Key Highlights

- COVID-19 had a severe impact on the textile manufacturing industry. In the first half of 2020, the industry faced a shortage of labor supply and logistics difficulty due to the country's lockdown. COVID-19 also impacted the sales of textiles due to the closure of supermarkets and other physical retail stores as per the government's strict restrictions.

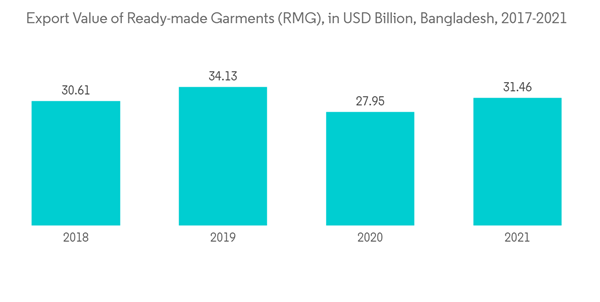

- However, the COVID-19 crisis accelerated e-commerce sales in the market studied. Still, in FY 2020-21, Bangladesh's ready-made garment (RMG) exports grew by 12.55% to USD 31.46 billion (out of USD 38.76 billion in total exports) as demand in major markets in Europe and North America began to recover from the COVID-19 pandemic.

- The textile sector contributes more than 13% of Bangladesh's GDP. Over 84% of the export earnings come from textiles and textile-related products. The country invested around USD 15 billion in the primary textile sector. The Primary Textile Sector (PTS) meets approximately 85-90% of the yarn demand for knit RMG and 35-40% for woven RMG.

- The demand for local fabric and yarn for handlooms is also met by the Primary Textile Sector (PTS). The Bangladesh Textile Mills Association (BTMA) is the national trade organization representing yarn and fabric manufacturers and textile product processors in the country in the private sector. The BTMA has 510 yarn manufacturing mills, 901 fabric manufacturing mills, and 317 dyeing, printing, and finishing mills as members, totaling 1,728 member mills.

- According to statistics from the Export Promotion Bureau of the Government of Bangladesh, RMG exports were up by 13.4% from July to September 2022, at USD 10.27 billion from USD 9.06 billion a year earlier. The figure beat Bangladesh's export target of USD 10.02 billion for the quarter. Knitwear exports were up by 9.4% to reach USD 5.65 billion from USD 5.16 billion, beating a target of USD 5.5 billion. Exports of woven garments jumped by nearly 19% to reach USD 4.62 billion, up from USD 3.9 billion a year earlier. This trend greatly benefited the textile manufacturing sector in the country. However, Bangladesh RMG exporters are facing hurdles with declining shipments to and payments from Russia due to the ongoing Russia-Ukraine war.

- Many garment suppliers are not receiving export receipts as several Russian banks have been banned from using SWIFT, the global payments messaging network. Around 150 apparel exporters from Bangladesh have been keenly tapping the emerging Russian market. Bangladesh-Russia trade is valued at more than USD 1 billion and is growing. Many exporters stated that their goods are stuck at Chattogram port because shipping lines are not ready to take them on board. Others have reported that their documents have been sent back from Hungary due to the SWIFT ban. These factors are negatively affecting the market.

Bangladesh Textile Market Trends

Increasing Demand for Natural Fibers

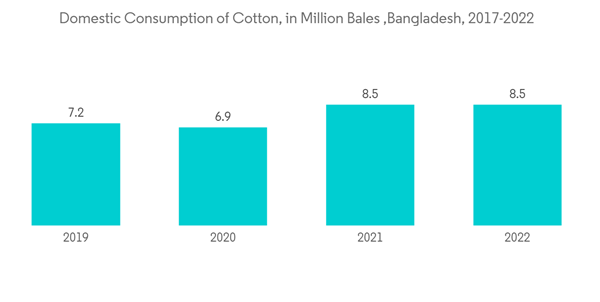

Natural fiber composites are relatively lighter and stronger than conventional fibers. Thus, they find extensive applications in the automotive industry for interiors and exteriors. Natural fibers obtained from plants and animals include cotton, silk, linen, wool, hemp, jute, and cashmere. These fibers are widely used to manufacture garments, apparel, construction materials, medical dressings, and the interiors of automobiles. Silk is used in upholstery and apparel, as it is available in both variations: fine and coarse. Wool and jute are used as textile materials for their resilience, elasticity, and softness. Despite lower production volume, the requirement for raw cotton for the textile industry is very high. In 2022, approximately 8.5 million 480-pound bales of cotton were consumed in Bangladesh, an increase from 2020, when just over 6.9 million 480-pound bales of cotton were consumed in Bangladesh. The increasing consumption of natural fibers, such as cotton, silk, wool, and jute, will likely drive the Bangladeshi textile manufacturing market during the forecast period.Clothing Export is the Main Growth Driver

Currently, Bangladesh is the second-largest clothing exporter in the world, behind China. There are more than 4,500 factories presently operating within the industry, with most of them located around Dhaka. The garment industry in Bangladesh continues to drive economic growth for the country, contributing a 6% average annual growth rate since 2007. The garment industry accounts for about 80% of all export earnings achieved by Bangladesh each year. Europe receives 61% of the exports that are created by the Bangladesh garment industry every year. About 75% of Bangladesh's manufacturing employment is held within the clothing and textile sector. At the same time, up to 75% of the value-added amount generated by the industry goes to retailers or producers. Emerging export markets for Bangladesh represent 15% of the total exports the garment industry can achieve. The emerging markets include China, Brazil, Japan, and Australia.In comparison, the United States accounts for 21% of the exports achieved by the industry each year. For knit clothing, the United States leads the export market, accounting for 37% of the purchases. Germany and the United Kingdom account for 24% of total knit purchases. Outside of Europe and the United States, only Canada provides more than USD 1 billion in export revenues to the Bangladeshi garment industry each year.

In 2021, the share of ready-made garment (RMG) exports in Bangladesh amounted to approximately 81.16% of the total exports. Although a decrease from the previous year, this was an increase from 2012, when RMG exports accounted for approximately 78.5% of the total exports to Bangladesh. In 2021, the export value of ready-made garments (RMG) in Bangladesh amounted to approximately USD 31.46 billion, an increase from the previous year when RMG exports to Bangladesh amounted to just about USD 28 billion. With the clothing industry being such an important aspect of the Bangladeshi economy, the textile manufacturing industry is extremely important for the country and directly benefits from clothing exports.

Bangladesh Textile Industry Overview

The Bangladeshi textile manufacturing market is moderately fragmented in nature. The market is highly competitive, with the presence of a considerable number of regional and global players. The major strategies adopted by these companies include product innovations, expansions, and mergers and acquisitions. The key players in the market are Ha-Meem Group, Noman Group, Beximco Textile Division Limited, Square Textile Ltd, DBL Group, Thermax Group, Viyellatex Group, Epyllion Group, and Mohammadi Group.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ha-meem Group

- Noman Group

- Beximco Textile Division Limited

- Square Textile Ltd

- DBL Group

- Thermax Group

- Viyellatex Group

- Epyllion Group

- Mohammadi Group

- Fakir Group

- Akij Textile Mills Ltd

- Pakiza Group

- Masco Industries Limited*