Propane is a colorless, odorless gas belonging to the alkane family. It comprises three carbon atoms and eight hydrogen atoms (C3H8) and is widely used as a fuel source for heating, cooking, and various industrial applications. Propane is often derived from natural gas processing or crude oil refining. It becomes a liquefied petroleum gas (LPG) under moderate pressure and is stored in pressurized tanks. Its clean-burning properties and high energy content make it an efficient choice for residential and commercial heating systems, as well as vehicles, portable stoves, and other appliances that require a reliable and versatile source of energy.

The escalating global push towards decarbonization and sustainable energy sources due to environmental concerns and stringent government regulations have bolstered the adoption of propane as a relatively low-emission and efficient fuel source, thus primarily accelerating the market growth. In addition to this, the rising preference for propane over traditional fossil fuels, due to its lower greenhouse gas (GHG) emissions and clean-burning characteristics, across various industrial verticals, households, and transportation sectors are contributing to the market's growth. Furthermore, the petrochemical industry's expanding need for feedstock in the production of plastics and chemicals has heightened the demand for propane as a crucial raw material, creating a positive outlook for market expansion. Besides this, the versatility of propane across sectors, such as transportation, agriculture, and power generation, are contributing to the increasing demand for propane. Moreover, significant technological advancements in propane production, storage, and distribution infrastructure have enhanced the accessibility and affordability of this versatile fuel, thereby strengthening the market growth.

Propane Market Trends/Drivers:

Energy demand and transition

One of the prime drivers of the global propane industry is the evolving energy landscape. With various countries striving towards reducing their carbon footprint and transitioning towards cleaner energy sources, propane emerges as a versatile and environmentally friendly option. Propane's lower carbon emissions compared to traditional fossil fuels, such as coal and oil, position it as an attractive choice for various applications, particularly in residential heating, cooking, and transportation. In regions with restricted access to natural gas pipelines, propane offers an accessible alternative for heating and power generation. Apart from this, its adaptability as a fuel for off-grid areas, remote locations, and backup power systems enhances its demand as countries seek reliable energy solutions.Industrial applications and petrochemical demand

Propane's significance extends beyond energy. The thriving petrochemical industry plays a crucial role in driving propane demand, as it serves as a feedstock to produce plastics, chemicals, and other essential materials. As global consumption of plastics continues to rise, so does the demand for propane. The versatile nature of propane as a building block for various petrochemical processes underscores its importance in the manufacturing sector. The petrochemical industry's growth and innovation rely on a stable and consistent supply of propane, further solidifying its position as a driving force in the market.Market dynamics and supply factors

Geopolitical events, changes in crude oil prices, and supply disruptions exert significant influence on the propane industry. Propane is often a byproduct of natural gas processing and crude oil refining. Therefore, shifts in these industries directly impact propane availability and pricing. In line with this, production changes due to geopolitical tensions or decisions by major oil-producing countries can create fluctuations in supply, bolstering the demand for propane. Furthermore, weather conditions, especially in cold regions where it is essential for heating, are impelling the demand for propane. The balance between supply and demand is a pivotal market dynamic that can determine price trends and trade patterns, influencing market participants' decisions and investment strategies.Propane Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global propane market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on form, grade, and end use industry.Breakup by Form:

- Liquid

- Gas

Liquid propane, often referred to as LPG, is prized for its portability and ease of storage, making it a favored choice for residential, commercial, and industrial settings. Moreover, the expanding use of LPG as a crucial energy source for off-grid locations, remote areas, and outdoor activities, such as camping and grilling, is acting as another significant growth-inducing factor. Besides this, the convenience of transportable LPG cylinders and tanks allows for flexible usage in various appliances, thereby propelling the market forward. Apart from this, the surging need for constant gas propane supply, delivered through pipelines in urban areas and industries for powering heating systems, stoves, and industrial processes efficiently, is strengthening the market growth. Concurrently, the complementary nature of liquid and gas propane caters to diverse energy needs and ultimately impels their combined demand across a spectrum of applications.

Breakup by Grade:

- HD-5 Propane

- HD-10 Propane

- Commercial Propane

The rising use of HD-5 propane in applications that require precise and consistent combustion, such as in forklifts, residential heating, and food processing, owing to its high purity and low moisture content, is contributing to the market's growth. In addition to this, HD-10 propane, with slightly relaxed purity standards, remains a popular choice for similar applications, offering a cost-effective alternative while maintaining acceptable performance. Furthermore, the surging demand for commercial propane across a wide array of industrial verticals, including agriculture, construction, hospitality, and transportation, due to its versatility and adaptability to various equipment and processes, is presenting lucrative opportunities for the market. Concurrent with this, the widespread product utilization as a reliable fuel source, supporting operations ranging from irrigation pumps and space heating to fleet vehicles, is aiding in market expansion.

Breakup by End Use Industry:

- Residential

- Commercial

- Transportation

- Others

Residential holds the largest share in the market

A detailed breakup and analysis of the market based on the end use industry has also been provided in the report. This includes residential, commercial, transportation, and others. According to the report, residential accounted for the largest market share.The growing use of propane in the residential sector is driven by its distinctive advantages and contributions to modern living. As homeowners increasingly prioritize energy efficiency and environmental responsibility, propane emerges as a clean-burning alternative that significantly reduces GHG emissions compared to traditional fossil fuels. Moreover, its versatility in powering a range of residential applications, including space and water heating, cooking, and backup power generation, is contributing to the market's growth. In addition to this, propane's widespread availability, especially in areas without natural gas infrastructure, ensures consistent access to energy for households. Furthermore, ongoing technological advancements have enhanced propane appliances' efficiency and safety, further boosting their appeal.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest propane market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific propane market is experiencing robust growth driven by rapid urbanization, industrialization, and economic development. Besides this, widespread product utilization across various sectors, such as manufacturing, agriculture, and residential heating, is contributing to the market's growth. In countries such as China and India, where energy consumption is soaring, propane serves as a cleaner alternative, aligning with governmental efforts to mitigate air pollution and reduce carbon emissions. Moreover, the expansion of LPG distribution networks and increased consumer awareness are further bolstering propane's role in catering to the rising energy needs of both urban and rural areas. The region's strategic investments in propane infrastructure, coupled with its burgeoning middle class and evolving energy policies, are aiding in market expansion.

Competitive Landscape:

The global propane industry is characterized by a dynamic competitive landscape shaped by various factors. Key players in the market include major oil and gas companies, regional energy providers, and LPG distributors. These players often engage in exploration, production, and distribution activities, influencing supply dynamics. Market competitiveness is also driven by the diverse applications of propane, ranging from residential heating and cooking to industrial processes and transportation. The growth of cleaner energy trends has prompted these companies to invest in research and development to enhance propane efficiency and environmental performance. Geopolitical events, supply disruptions, and fluctuations in crude oil prices significantly shape the competitive environment, impacting pricing and trade dynamics. Regulatory frameworks, environmental policies, and technological advancements further contribute to competitive strategies as companies strive to meet evolving market demands.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Air Liquide S.A.

- BP plc

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ConocoPhillips Company

- Eni S.p.A.

- Evonik Industries AG

- Exxon Mobil Corporation

- GAIL (India) Limited

- Gazprom

- Indian Oil Corporation Ltd.

- Royal Dutch Shell plc

- Saudi Arabian Oil Co.

- TotalEnergies SE

Key Questions Answered in This Report

1. What is propane?2. How big is the propane market?

3. What is the expected growth rate of the global propane market during 2025-2033?

4. What are the key factors driving the global propane market?

5. What is the leading segment of the global propane market based on grade?

6. What is the leading segment of the global propane market based on end use industry?

7. What are the key regions in the global propane market?

8. Who are the key players/companies in the global propane market?

Table of Contents

Companies Mentioned

- Air Liquide S.A.

- BP plc

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ConocoPhillips Company

- Eni S.p.A.

- Evonik Industries AG

- Exxon Mobil Corporation

- GAIL (India) Limited

- Gazprom

- Indian Oil Corporation Ltd.

- Royal Dutch Shell plc

- Saudi Arabian Oil Co.

- TotalEnergies SE.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | May 2025 |

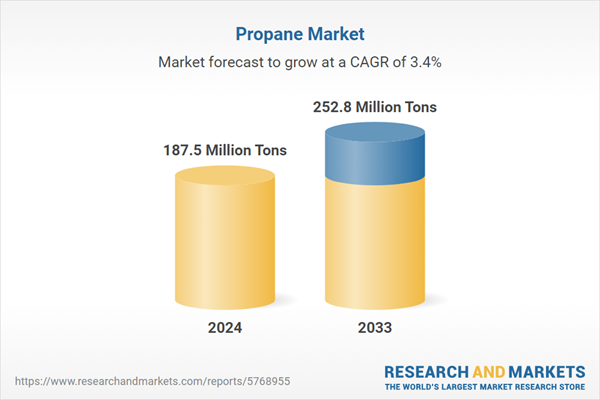

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 187.5 Million Tons |

| Forecasted Market Value by 2033 | 252.8 Million Tons |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |