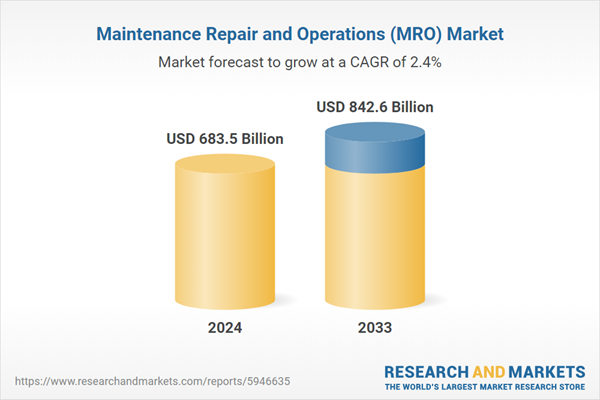

The global maintenance repair and operations (MRO) market size was valued at USD 683.5 Billion in 2024. Looking forward, the publisher estimates the market to reach USD 842.6 Billion by 2033, exhibiting a CAGR of 2.33% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 32.7% in 2024. The market is driven by the increasing level of awareness among individuals and businesses as well about the importance of asset lifecycle management, the growing aspect of sustainability and environmental responsibility, and the increasing outsourcing of MRO services.

Maintenance repair and operations (MRO) refer to a a comprehensive approach that entails the regular upkeep, servicing, and repair of assets to prevent potential breakdowns, minimize downtime, and maximize operational efficiency. It involves various tasks, such as equipment cleaning, lubrication, calibration, and performance assessments. It encompasses routine inspections, scheduled maintenance tasks, and timely replacements of parts and components. It helps reduce the risk of sudden equipment failures that can disrupt operations and lead to costly downtime. It is used by various industries, including manufacturing, healthcare, and aviation, to maintain a smooth workflow and sustain the value of their investments.

The increasing emphasis on sustainability and environmental responsibility is driving the adoption of MRO practices that minimize resource consumption, reduce waste, and enhance energy efficiency. Additionally, the escalating demand for mobile MRO applications to enhance field communication, asset tracking, and task execution, improving overall operational agility is augmenting the industry growth. Apart from this, the accumulation of large amounts of data from sensors and equipment are driving the adoption of data analytics and machine learning. These technologies enable predictive maintenance, performance optimization, and informed decision-making based on historical and real-time data insights. Moreover, various companies are increasingly opting for proactive maintenance contracts with service providers. These contracts guarantee timely inspections, preventive measures, and swift responses to issues, which aid in reducing the risk of unexpected downtime.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

2. How big is the global maintenance repair and operations (MRO) market?

3. What is the expected growth rate of the global maintenance repair and operations (MRO) market during 2025-2033?

4. What are the key factors driving the global maintenance repair and operations (MRO) market?

5. What is the leading segment of the global maintenance repair and operations (MRO) market based on provider?

6. What is the leading segment of the global maintenance repair and operations (MRO) market based on MRO type?

7. What are the key regions in the global maintenance repair and operations (MRO) market?

8. Who are the key players/companies in the global maintenance repair and operations (MRO) market?

Maintenance repair and operations (MRO) refer to a a comprehensive approach that entails the regular upkeep, servicing, and repair of assets to prevent potential breakdowns, minimize downtime, and maximize operational efficiency. It involves various tasks, such as equipment cleaning, lubrication, calibration, and performance assessments. It encompasses routine inspections, scheduled maintenance tasks, and timely replacements of parts and components. It helps reduce the risk of sudden equipment failures that can disrupt operations and lead to costly downtime. It is used by various industries, including manufacturing, healthcare, and aviation, to maintain a smooth workflow and sustain the value of their investments.

The increasing emphasis on sustainability and environmental responsibility is driving the adoption of MRO practices that minimize resource consumption, reduce waste, and enhance energy efficiency. Additionally, the escalating demand for mobile MRO applications to enhance field communication, asset tracking, and task execution, improving overall operational agility is augmenting the industry growth. Apart from this, the accumulation of large amounts of data from sensors and equipment are driving the adoption of data analytics and machine learning. These technologies enable predictive maintenance, performance optimization, and informed decision-making based on historical and real-time data insights. Moreover, various companies are increasingly opting for proactive maintenance contracts with service providers. These contracts guarantee timely inspections, preventive measures, and swift responses to issues, which aid in reducing the risk of unexpected downtime.

Maintenance Repair and Operations (MRO) Market Trends/Drivers:

Technological advancements and Industry 4.0 integration

The advent of Industry 4.0 and continuous technological advancements in smart manufacturing represents one of the key factors positively influencing the industry. Additionally, the integration of the Internet of Things (IoT), sensors, and predictive analytics into equipment and machinery offers real-time insights into their performance and health. This enables companies to adopt proactive maintenance strategies by predicting potential failures before they occur. Additionally, predictive maintenance reduces downtime, minimizes operational disruptions, and optimizes resource allocation. Moreover, the utilization of digital twins virtual replicas of physical assets enhances decision-making processes and facilitates remote monitoring and troubleshooting.Emphasis on asset lifecycle management

The increasing awareness among businesses and individuals about the importance of asset lifecycle management is strengthening the growth of the industry. Additionally, businesses are increasingly recognizing that effective management of assets during procurement and disposal can yield substantial cost savings and improved operational efficiency. Additionally, integrated asset management systems provide comprehensive visibility into the condition, usage, and maintenance history of assets. This facilitates data-driven decision-making, informed repair or replacement choices, and efficient resource allocation. Apart from this, by optimizing the utilization and longevity of assets, companies can extend their return on investment (ROI) and reduce overall operational expenditures, which is driving the adoption of MRO across the globe.Outsourcing of MRO services

The outsourcing of MRO services by businesses seeking to streamline their operations and focus on their core competencies is influencing the industry positively. Outsourcing MRO allows companies to leverage expertise, economies of scale, and access to advanced technologies without the need for significant in-house investments. Apart from this, MRO services offer flexibility, cost-effectiveness, and adherence to industry regulations and standards. This approach enables companies to allocate resources more efficiently, enhance operational agility, and concentrate on their primary business objectives. Furthermore, the increasing adoption of MRO solutions in industries where complex machinery and equipment require specialized maintenance and repair is favoring the market growth.Maintenance Repair and Operations (MRO) Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global maintenance repair and operations (MRO) market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on provider and MRO type.Breakup by Provider:

- OEM

- Aftermarket

OEM dominates the market

The report has provided a detailed breakup and analysis of the market based on the provider. This includes OEM and aftermarket. According to the report, OEM represented the largest segment due to their unparalleled expertise and in-depth knowledge of the products. OEMs possess intricate insights into the design, functionality, and intricacies of their equipment, which makes them uniquely qualified to offer specialized maintenance and repair services. Furthermore, OEMs are synonymous with quality assurance. The use of genuine OEM parts and components during maintenance and repairs guarantees optimal performance and reliability. These authentic parts are specifically engineered to meet the original specifications, ensuring a seamless fit and compatibility. Apart from this, OEMs also excel in technological advancements, leveraging their research and development (R&D) efforts to integrate cutting-edge technologies into their products.Breakup by MRO Type:

- Industrial MRO

- Electrical MRO

- Facility MRO

- Others

Industrial MRO holds the largest share in the market

A detailed breakup and analysis of the market based on the MRO type has also been provided in the report. This includes industrial MRO, electrical MRO, facility MRO and others. According to the report, industrial MRO accounted for the largest market share as the industrial sector relies heavily on complex and specialized machinery and equipment. Industrial MRO offers proactive maintenance, timely repairs, and comprehensive diagnostics to identify potential issues before they escalate. This approach minimizes unscheduled downtime, increases overall equipment effectiveness, and ensures the continuous operation of production lines. Additionally, industrial environments involve high-intensity operations, subjecting equipment to extreme conditions and wear, which drives the adoption of MROs to deal with the challenges posed by heavy usage, exposure to harsh environments, and the wear and tear associated with continuous production.Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance, accounting for the largest maintenance repair and operations (MRO) market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share since the region has a well-established industrial infrastructure. Additionally, European MRO providers offer specialized solutions tailored to the unique requirements of different industry verticals, bolstering their reputation as reliable partners for maintenance and repair. Furthermore, European countries place a significant emphasis on the adoption of environment friendly practices, which promote the adoption of green initiatives. Sustainable maintenance practices, efficient resource utilization, and eco-friendly disposal procedures are integral to European MRO services. Moreover, the region is home to numerous research centers, which support innovation in various industries. This innovation translates into advanced MRO solutions that incorporate cutting-edge technologies such as predictive analytics, IoT integration, and remote monitoring.Competitive Landscape:

Companies are actively engaged in various activities aimed at providing essential services to ensure the optimal functionality, efficiency, and longevity of equipment, machinery, and infrastructure across various industries. Additionally, MRO companies specializing in preventive maintenance are conducting routine inspections and servicing equipment to identify and address potential issues before they lead to costly breakdowns. Furthermore, various MRO companies are offering reactive maintenance services, swiftly responding to unexpected equipment failures or malfunctions. Moreover, they are adopting technological advancements, and integrating digital solutions into their services. This includes utilizing IoT sensors for real-time monitoring, implementing digital twin technologies to simulate equipment behavior, and offering cloud-based platforms for data storage and analysis.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Adolf Würth GmbH & Co. KG

- Airgas Inc. (Air Liquide S.A)

- Applied Industrial Technologies Inc.

- Cromwell Group Holdings Ltd. (W. W. Grainger Inc.)

- Electrocomponents PLC

- Eriks NV (SHV Holdings)

- Genuine Parts Company

- Graybar Electric Company Inc.

- Hayley Group Limited (Descours et Cabaud SA)

- Lawson Products Inc.

- Rexel

- Wesco International Inc.

Key Questions Answered in This Report

1. What is maintenance repair and operations (MRO)?2. How big is the global maintenance repair and operations (MRO) market?

3. What is the expected growth rate of the global maintenance repair and operations (MRO) market during 2025-2033?

4. What are the key factors driving the global maintenance repair and operations (MRO) market?

5. What is the leading segment of the global maintenance repair and operations (MRO) market based on provider?

6. What is the leading segment of the global maintenance repair and operations (MRO) market based on MRO type?

7. What are the key regions in the global maintenance repair and operations (MRO) market?

8. Who are the key players/companies in the global maintenance repair and operations (MRO) market?

Table of Contents

1 Preface3 Executive Summary10 Value Chain Analysis12 Price Analysis

2 Scope and Methodology

4 Introduction

5 Global Maintenance Repair and Operations (MRO) Market

6 Market Breakup by Provider

7 Market Breakup by MRO Type

8 Market Breakup by Region

9 SWOT Analysis

11 Porters Five Forces Analysis

13 Competitive Landscape

List of Figures

List of Tables

Companies Mentioned

- Adolf Würth GmbH & Co. KG

- Airgas Inc. (Air Liquide S.A)

- Applied Industrial Technologies Inc.

- Cromwell Group Holdings Ltd. (W. W. Grainger Inc.)

- Electrocomponents PLC

- Eriks NV (SHV Holdings)

- Genuine Parts Company

- Graybar Electric Company Inc.

- Hayley Group Limited (Descours et Cabaud SA)

- Lawson Products Inc.

- Rexel

- Wesco International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 683.5 Billion |

| Forecasted Market Value ( USD | $ 842.6 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |