Key Highlights

- Over the long term. Factors such as solar PV projects under construction in the pipeline and planning stages are expected to boost the cumulative installed solar energy capacity during the forecast period. Also, the market is being propelled by supportive government policies, particularly the plans formulated to encourage renewables-based power generation.

- On the other hand, increasing adoption of alternate renewable energy, such as wind, is likely to hinder market growth during the forecast period.

- Nevertheless, with a target of reducing GHG emissions by 2030, the region is expected to increase the opportunity for solar energy companies to install solar PV plants in the region during the upcoming years. Moreover, the region has plans to reduce dependency upon foreign fossil fuels like crude oil and would opt for renewable energy like solar to reduce regional expenses related to imported oil.

Japan Solar Energy Market Trends

Ground-mounted to Dominate the Market

- Japan has been at the forefront of ground-mounted solar PV development through corporations like Mitsubishi and Toshiba. The continuous reductions in technology costs and the increasing growth in the country, owing to policy changes like FiT and the growing focus on achieving various capacity targets, are expected to contribute to the increase in the growth of the solar PV market during the forecast period.

- Companies in the country are also looking to collaborate with other global giants, which is expected to further decrease the prices due to the exchange of knowledge and aid the growth of the segment in the country.

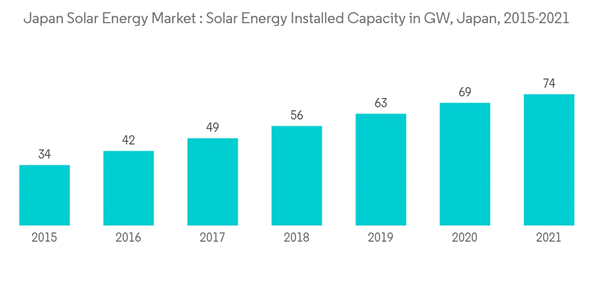

- Japan is trying to expand its installed solar capacity due to efforts to reduce the share of nuclear in their energy mix and aims to expand installed solar capacity to nearly 108 GW by 2030. However, due to the high solar penetration rate in the residential sector, the ground-mounted segment is expected to grow at the fastest pace, creating a demand for larger, central inverters for large utility-scale projects.

- The country's utility-size solar PV market has grown significantly in recent years. In September 2021, Amazon announced that the company would partner with Japanese trading house Mitsubishi Corp. to build solar power stations in Japan and procure renewable energy from them to supply electricity to its data centers for ten years. West Holdings, a solar power company, is developing the power stations and is expected to build 450 in the Tokyo Metropolitan area and Tohoku region. Mitsubishi will collect electricity generated there and supply it to Amazon's data centers, logistic centers, and offices through electricity sales companies in which Mitsubishi has a stake. The total electricity generated will be 22,000 kilowatts, equivalent to the electricity consumed in 5,600 houses. The power stations are likely to start operations by 2023.

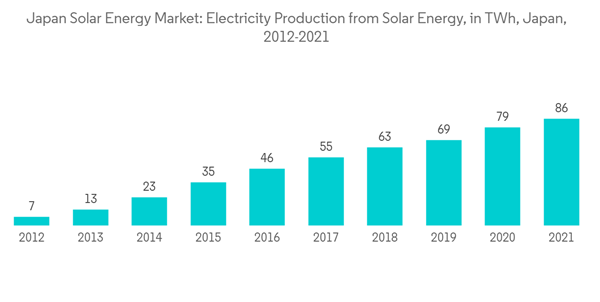

- Solar energy generated approximately 86 terawatt hours of electricity in Japan in the fiscal year 2021, a significant increase from about seven terawatt hours in the fiscal year 2012. As of 2021, solar power has overtaken hydroelectricity as Japan's leading renewable energy source.

- Hence, such developments and favorable government schemes and initiatives are expected to drive Japan's ground-mounted solar energy market.

Supportive Government Policies to Drive the Market

- One of Japan’s most compelling drivers for renewable energy has been the Feed-In Tariff (FIT) scheme, which was introduced in 2012 by the Ministry of Economy, Trade, and Industry under the Special Measures Concerning the Procurement of Renewable Energy by Operators of Electric Utilities Act.

- Japan introduced feed-in tariff (FiT) rates in 2009, which increased in the subsequent years in the wake of the Fukushima nuclear accident, stimulating the solar PV market growth. However, Japan reduced its solar power FiT, as the country aims to reduce the dependency of solar power on subsidies and promote competitive bidding for solar power development.

- For instance, in Japan, in 2020, there was a rush to complete FiT-approved commercial solar projects by 2022 due to the commissioning deadlines and additional investment subsidies for PV and storage as part of the COVID‑19 pandemic.

- However, the Japanese government has announced that smaller commercial installations are expected to continue to be eligible for FiT-based compensation. Still, they will likely face stricter rules, such as a self-consumption requirement of at least 30%.

- The Japanese government announced it would begin transitioning from a Feed-in-Tariff (FiT) to a Feed-in-Premium (FiP) starting in April 2022. The new program will allow renewable generators to sell electricity in the spot market at a premium to wholesale prices.

- The first FiP was launched by the Japanese Ministry of Economy and Trade Industry, with 13 projects presenting a bid that awarded a total of 128.94 MW between five bidders. In August 2022, X-Elio was awarded 15 MW solar PV capacity in Japan’s first feed-in premium (FiP) auction.

- As of 2021, the country had an installed capacity of 74 GW. The solar energy market in Japan is poised for growth in the coming years because of the government’s policy to implement clean energy measures in the country, the declining cost of solar energy generation, and reduced energy storage prices.

- Hence, supportive government policies are expected to drive the market in the coming years.

Japan Solar Energy Industry Overview

The Japanese solar energy market is fragmented. Some key players in this market (in no particular order) include Canadian Solar Inc., First Solar Inc., Mitsubishi Electric Corporation, SunPower Corporation, and Trina Solar Co. Ltd., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Canadian Solar Inc.

- First Solar Inc.

- SunPower Corporation

- Trina Solar Co. Ltd

- Sharp Corporation

- Hanwha Corporation

- LG Electronics Inc.

- JinkoSolar Holding Co. Ltd

- Mitsubishi Electric Corporation

- Toshiba Corp.