According to Agency for Healthcare Research and Quality (AHRQ), the vast majority of these hospitals- about 70%- are part of a healthcare system. This trend may increase the importance of these facilities in determining how people are treated. According to CDC in 2018, each year, around 2.8 million people in the U.S. suffer from traumatic brain injuries, which lead to approximately 56,000 deaths and 282,000 hospitalizations. Around 2.5 million of these patients are treated and released from the emergency room annually. In addition, according to the National Spinal Cord Injury Association, each year, around 17,730 cases of spinal cord injury are recorded in the U.S., out of which, around 20% to 30% opt for neurological rehabilitation.

Acute hospital care aims to help patients attain stable and healthy medical conditions as well as discharge them as early as possible. The aforementioned factors are anticipated to drive the overall market growth in the coming years. The COVID-19 pandemic had a substantial impact on healthcare utilization across all sectors of the U.S. healthcare system. Hospitals were flooded with COVID-19 patients, straining ICUs beyond their customary capacity and increasing mental health boarding. ICU utilization declined following the initial increase, however, ICU/CCU days remained greater than that in 2019. As per Massachusetts HPC Report, ICU/CCU days increased by 10.0% between 2019 and 2020, despite a decline in admissions. Moreover, healthcare utilization of non-COVID-19 patients decreased as a result of a variety of factors, including state and federal guidance intended to preserve needed hospital bed capacity while minimizing infection transmission, patient reluctance to receive in-person care, and shift to telehealthcare.

U.S. Acute Hospital Care Market Report Highlights

- The emergency care segment dominated the market in 2021 and is expected to maintain its dominance during the forecast period. This can be attributed to the growing incidence of accidents, burns, heart attacks, severe bleeding, acute infections, and other conditions. As per CDC, each year, roughly 130.0 million people visit emergency departments in the U.S. Adults aged 18 and over attended EDs at a rate of approximately 22.0% in 2019

- The general acute care hospital segment accounted for the maximum market share in 2021 owing to a growing number of admissions at these facilities. In recent years, there is a drastic shift of patients from EDs to these facilities, which is poised to surge segment growth

- The ICU segment held the major share of the market in 2021. This can be attributed to the growing patient population requiring intensive monitoring. Moreover, the ongoing COVID-19 pandemic is expected to boost the demand for intensive care

- Mergers and acquisitions and partnerships are some of the key strategies being undertaken by the market players. For instance, in June 2019, Community Health Systems, Inc. acquired Northwest Mississippi Medical Center in Clarksdale, Mississippi, with its 181 licensed beds and other outpatient and ancillary services

Table of Contents

Companies Mentioned

- Th Medical (Tenet Healthcare Corporation)

- Universal Health Services Inc.

- Community Health Systems, Inc.

- Ascension

- Lifepoint Health, Inc.

- Ardent Health Services

- Emerus Hospital Partners, Llc

- Stanford Health Care, Inc.

- Nyu Langone Hospitals

- Newyork-Presbyterian Hospital

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 95 |

| Published | March 2022 |

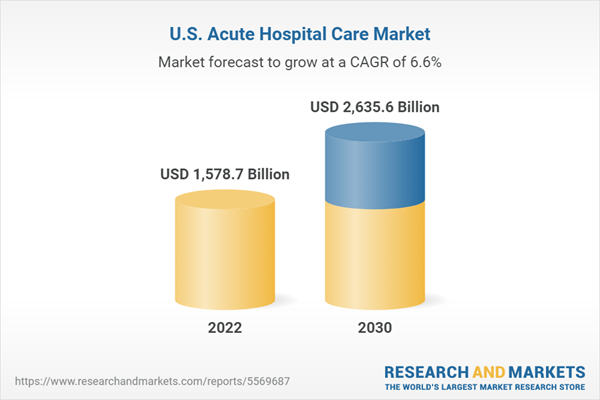

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1578.7 Billion |

| Forecasted Market Value ( USD | $ 2635.6 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |