The influence of self-driving technology extends well beyond individual cars, encompassing a numerous range of programs, from driverless taxis to computerized shipment vehicles. This technological transition marks a profound revolution in the automobile and mobility industries. Once perceived as a concept confined to the realm’s of science fiction, self-sustaining automobiles at the moment are becoming a tangible reality in China, infiltrating every-day life earlier than expected. This groundbreaking technology holds vast capacity to redefine every day routines and inaugurate a brand-newera of smart transportation.

In select Chinese towns, autonomous taxis, commonly called robotaxis, are already reachable for booking thru ride hailing applications. These self-riding automobiles can efficiently transportpassengers to numerous locations, which include subway stations, business districts, and home areas. Users input their favored pickup and drop-off places, specifying the quantity of passengers, and within minutes, a self-driving taxi arrives to offer transportation services.

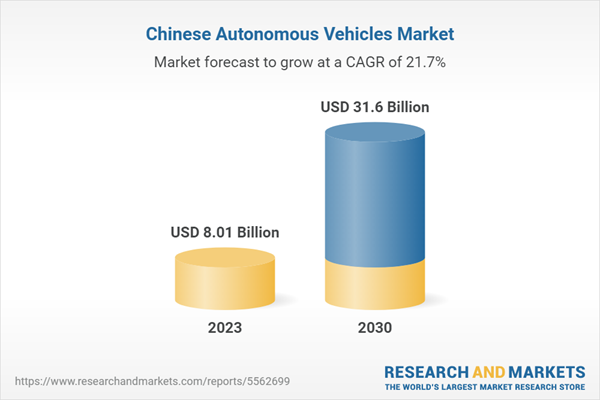

China Autonomous Vehicles Market is poised for significant surge, with an anticipated CAGR of 21.66% from 2024 to 2030

The commercialization of autonomous using high technology will benefit substantialtraction in China over the next couple of years, pushed by using on-going technological improvements and strong policy support. Experts assert that China is at the forefront of global research, development, and utilization of modern vehicle technology. China technology corporations are intensifying their efforts to expedite the practical use of self-riding vehicles. Baidu, for example, has bold plans to deploy an additional 200 absolutely self-sustainingrobotaxis nationally to establish the world's biggest fully driverless journey-hailing service place. According to CEO of Apollo, the plan is to extend the attain of its autonomous trip-hailing platform, Apollo Go, to encompass 65 cities by 2025 and expend further to 100 cities by 2030.Chinese tech firms like Pony.ai, WeRide, and Didi Autonomous Driving, a Didi Global subsidiary, are aggressively pushing self-driving taxi services to boost widespread commercial adoption of this evolving transport tech. China, the world's second-largest autonomous driving market, offers domestic and international players significant opportunities. With the availability of public driverless shuttles, China could emerge as a global leader in autonomous vehicles. China is moving swiftly towards extensive adoption of autonomous technology, thanks to a favourable regulatory climate in Beijing, which encompasses thorough highway testing and the goal to incorporate partial self-driving technology into 50% of all new vehicle sales by 2025.

Over the recent years, China has implemented a series of policies aimed at promoting the advancement and commercialization of autonomous driving technology. Notably, the Ministry of Industry and Information Technology and the Ministry of Public Security have introduced a preliminary guideline to expand the scope of road tests for self-driving vehicles throughout the country. Additionally, China has released its inaugural national draft guideline concerning using autonomous vehicles for public transportation. Furthermore, in a pioneering move, authorities in Wuhan, Hubei province, and the Yongchuan district in Chongqing have granted Baidu the first permits in China to charge fares for fully autonomous ride-hailing services within designated areas. As autonomous driving technology continues to reach a state of maturity, the industry is expected to consolidate in the forthcoming years. China Driverless Cars Market was US$ 8.01 Billion in 2023.

Level 3 autonomous driving is experiencing rapid growth in China

By Level of Driving, the China Autonomous Vehicles Market is segmented into L1, L2, L3, L4 and L5. In the dynamic realm of China's automotive industry, Level 3 autonomous driving is gaining remarkable traction. This sophisticated autonomous technology, where vehicles can independently handle specific driving tasks while necessitating human supervision, is experiencing a notable surge in popularity nationwide. Notably, both Chinese technology giants and established automakers are making substantial investments in advancing and implementing Level 3 autonomous vehicles. As the demand for safer, more convenient, and more efficient transportation solutions grows, these semi-autonomous vehicles are finding a warm welcome in the Chinese market. This surge positions China as a pivotal global contributor to cutting-edge autonomous transportation solutions.Software is witnessing the maximum rapid growth in China's autonomous vehicles sector

Within China burgeoning self-sufficient automobile industry, the software segment will hold major market percentage in upcoming years. As software technology advances, software's pivotal role in enabling vehicles to understand their surroundings, make actual-time decisions, and navigate safely is becoming increasingly evident. Chinese companies both mounted and start-ups, are channelling significant investments and understanding into developing current autonomous software solutions. This growth aligns with the nation's broader push for technological innovation and self-reliance in the vehicles sector. The software extended development underscoresits essential role in shaping the future of autonomous transportation in China.In the Chinese self-using automobile industry, Lidar hardware and V2X software will take center stage in upcoming years

