Key Highlights

- Grapes are one of the largest fruit crops, with approximately 6,729,198 hectares of area harvested worldwide in 2021. According to a United States Department of Agriculture report, global table grape production in 2021 reached about 25.5 million metric tons (MMT). Table grapes and wine grapes are the two major types of grapes grown worldwide, out of which table grapes are freshly consumable.

- The Farmers are the primary stakeholder in the grape value chain, and they involve in the process of production of grapes. Farmers incur various costs, including seed, labor, tractor, and transportation. Aggregators/farmer co-operatives are the stakeholders in the grape value chain next to farmers.

- After aggregators/farmer co-operatives exporters come into the role, the major exporters of grapes are the United States, Peru, Chile, and the Netherlands. The costs incurred by exporters include labor, transportation, overheads, bulk packaging, fertilizer, crop protection, and insurance charges. Exporters also pay insurance for the value of the commodity and vehicle they are exporting to safeguard the capital invested, despite the adverse situations during transport from one port to another.

- Moving forward in the chain, importers, and wholesalers come next to exporters. And the final stakeholders in the grape value chain are retailers. Costs incurred by the retailers include transportation, overheads, and packaging costs.

- Developing new varieties of fresh grapes requires significant investment and experimentation. The R&D activities and launching of. It produces grapes varieties tiesfreshmanainly being carried out around the globe by public and private firms for future development in the grape market. For instance, recently, Embrapa, the Brazilian Agricultural Research Corporation, Semiárido unveiled the first table grape variety BRS Tainá to be bred exclusively for production in the northeast of Brazil. BRS Tainá is a white seedless variety with a 'neutral and pleasant flavor,' developed to suit the growing conditions in the Sào Francisco Valley. It is also a fast-growing, vigorous variety with an average yield of 25 tonnes per hectare per production cycle,' medium-sized bunches weighing around 270g and measuring 15cm x 10cm.

Grapes Value Chain Analysis Market Trends

Increased Production Due to Rise in Consumer Demand and Awareness

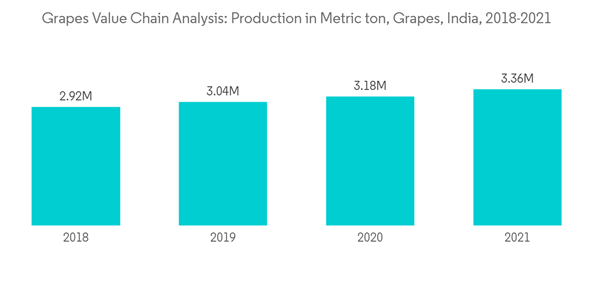

The increased awareness among consumers regarding the health benefits associated with the consumption of grapes has led major producing countries to increase their production year-on-year to meet the rising consumer demand. Nutrients found in grapes have been shown to have anti-inflammatory benefits. Consuming fresh grapes can also help regulate blood pressure.Due to the nutritional benefits of grapes, such as higher levels of antioxidants, vitamin C, K, etc., that help cure chronic diseases, the demand is increasing. Subsequently, the production of fresh grapes increased. For instance, according to FAO, the production of grapes in India increased from 2,920,000 hectares in 2018 to 3,358,000 hectares in 2021, indicating the potential growth of the grapes market in the future.

According to the California Table Grape Commission, consuming about 2-2.25 cups of fresh grapes daily can protect the skin against diseases caused by ultraviolet rays, as grapes contain natural compounds such as polyphenols that act as edible sunscreen. Subsequently, the demand for grapes among consumers is increasing, thereby spiraling the overall consumption.

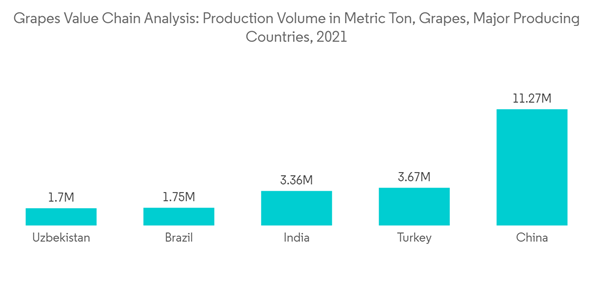

Furthermore, according to the database published by FAO, countries such as China and Turkey are the primary producers of grapes, accounting for 11,269,900 metric ton and 3,670,000 metric ton of grapes production, respectively, in 2021. Moreover, countries such as Brazil, the United States, and Uzbekistan are also considered to be the primary producers of grapes globally.

As per California Table Grape Commission, in 2020, 46% of significant shoppers in the United States perceived fresh grapes to be a staple in their household, rising from 32% in 2019. Another 35% claim grapes are frequently purchased in their homes. This points out that grapes consumers in the country are growing, which is further expected to increase in the coming years due to the rising veganism trend in the region.

Therefore, due to rising health consciousness, the consumption of grapes around the globe is expected to increase, thereby surging the market during the forecast period.

China Dominates the Production of Grapes

China dominates the production of grapes in the world. China produced approximately 11.3 million metric ton of grapes and remained the largest grape-producing country in Asia-Pacific and the world in 2021, comprising approximately 15.3% of the total volume of grapes produced around the globe in 2021.The country has its production mainly concentrated in regions such as Xinjiang, Hebei, Shandong, Yunnan, Henan, and Liaoning, among others. Many farmers in China have been replacing traditional grape varieties with more profitable cultivars. Although kyoho, red globe, and muscat remain the dominant varieties, the cultivation of other varieties such as summer black, shine muscat, jumbo muscat, gold finger, and crimson seedless is also gaining momentum in the country.

Furthermore, the wine industry expanding year on year in the country positively impacts the production of grapes as grapes are the primary fruits used in the production of wines. In Southern China, Grape producers are willing to invest more in production facilities to improve fruit quality or lengthen the supply season. It is estimated that greenhouse vineyards or vineyards with rain shield facilities account for around 25% of total grape acreage and are growing. Therefore, Rising investment results in increased production of grapes which results in the overall growth of the market studied during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.