The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as encouraging government policies and pressure to meet the power demand using renewable energy to decrease dependency on fossils and decrease carbon footprints are significant contributors to the market's growth.

- On the other hand, the rising adoption of alternate clean energy sources is expected to restrain market growth.

- Nevertheless, with the adaption of the visionary UAE Energy Strategy 2050, the country is set to increase its clean energy share to 44% by 2050 by investing in nuclear and solar energy. This, in turn, is expected to create several opportunities for United Arab Emirates solar photovoltaic (PV) market in the future.

United Arab Emirates Solar Photovoltaic (PV) Market Trends

Commercial and Industrial Segment is Expected to Witness Significant Growth

- Commercial and industrial solar power refers to any ground-mounted or rooftop distributed solar generation system or systems designed and installed for commercial or industrial applications,

- The UAE government has set out various initiatives, such as the Dubai Clean Energy Strategy 2050, a strategy to produce 75% of its energy from renewable sources by 2050. Under this strategy, interim targets of 7% solar power by 2020 and 25% by 2030 have also been set. Achieving these goals is also dependent on commercial and industrial installments.

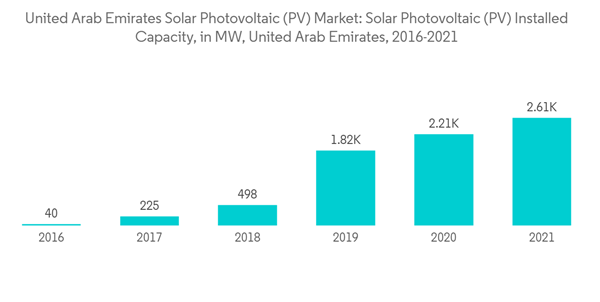

- Further, the solar PV capacity installed was 2605 MW in 2021, with a growth rate of nearly 18% over the previous year.

- In July 2021, Dubai Electricity & Water Authority (DEWA) launched the Shams Dubai Solar program to facilitate the Dubai Clean Energy Strategy. Based on the net metering principle, Shams allowed customers to install solar panels to produce power, reducing their monthly electricity bill. Moreover, any surplus electricity not consumed immediately is sold back to the grid at the same price, and the end of the month, only the net amount is billed to the consumer. This was a massive incentive for the commercial and industrial sectors, wherein they could do cost-saving while assisting the Clean Energy Strategy 2050.

- Recent developments in building-integrated photovoltaics (BIPV) have opened many opportunities for commercial and industrial solar energy producers. However, BIPV applications are still in the development phase with very few installations; distribution generation across commercial and industrial establishments is the key target segment for BIPV.

- Notable projects in the commercial & industrial sector include Nurai Island’s Floating Solar PV (FPV), an 80-kW project aimed to provide solar power energy to the nearby Zaya Nurai resort, which already has 1,000 kilowatts of rooftop and ground-mounted photovoltaic (PV) systems.

- Further, in January 2023, Emerge, a joint venture between EDF and Masdar, announced signing an agreement with Coca-Cola Al Ahlia Beverages to develop a 1.8 MW solar PV plant for its Al Ain facility. This commercial and industrial project is located at the Coca-Cola Al Ahlia Beverages facility in Al Ain. This plant would combine the rooftop, ground-mounted, and car park installations.

- Government plays a vital role in developing the commercial and industrial solar power sector since the market is driven by the cost of subsidies, a regulatory framework for wheeling and net metering, and incentive policies such as Shams. The government of the UAE has been an active supporter of the use of solar power. However, not many policies are in place for distributed solar power generation.

- The commercial and industrial have been fairly small shareholders in UAE’s solar energy mix. However, with rising awareness for clean energy and supporting government policies and technological developments such as BIPV and FPV, the segment is expected to grow significantly during the forecast period.

Declining Prices and Installation Cost of Solar PV to Drive the Market

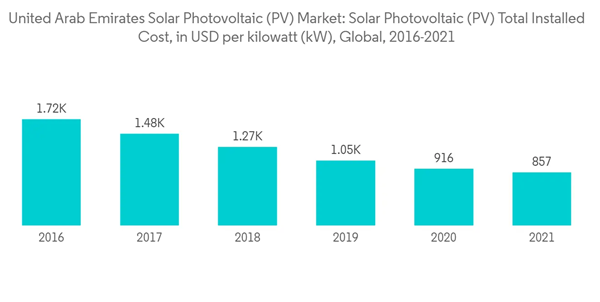

- The solar industry has dramatically cut costs over the past five years through the economies of scale. As the market was flooded with equipment, the prices plummeted. The cost of solar panels is dropping exponentially.

- Solar photovoltaic (PV) modules are now more than 80% cheaper than they were in 2009. The cost of electricity from solar PV fell significantly between 2016 and 2021, and it continues to decline due to various technological developments and mass production. In 2021, the cost of Solar PV is 857 USD per kW.

- The cost reductions are driven by continuous technological improvements, including higher solar PV module efficiencies. The industrialization of these highly modular technologies has yielded impressive benefits, ranging from economies of scale and greater competition to improved manufacturing processes and competitive supply chains.

- Moreover, competitive costs and a strong regulatory framework have led to the adoption of solar power by many private companies in the country. For instance, in January 2022, ACWA Power got the green light to start work on the first 217-MW phase of the Noor Energy 1 solar project in Dubai after receiving a certificate of commercial operation.

- Rapid declines in installed costs and high-capacity factors have also improved the economic competitiveness of solar PV. For new generation build, the LCOE of solar PV plants is below coal-fired plants and is projected to undercut a typical combined-cycle gas turbine in the next five years.

- Also, the infrastructure requirements for a grid-connected solar rooftop plant are often very limited, as the solar panels are being installed on an existing roof, and the electricity is fed into the same cables that bring electricity to the equipment. The solar power plant is connected to the grid and does not require any batteries, which has, in turn, reduced the cost of overall installation of solar panels. Thus, the improved cost-effectiveness of batteries or modules is expected to further propel the use of the solar PV in the country in the coming future.

- Therefore, owing to the above points, declining prices and installation cost of solar PV is expected to drive the market during the forecast period.

United Arab Emirates Solar Photovoltaic (PV) Industry Overview

The UAE solar photovoltaic (PV) market is partially fragmented. The major companies in the market (not in particular order) include Masdar (Abu Dhabi Future Energy Company), Sunergy Solar LLC, Maysun Solar FZCO, ACWA Power, and CleanMax Mena FZCO., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Panel Manufacturers

- EPC Companies/ Developers