By technology, the China Autonomous Vehicle Market is sub-divided into Hardware (Passive Components, Embedded Modem, Ultrasonic Sensors, Odometry Sensors, Other Electronics and architecture, Actuators, HMI Hardware, Mapping Hardware, V2X Hardware, Embedded Controls Hardware, Radar & Lidar and Cameras) and Software (Data Security Software, HMI Software, Embedded Controls Software, Mapping Software, and V2X Software). The China self-sufficient automobile industry is standing at the threshold of a large transformation, with Lidar hardware and V2X software program poised for a distinguished ascent quickly.Lidar, a crucial sensor technology that makes use of lasers for particular 3D mapping and item detection, is hastily gaining traction as a fundamental factor for safe and reliable autonomous driving. Simultaneously, V2X (Vehicle-to-Everything) software, permitting automobiles to speak with everybody and their surroundings, is emerging as a linchpin for better connectivity and safety. This forthcoming dominance of Lidar hardware and V2X software program signifies a pivotal step forward inside the evolution of self-riding era in China.

Commercial vehicle sector is experiencing the most rapid growth in the China autonomous vehicle industry

By Vehicle Type, the China Autonomous Vehicle Market is classified into Passenger and Commercial Vehicles. The commercial vehicle sector is presently at the leading edge of rapid growth in China's dynamic self-reliant vehicle industry. Commercial vehicles, including trucks, vans, and other utility vehicles, are increasingly more incorporated with autonomous technology to enhance efficiency, reduce operational cost, and enhance safety. This surge in the adoption of autonomous system for commercial vehicles aligns with the growing demand for more efficient logistics and transportation solutions within the world most populous country. As the sector evolves, it opens up new avenues for innovation and has the capability to transform the logistics and delivery panorama at some point of China considerably.Defence segment will possess the prime market percentage in the China autonomous vehicle industry

By Application, the China Autonomous Vehicle Market is split into Civil, Defence, Transportation logistics, and Construction. The China autonomous automobile industry is witnessing a remarkable shift in market dominance as the defence quarter takes the lead with the major market share. This transformation is pushed by increasingly more integrating autonomous technologies into military programs, consisting of unscrewed ground motors and self-sufficient surveillance structures.China defence industry is making an investment in cutting-edge, impartial solutions for defence and protection. This significant market proportion underscores the china dedication to enhancing its military abilities via superior self-sustaining technology, reflecting a broader trend of technological innovation shaping the defence landscape in China and doubtlessly setting new requirements in autonomous military applications.

Internal Combustion Engines revenue share was dominatedin the China autonomous vehicle market

Propulsion sub-divides the China Autonomous Vehicle Market into Battery Electric Vehicle, Fuel Cell Electric Vehicles, Hybrid Electric Vehicle, Internal Combustion Engine, and Plug-in Hybrid Electric Vehicle. In the evolving landscape of the China self-sufficient vehicle market; internal combustion engines keep preserving a dominant presence. While the market increasingly more embraces electric and hybrid powertrains, the attempted-and-actual internal combustion engines are nevertheless being organized to relinquish their foothold. These engines power various autonomous automobiles, from passenger vehicles to commercial vehicles. Their reliability, present infrastructure, and familiarity make them a realistic choice for producers and purchasers. As China speeds up its efforts to lead in autonomoustransportation, versatile internal combustion engines remain a steadfast force in the market, illustrating the on-going synergy among traditional and presentday technologies.Key Players

Prominent companies in the China Autonomous automobile market encompass AutoX, Baidu Apollo, Didi Chuxing, Pony.ai, TuSimple and WeRide.This research report provides a detailed and comprehensive insight of the China Autonomous Vehicles Industry.

Level of Driving - Market breakup from 5 viewpoints:

- L1

- L2

- L3

- L4

- L5

Hardware - Market breakup from 13 viewpoints:

- Passive Components

- Embedded Modem

- Ultrasonic Sensors

- Odometry Sensors

- Other Electronics & Architecture

- Actuators

- HMI Hardware

- Mapping Hardware

- Embedded Controls Hardware

- V2X Hardware

- Cameras

- Radar

- Lidar

Software - Market breakup from 5 viewpoints:

- HMI Software

- Data Security Software

- Mapping Software

- Embedded Controls Software

- V2X Software

Vehicle Type - Market breakup from 2 viewpoints:

- Passenger Vehicle

- Commercial Vehicle

Application - Market breakup from 4 viewpoints:

- Civil

- Defense

- Transportation & Logistics

- Construction

Propulsion - Market breakup from 5 viewpoints:

- Battery Electric Vehicle

- Fuel Cell Electric Vehicles

- Hybrid Electric Vehicle

- Internal Combustion Engine

- Plug-in Hybrid Electric Vehicle

All companies have been covered from 2 viewpoints:

- Overview

- Recent Development

Company Analysis

- AutoX

- Baidu Apollo

- Didi Chuxing

- Pony.ai

- TuSimple

- WeRide

Table of Contents

Companies Mentioned

- AutoX

- Baidu Apollo

- Didi Chuxing

- Pony.ai

- TuSimple

- WeRide

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | January 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 8.01 Billion |

| Forecasted Market Value ( USD | $ 31.6 Billion |

| Compound Annual Growth Rate | 21.6% |

| Regions Covered | China |

| No. of Companies Mentioned | 6 |