments: Internet Payments; SMS Payments; Direct Carrier Billing; Mobile Banking

3) By Application: Retail and E-Commerce; Healthcare; BFSI; Enterprise

Subsegment:

1) By Point-of-Sale (POS): Contactless Payments; Mobile Wallets (Apple Pay, Google Pay); Near Field Communication (NFC)-enabled Devices; QR Code-based Payments2) By in-Store Payments: Digital Wallets; Mobile Banking Apps; NFC-enabled Payment Terminals

3) By Remote Payments: Mobile Websites/Apps for E-commerce; Subscription-Based Payments (Streaming Services); Peer-to-Peer (P2P) Payment Apps; Mobile Payment Platforms (PayPal, Venmo)

Key Companies Mentioned: PayPal Holdings Inc.; Mastercard Incorporated; Bharti Airtel Limited; Google LLC; Apple Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Mobile Payment Technologies market report include:- PayPal Holdings Inc.

- Mastercard Incorporated

- Bharti Airtel Limited

- Google LLC

- Apple Inc.

- First Data Corporation

- American Express Company

- Vodacom Group Limited

- Millicom International Cellular S.A.

- Mahindra Comviva Technologies Limited

- Orange S.A.

- Dwolla Inc.

- Worldpay Inc.

- One97 Communications Limited

- AT&T Inc.

- Safaricom Limited

- MTN Group Limited

- Econet Wireless Zimbabwe Limited

- Visa Inc.

- BlueSnap Inc.

- PayU Holdings Pvt. Ltd.

- Bank of America Corporation

- Amazon.com Inc.

- Citrus Payment Solutions Pvt. Ltd.

- Stripe Inc.

- SIX Payment Services AG

- Paysafe Group Limited

- Wirecard AG

- Novatti Group Limited

- Vodafone Group Plc

- Microsoft Corporation

- Samsung Electronics Co. Ltd.

- Square Inc.

- Ant Group Co. Ltd.

- Tencent Holdings Limited

- Discover Financial Services

- JPMorgan Chase & Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 168.13 Billion |

| Forecasted Market Value ( USD | $ 432.21 Billion |

| Compound Annual Growth Rate | 26.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 38 |