Generic drugs are medications that are bioequivalent to brand-name drugs in terms of active ingredients, dosage form, strength, route of administration, quality, safety, and efficacy. They consist of a wide range of medications, including ibuprofen, metformin, and simvastatin. They are produced after the patent protection of the brand-name drug expires. They are approved by regulatory authorities and available at affordable prices. They play a vital role in managing various health conditions, such as hypertension, diabetes, infections, and cardiovascular diseases. They are essential in improving affordability, particularly for individuals without comprehensive insurance coverage or facing high expenses.

The increasing demand for generic drugs due to the rising number of patent expirations of brand name drugs is impelling the growth of the market. Besides this, the growing cost of healthcare services around the world is offering a favorable market outlook. In addition, the increasing geriatric population across the globe experiencing various chronic conditions, such as cardiovascular diseases, diabetes, and respiratory disorders, is contributing to the growth of the market. Apart from this, the rising number of collaborations between key market players to increase the production of various generic drugs is supporting the growth of the market. Additionally, the increasing integration of technologically advanced equipment in the pharmaceutical industry to produce various complex generic drugs with specialized formulations is bolstering the growth of the market.

Generic Drugs Market Trends/Drivers:

Rising prevalence of chronic diseases

At present, there is an increase in the prevalence of chronic diseases among the masses due to the rising adoption of unhealthy lifestyle habits. Sedentary lifestyles and poor diet (increased consumption of processed and fast foods) are significant contributors to a rise of chronic ailments like diabetes, heart disease, and certain cancers. Apart from this, the excessive consumption of alcohol and tobacco is propelling the occurrence of various chronic disorders, such as hypertension and cardiovascular complications. In addition, chronic stress, often a byproduct of the modern, fast-paced lifestyle, can contribute to a host of health problems, including heart disease and mental illness. However, enhanced screening and diagnostic tools are leading to better, earlier, and more frequent detection of chronic conditions. Furthermore, the consumption of various generic drugs is helping patients to treat a wide array of chronic diseases.Growing research-related activities in the pharmaceutical industry

At present, there is an increase in research activities in the pharmaceutical industry to develop treatments and vaccines for emerging diseases. Besides this, the demand for medications is increasing as the geriatric population is rising around the world. Moreover, recent breakthroughs in areas, such as genomics, proteomics, and bioinformatics, are opening new avenues for drug discovery and development. The ability to manipulate genes and proteins at a molecular level, and the increasing understanding of disease mechanisms at the molecular and genetic levels, are paving the way for the development of targeted therapies. Apart from this, pharmaceutical companies are investing in manufacturing various generic versions of branded drugs to make them affordable and easily accessible for patients.Increasing number of government initiatives to provide affordable healthcare services

Governing agencies of various countries are heavily investing in making healthcare services affordable and finding treatments for various chronic illnesses. They are also taking numerous initiatives, including subsidizing healthcare costs, implementing policies to reduce the cost of drugs, providing insurance coverage, and investing in public health facilities and programs. Apart from this, governing authorities of various countries are focusing on reducing health disparities among different income and social groups by constructing free clinics in various rural areas. These clinics are also prioritizing generic drugs and various other medications for nominal prices, along with free checkups.Generic Drugs Market Trends:

The growing global geriatric population and the rising occurrence of chronic medical disorders, such as cancer, diabetes, and cardiovascular diseases, represent one of the key factors positively influencing the market. In addition, changing dietary patterns and hectic schedules of individuals are leading to various conditions, which, in turn, is catalyzing the demand for generic drugs worldwide. Along with this, increasing efforts by governments of various countries to reduce healthcare costs and promote the manufacturing and uptake of generics are contributing to the market growth. They are also encouraging key players to introduce effective generic drugs and provide easy availability. Apart from this, the low production cost of generic medicines is creating a positive outlook for the market. Additionally, the expansion of the pharma companies and medical stores across the globe is further augmenting the market growth. Furthermore, the rising focus of leading manufacturers on partnership strategies to launch new products is propelling the market growth. Moreover, increasing investments in extensive research and development (R&D) activities and technological advancements in medicine formulation are anticipated to drive the market.Generic Drugs Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global generic drugs market report, along with forecasts at the global and country levels from 2025-2033. Our report has categorized the market based on therapy area, drug delivery, and distribution channel.Breakup by Therapy Area:

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

Central nervous system dominates the market

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others. According to the report, central nervous system represented the largest segment.Generic drugs play a significant role in the treatment of various central nervous system (CNS) disorders. They offer several benefits, including affordability, accessibility, and comparable efficacy to their brand-name counterparts. They comprise serotonin reuptake inhibitors (SSRIs), such as fluoxetine, sertraline, and escitalopram, that are commonly prescribed for these conditions. They also consist of antiepileptic drugs, including levetiracetam, lamotrigine, and topiramate, which are commonly prescribed and have proven efficacy in controlling seizures. They are used to treat Parkinson’s disease and attention deficit hyperactivity disorder (ADHD).

Generic drugs are employed for curing cardiovascular complications, such as hypertension or hypertension, coronary artery diseases, heart failure, and arrhythmias. They consist of diuretics, aldosterone antagonists, digoxin, beta-blockers, and calcium channel blockers.

Breakup by Drug Delivery:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

Oral holds the largest share in the market

A detailed breakup and analysis of the market based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers. According to the report, oral accounted for the largest market share as they are generally easy to administer and can be self-administered by the patient. They can be taken at home or on the go without the need for medical supervision or assistance. Besides this, oral drugs can be obtained from pharmacies, hospitals, or prescribed by healthcare providers, making it convenient for patients to obtain and take their medications. They can be taken in a non-invasive manner by eliminating the need for needles, injections, or invasive procedures, which can be uncomfortable or cause anxiety for some individuals. They can get absorbed through the digestive system, allowing for efficient delivery into the bloodstream. Furthermore, oral medications offer a higher level of patient compliance as they are easy to consume regularly.Breakup by Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

Retail pharmacies account for the majority of the market share

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail pharmacies and hospital pharmacies. According to the report, retail pharmacies accounted for the largest market share.Retail pharmacies, also known as community pharmacies or outpatient pharmacies, are establishments wherein prescription medications, over the counter (OTC) drugs, and other healthcare products are dispensed and sold directly to consumers. These pharmacies are commonly found in retail settings, such as drugstore chains, supermarkets, or independent pharmacies. They play a crucial role in providing accessible and convenient pharmaceutical services to the public. They present a wide variety of medications, including pain relievers, cough and cold medicines, allergy medications, and more. Besides this, they often stock various health and wellness products, such as supplements, vitamins, personal care items, first aid supplies, and medical devices like blood pressure monitors and glucose meters.

Breakup by Country:

- United States

- China

- Brazil

- Germany

- France

- India

- United Kingdom

- Japan

- Canada

- Italy

- Others

The United States exhibits a clear dominance, accounting for the largest generic drugs market share

The report has also provided a comprehensive analysis of all the major regional markets, which include the United States, China, Brazil, Germany, France, India, the United Kingdom, Japan, Canada, Italy, and others.The United States held the biggest market share since the region has an advanced medical infrastructure and efficient regulatory support. Besides this, the increasing number of insurance companies and healthcare providers encouraging patients to consume generic drugs is propelling the growth of the market. Apart from this, increasing availability of generic drugs at affordable prices are bolstering the growth of the market. Moreover, the growing occurrence of various chronic diseases among the masses is influencing the market positively.

China is estimated to expand further in this domain due to the increasing investments in developing novel drugs and promoting the use of generic drugs. Besides this, the rising construction of hospitals, nursing homes, and clinics is propelling the growth of the market in the country.

Competitive Landscape:

Key market players are investing in research activities to develop a pipeline of generic drugs. They are also focusing on identifying opportunities to introduce generic versions of brand-name drugs as patents expire. Top companies are forming strategic partnerships or engaging in acquisitions to strengthen their market position and expand their capabilities. They are also collaborating with other generic drug manufacturers, contract research organizations (CROs), or acquiring smaller companies to achieve access to new markets or technologies. Leading companies are expanding their geographic reach by entering new market positions and establishing a presence in emerging economies. They are also focusing on the development of complex generic drugs, such as extended-release formulations, transdermal patches, inhalers, and injectables.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Teva Pharmaceuticals Industries Ltd.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Fresenius SE & Co.

- Lupin Limited

- Endo Pharmaceuticals Inc.

- Aurobindo Pharma Limited

- Aspen Pharmacare Holdings Limited

Key Questions Answered in This Report

1. What was the size of the global generic drugs market in 2024?2. What is the expected growth rate of the global generic drugs market during 2025-2033?

3. What are the key factors driving the global generic drugs market?

4. What has been the impact of COVID-19 on the global generic drugs market?

5. What is the breakup of the global generic drugs market based on the therapy area?

6. What is the breakup of the global generic drugs market based on the drug delivery?

7. What is the breakup of the global generic drugs market based on the distribution channel?

8. What are the key regions in the global generic drugs market?

9. Who are the key players/companies in the global generic drugs market?

Table of Contents

Companies Mentioned

- Teva Pharmaceuticals Industries Ltd.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Fresenius SE & Co.

- Lupin Limited

- Endo Pharmaceuticals Inc.

- Aurobindo Pharma Limited

- Aspen Pharmacare Holdings Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | January 2025 |

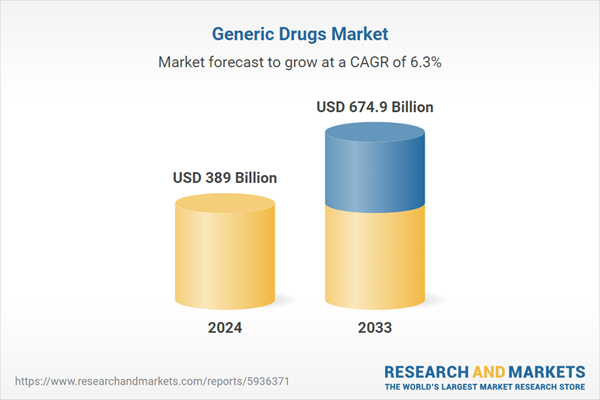

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 389 Billion |

| Forecasted Market Value ( USD | $ 674.9 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |