Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Working Population Across the Region

The increasing proportion of Saudi Arabia’s population engaged in full-time employment is a key growth driver for the online grocery delivery market. In 2024, approximately 73.2% of the population is within the working-age group. This demographic, particularly concentrated in cities like Riyadh and Jeddah, demands efficient and time-saving solutions to manage daily tasks such as grocery shopping. Online grocery platforms cater to this need by offering delivery services that reduce the burden of in-person store visits. The Saudi Vision 2030 initiative, which supports digital transformation across sectors, further complements this demand shift. As dual-income households grow and urban life becomes more fast-paced, digital grocery platforms are becoming an essential part of modern retail, offering convenience tailored to evolving consumer lifestyles.Key Market Challenges

Intense Competition Among Key Players

Saudi Arabia's online grocery delivery market faces significant competitive pressures. Leading players such as HungerStation maintain strong market positions, but the entry of global contenders like Meituan (with its KeeTa app) and the growing popularity of domestic platforms like Mrsool are intensifying rivalry. The landscape is increasingly marked by price wars, rising marketing expenditures, and shrinking profit margins. Differentiation has become a challenge, as platforms race to offer faster delivery times, competitive pricing, and more intuitive user experiences. Balancing customer satisfaction with operational efficiency is essential for survival and success. With consumer expectations continuously rising, companies must constantly innovate while managing cost-effectiveness and service reliability.Key Market Trends

Rise of Quick Commerce (Q-Commerce)

Quick Commerce is reshaping the online grocery delivery market in Saudi Arabia by meeting the growing consumer expectation for ultra-fast delivery - typically within 30 minutes. This trend is accelerating in urban areas like Riyadh and Jeddah, where dense populations and tech-savvy consumers demand rapid fulfillment for everyday essentials such as dairy, snacks, and produce. To meet these expectations, companies are investing in localized distribution models, including dark stores and micro-fulfillment centers. The trend is also influencing logistics strategies and technology investments to improve last-mile efficiency. As consumers increasingly prioritize speed and reliability, Q-Commerce is becoming a core differentiator, shaping service models and intensifying competition in the sector.Key Market Players

- Nana Direct

- LuLu Hypermarket

- Noon AD Holdings One Person Company

- Talabat

- Shgardi

- Zepto Marketplace Private Limited

- Reliance Retail Limited

- Fresh Direct, LLC

- Swiggy Limited

- Fiora Online Limited

Report Scope:

In this report, the Saudi Arabia Online Grocery Delivery Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Online Grocery Delivery Market, By Product Category:

- Fresh Products

- Household Products

- Packaged Food & Beverages

- Personal Care

- Others

Saudi Arabia Online Grocery Delivery Market, By Platform:

- Mobile Application

- Desktop Website

Saudi Arabia Online Grocery Delivery Market, By Mode of Payment:

- Pre Delivery Online Payment

- Card on Delivery

- Cash on Delivery

Saudi Arabia Online Grocery Delivery Market, By Region:

- Eastern

- Western

- Northern & Central

- Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Online Grocery Delivery Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nana Direct

- LuLu Hypermarket

- Noon AD Holdings One Person Company

- Talabat

- Shgardi

- Zepto Marketplace Private Limited

- Reliance Retail Limited

- Fresh Direct, LLC

- Swiggy Limited

- Fiora Online Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | July 2025 |

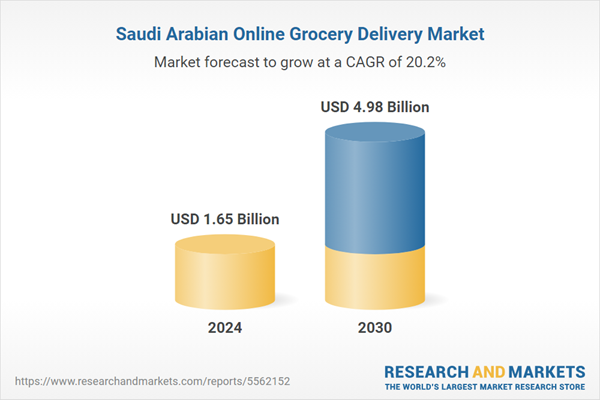

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.65 Billion |

| Forecasted Market Value ( USD | $ 4.98 Billion |

| Compound Annual Growth Rate | 20.2% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |