A digital twin is a digital representation that mirrors a physical object, system, or process using computer programs, real-time data, simulations, and machine learning (ML) techniques. Engineered to be an exact counterpart with real-time data syncing, digital twins serve as a bridge between the physical and digital realms. These virtual models are created using sensors that gather data from the physical world and send it to their digital counterpart. High-fidelity simulation technology often bolsters this data to predict performance, optimize operations, and solve problems. Digital twins have gained prominence across various sectors, including manufacturing, healthcare, and urban planning, offering a wide range of applications from optimizing machine operations to predictive maintenance in complex systems.

The global market is primarily driven by the growing industrial Internet of Things (IoT) adoption, which is leading to increased data generation and analytics capabilities. In line with this, continual advancements in cloud computing technologies are making it easier to store and manage enormous sets of real-time data, providing an impetus to the market. Moreover, the need for efficient resource utilization in large-scale manufacturing is acting as a significant growth-inducing factor for the market. In addition to this, the rising adoption of digital twin technology in healthcare for patient monitoring and diagnostics is opening new avenues for investment. The market is further propelled by increased government spending on digital transformation initiatives. Apart from this, the growth in e-commerce logistics requiring complex supply chain optimizations has led to greater application of digital twins. Some other factors contributing to the market include heightened cybersecurity needs in connected environments, the adoption of virtual reality (VR) and augmented reality (AR), and rising integration of Artificial Intelligence (AI) for predictive analytics.

Digital Twin Market Trends/Drivers:

Rapid expansion of digital transformation across numerous end-use industries

The accelerated pace of digital transformation initiatives is rapidly changing the business landscape, rendering traditional business models obsolete and necessitating new avenues for optimization and innovation. In this milieu, digital twins emerge as a game-changing tool, designed to replicate physical systems in a virtual space accurately. These digital avatars can model various operational scenarios, allowing businesses to test changes in a risk-free environment before deploying them in the real world. This capability is becoming increasingly vital as organizations pivot towards digital-first strategies, where agility and adaptability are paramount. The relevance of digital twins is not confined to any single industry; rather, it is universally applicable - from manufacturing and healthcare to supply chain management and urban planning. Their increasing adoption is thus a crucial indicator of long-term market growth, fueled by the universal emphasis on digital transformation.Growing importance of real-time data analysis

The velocity of data generation is staggering in the modern business ecosystem, and the capability to analyze this data in real-time is evolving into a decisive competitive advantage. Digital twins excel in this regard by offering both real-time monitoring and predictive analytics. By continuously gathering data from their physical counterparts, digital twins offer unparalleled insights into system performance, thereby enabling organizations to preemptively address any potential issues. This proactive approach translates into measurable benefits such as operational cost savings, increased efficiency, and enhanced customer satisfaction. The utility of real-time data extends beyond mere monitoring; it acts as a vital cog in predictive maintenance, quality control, and even disaster management. As the reliance on data analytics becomes increasingly pronounced, the role of digital twins in offering timely, actionable insights gains even greater significance, thereby amplifying market demand.Rapid changes in regulatory compliance

The increasingly stringent legal requirements involving complex operational constraints that are difficult to manage manually is acting as an essential factor driving the market. Digital twins provide a valuable solution to this quandary by modeling how different scenarios affect compliance status. With virtual replicas, organizations can simulate changes in processes or procedures and immediately assess the impact on compliance. This capability is particularly beneficial in industries like pharmaceuticals, energy, and finance, where regulatory scrutiny is intense, and non-compliance can result in severe penalties. Moreover, the agile nature of digital twins allows organizations to adapt quickly to new or revised regulations. For instance, when a new environmental law comes into effect, companies can use digital twins to simulate the impact on their operations, thereby identifying the most cost-effective way to remain compliant. This agility is a market differentiator, enabling organizations to stay ahead of competitors who are slower to adapt.Digital Twin Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global digital twin market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, end use, and region.Breakup by Type:

- Product Digital Twin

- Process Digital Twin

- System Digital Twin

The need for a more accurate and real-time simulation of products is driving the growth of product digital twins. By creating a digital replica of physical products, manufacturers can test, iterate, and optimize designs without the costs associated with physical prototyping. This enhances not only R&D but also the efficiency of the manufacturing process.

