The Asia-Pacific combined heat and power (CHP) market is expected to register a CAGR of more than 5.9% during 2022 to 2027. The outbreak of COVID-19 in Q1 of 2020 has negatively impacted the market's growth. Governments in the region were forced to implement lockdowns during the first half of 2020, and all non-essential operations remain halted. This adversely impacted the CHP market due to end users' suspension of activities. In addition, production and disruption in the supply chain have slowed down the construction activities, which posed a challenge to the CHP market in the region. For Instance, in November 2020, Bert Energy GmbH announced that its Bert Mobil Gas demo plant scheduled to be commissioned at Sri City in Andhra Pradesh (India) was delayed by over six months due to disruptions caused by COVID-19. Factors such as the positive outlook for natural gas supply and price, increased energy efficiency, and environmental regulatory pressures on power plants and industrial boilers are expected to drive the number of installations of combined heat and power plants across the region. However, factors such as weak grid interconnections and high capital investment remain a significant challenge for Asia-Pacific's combined heat and power market.

The Asia-Pacific combined heat and power market is moderately fragmented. Some of the key players in this market include General Electric Company, Siemens Energy AG, Mitsubishi Electric Asia Pte Ltd, MAN Energy Solutions SE, and Caterpillar Inc.

This product will be delivered within 2 business days.

Key Highlights

- Biomass-based combined heat and power are expected to witness the fastest growth during the forecast period.

- Small-to-medium industrial facilities could benefit from flexible and cost-effective combined heat and power systems. Such systems benefit from conventional combined heat and power but could also provide support to the electricity grid in the form of electricity supply, frequency regulation, and reserve capacity. This, in turn, is expected to create significant opportunities for the combined heat and power system providers and plant developers shortly.

- China has dominated the combined heat and power market, with the majority of the demand coming from the industrial application of CHP.

Key Market Trends

Biomass-based Combined Heat and Power to Witness Significant Growth

- Over the recent decade, the biomass industry has grown significantly as it is a carbon-free process, as the resulting CO2 is captured by the plants being combusted. Biomass combined heat and power is a beneficial technology for sites with a constant demand for both heat and electricity, mainly when the site is off the mains gas grid and where biomass fuel is readily available.

- In cogeneration mode, the total efficiency may reach 85%-90%. Biomass integrated gasification in gas-turbine plants (BIG/GT) is not yet commercial. Still, integrated gasification combined cycles (IGCC), using black liquor (a by-product from the pulp and paper industry), are already used.

- Abundant resources and favorable policies enable bio-power to expand in China, Japan, and India. The proliferation of small projects, including digesters for off-grid applications,, is recorded in all significant economies of the region.

- Several biomass-based are planned to be commissioned in the region in the coming years, driving the sector's growth during the forecast period. For instance, the Minokamo biomass power plant, with a capacity of around 7.1 MW, is scheduled to operate by October 2023. It is expected to supply electricity to the local grid firm Chubu Electric Power Grid at fixed prices for 20 years under the FiT system.

- Also, biofuel production in the Asia-Pacific region increased to 310 thousand barrels of oil equivalent per day in 2020, up from 159 thousand barrels of oil equivalent per day in 2015, driving the sector's growth in Asia-Pacific.

- Thus, the biomass-based CHP segment will dominate the market during the forecast period due to the aforementioned developments.

China to Dominate the Market

- China dominated the combined heat and power market in 2020, and it is expected to continue its dominance in the coming years.

- A reliable and resilient grid is critical to the economic growth and energy security of China. As the country’s grid interconnects a growing number of renewable energy sources, such as wind and solar, the intermittent nature of power generation from these sources is creating challenges for power system operations. Electric utilities and other system operators face an increasing and immediate need for additional power to keep the electric grid stable and secure.

- Combined heat and power technologies can help manufacturing facilities, federal and other government facilities, commercial buildings, institutional facilities, and communities reduce energy costs and emissions and provide more resilient and reliable electric power and thermal energy.

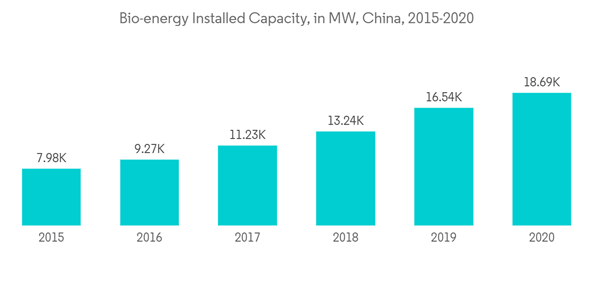

- In 2020, bioenergy capacity in China reached 18,687 megawatts (MW), from 16,637 megawatts (MW) in 2019, and it is expected to grow significantly as China has plans to add over 25 GW of biomass CHP capacity by 2035, which may drive the growth of the market.

- Moreover, China is looking to reduce the number of coal-fired power plants to be built abroad and in the country, as it has committed to carbon neutrality by 2060, which may drive the market's growth. For instance: Tianjin Junliangcheng Power Generation in China was building a CHP gas plant to replace its coal-fired plant.

- Thus, due to the aforementioned developments, the combined heat and power market is expected to grow in China during the forecast period.

Competitive Landscape

The Asia-Pacific combined heat and power market is moderately fragmented. Some of the key players in this market include General Electric Company, Siemens Energy AG, Mitsubishi Electric Asia Pte Ltd, MAN Energy Solutions SE, and Caterpillar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET OVERVIEW

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- General Electric Company

- Siemens Energy AG

- Mitsubishi Electric Asia Pte Ltd

- MAN Energy Solutions SE

- Caterpillar Inc.

- Kawasaki Heavy Industries Ltd

- Bosch Thermotechnology GmbH

- Viessmann Group