On the other hand, operational efficiency and process optimization are the key drivers for the adoption of Process Digital Twins. By digitally mirroring an entire process or production line, organizations can better monitor performance, anticipate issues, and implement improvements. This leads to reduced downtime and a more streamlined operation.

In addition to this, system digital twins are increasingly adopted due to their ability to replicate complex systems, from urban environments to entire ecosystems. These digital replicas allow for comprehensive analysis and simulation, thereby assisting in decision-making and long-term planning for sustainability and growth.

Breakup by Technology:

- IoT and IIoT

- Blockchain

- Artificial Intelligence and Machine Learning

- Augmented Reality, Virtual Reality and Mixed Reality

- Big Data Analytics

- 5G

The rapid expansion of Internet of Things (IoT) and Industrial Internet of Things (IIoT) devices facilitates the data collection required for digital twins. Increased connectivity between devices and systems ensures more accurate and timely data transfer, making digital twins a more effective tool for simulation and analysis.

On the other hand, the blockchain technology provides the secure and transparent transaction layers that are essential for the trustworthy exchange of data in digital twins. Its decentralized nature allows for secure and immutable records, thereby making the digital twin ecosystem more reliable.

In addition to this, artificial intelligence (AI) and machine learning (ML) algorithms are the engines that power the analytical capabilities of digital twins. They process vast datasets to produce actionable insights, enabling organizations to proactively address inefficiencies and capitalize on opportunities.

Moreover, the use of Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR) technologies enriches the digital twin experience by offering immersive, interactive environments. This facilitates more intuitive data visualization and better contextual understanding, making the technology more accessible and useful.

Also, the integration of big data analytics tools amplifies the computational capabilities of digital twins. These tools can handle large-scale data from multiple sources, providing a more nuanced and comprehensive understanding of the systems being modeled.

Furthermore, the rollout of 5G technology significantly boosts the data transfer rates and reliability needed for effective digital twins. The increased bandwidth and lower latency make real-time data analytics and remote monitoring more practical.

Breakup by End Use:

- Aerospace and Defense

- Automotive and Transportation

- Healthcare

- Energy and Utilities

- Oil and Gas

- Agriculture

- Residential and Commercial

- Retail and Consumer Goods

- Telecommunication

- Others

The adoption of digital twins in aerospace and defense is largely driven by the need for enhanced simulation, testing, and training programs. These technologies help in predictive maintenance and real-time monitoring of aircraft and defense systems. The emphasis on security and precision in operations further bolsters the adoption of the technology in this segment.

On the other hand, in the automotive and transportation sector, this technology is being embraced for designing, simulation, and the predictive analytics of vehicles and transportation systems. Factors such as the rise of autonomous vehicles and the push for more efficient supply chain operations contribute to the growing demand. The pursuit of optimizing fuel efficiency and lowering emissions also plays a role.

Moreover, in healthcare, they offer benefits in personalized medicine, patient monitoring, and disease prediction. The COVID-19 pandemic has accelerated the need for remote monitoring solutions, thereby driving demand. Regulatory support for healthcare innovation also contributes to adoption.

Additionally, the energy sector leverages digital twins for real-time monitoring and the predictive maintenance of power plants and energy distribution systems. The transition toward renewable energy sources and the need for optimized energy consumption are significant drivers. Regulatory policies advocating for sustainability further encourage adoption in this segment.

Besides this, the technology in the oil and gas sector is essential for simulating drilling operations and monitoring pipeline integrity. As the sector focuses on operational safety and environmental concerns, the utility of digital twins becomes increasingly valuable. The trend towards automation and data-driven decision-making also propels growth in this segment.

Furthermore, in agriculture, digital twins are employed for crop modeling, climate impact simulations, and precision agriculture. The need to meet the food demands of a growing global population drives technological adoption. Government initiatives to modernize farming techniques also contribute.

Apart from this, the residential and commercial sectors mostly utilize this technology for building information modeling and smart infrastructure planning. The drive for energy-efficient buildings and enhanced occupant comfort are primary motivators. Increasing smart city initiatives across the globe also fuel the demand.

In retail and consumer goods, digital twins find applications in inventory management, customer experience enhancement, and supply chain optimization. The rise of e-commerce and the competitive need for rapid, responsive supply chains are significant factors. Customer demand for personalized experiences also encourages the use of digital twin technology.

Apart from this, for telecommunication, digital twins assist in network design, optimization, and management. The roll-out of 5G and the growing complexity of network infrastructure are key drivers. The need for real-time data analytics for network monitoring and management is another contributing factor.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest digital twin market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America is a key player in the global market due to its early adoption of emerging technologies, robust infrastructure, and significant investments in R&D. The region hosts several major technology companies that are pioneering digital twin technologies. Furthermore, regulatory frameworks in North America are evolving to support digital transformation, encouraging the growth of digital twin solutions.

Additionally, the demand for efficiency and optimization in sectors like healthcare, manufacturing, and energy is accelerating the adoption of digital twins. A strong ecosystem of IoT and IIoT also enhances the data collection capabilities essential for digital twins. Educational institutions in North America are increasingly collaborating with industries to conduct research and offer specialized courses in digital twin technology, thereby fostering a skilled workforce.

With a wide range of application areas, from aerospace to agriculture, the market in North America is poised for significant growth. The presence of numerous startups alongside established companies fosters innovation and competition. Furthermore, consumer awareness and willingness to adopt new technologies play a crucial role in driving the market, making North America a dynamic region in the global landscape.

Competitive Landscape:

The principal participants in the global market are making significant strides in enhancing the capabilities of digital twin technology. They are consistently focusing on integrating artificial intelligence and machine learning to make the digital twins more intelligent and adaptive. These companies are forging partnerships with software providers and technology firms to broaden their service offerings. They are also targeting specific sectors like manufacturing, healthcare, and urban planning to deliver specialized solutions. To maintain a robust growth trajectory, these industry frontrunners are consistently updating their software platforms to ensure interoperability and real-time data analytics. Furthermore, they are heavily investing on regulatory compliance and data security.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- ABB Ltd

- Accenture Plc

- ANSYS Inc.

- AVEVA Group plc (Schneider Electric)

- Cal-Tek Srl

- Cityzenith

- Dassault Systèmes

- General Electric Company

- International Business Machines Corporation

- Microsoft Corporation

- PTC Inc.

- SAP SE

- Siemens AG

Key Questions Answered in This Report

- How big is the digital twin market?

- What is the future outlook of digital twin market?

- What are the key factors driving the digital twin market?

- Which region accounts for the largest digital twin market share?

- Which are the leading companies in the global digital twin market?

Table of Contents

Companies Mentioned

- ABB Ltd

- Accenture Plc

- ANSYS Inc.

- AVEVA Group plc (Schneider Electric)

- Cal-Tek Srl

- Cityzenith

- Dassault Systèmes

- General Electric Company

- International Business Machines Corporation

- Microsoft Corporation

- PTC Inc.

- SAP SE

- Siemens AG

Table Information

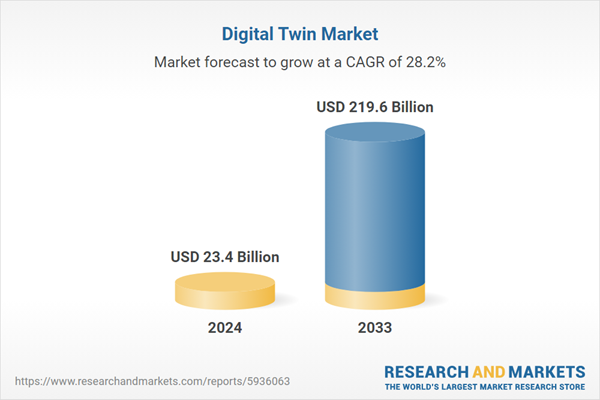

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 23.4 Billion |

| Forecasted Market Value ( USD | $ 219.6 Billion |

| Compound Annual Growth Rate | 28.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |