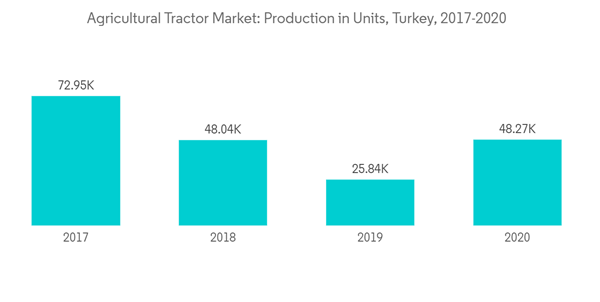

Due to the disruption of the supply chain as the COVID-19 pandemic spread across the country, the scheduled production of the tractor in facilities was affected, and it was not able to return to regular production. Furthermore, TurkTraktor, the leader of the Turkish tractor market with the highest tractor volume of 28,000-33,000 units and occupying 15,500 units with local tractor sales, worked to prevent the disruption of agricultural operations amid coronavirus outbreaks with 147 R&D centers employees, of which 123 are research. TurkTraktor launched its Online Training Program in April 2020 to share the technical knowledge that will enable the farmers to get higher efficiency from their greatest companions, their tractors, and related agricultural equipment in the pandemic days when agricultural productivity is even more critical than before.

Turkey's tractor market has been continuously growing. The decrease in the total agricultural area and the expansion of fragmented land prevented agricultural production from achieving expected levels. While the organic growth of sales of tractors is delivering a year-on-year increase, more than 45% of the tractors currently operating on the farms across the country can be placed under the age range of above 25 years. Among all, 60+ HP range tractors are most popular among the farmers owing to the convenience of carrying out multiple operations.

The domestic market for tractors has been steadily increasing on account of the increased value generated by the country's agricultural businesses. There has also been a robust demand for the export market of Turkish tractors since they are observed to be highly price-competitive compared to those from Europe. The tractor export has increased from 23.319 units to 20.309 units during the period 2019-2020, which decreased in 2020 due to the pandemic. The major export markets for Turkish tractors included Ukraine, Australia, and Algeria, which together accounted for exports worth USD 22 billion in 2020. Therefore, all these factors together influence the market positively.

Key Market Trends

Significant Domestic Manufacturing is Contributing to the Market Growth

Turkey has a sizeable domestic production base for tractors. Only a few major market players are engaged in the production of tractors. There are eight manufacturing plants which supply the bulk of the tractors for the domestic markets, as well as for exports. The domestic market for tractors has been steadily increasing on account of the increased value generated by the country's agricultural businesses. The factors that have contributed to a favorable economic scenario for investments in production include the availability of a cost-competitive and skilled labor force, competitive electricity and fuel prices, and a beneficial tax regulatory structure for the industry.

The Turkish economy experienced a significant slowdown in the second half of FY 2019 due to both currency tensions in August 2018 and the restrictive monetary policy adopted to contain inflation. This resulted in a decline in tractor manufacturing. However, the Turkish government provides VAT exemption on imported and locally manufactured machinery (parts of tractors) for production. The favorable factors related to the investment scenario and a robust historical production base have helped maintain tractors' prices. This is expected to drive the Turkish agricultural tractor market’s growth.

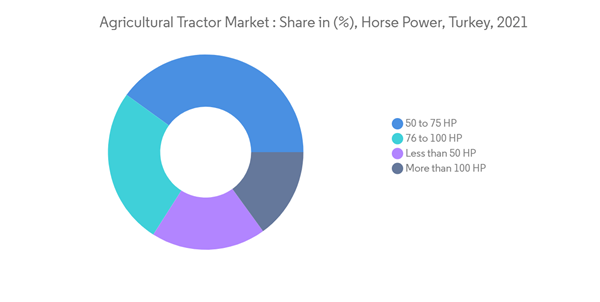

50 - 75 HP Range Tractors Dominate the Market

The Turkish government has the biggest support to let the agricultural mechanization spread wide. The agricultural mechanization of Turkey, which foreign companies had dominated, has come to support Turkey’s domestic economy. In the market, companies are focusing on strategies, such as expansions and product developments, not just for the domestic market but also for exports. The significant product developments occurred in the 50-75 HP power segment, the country's most popular engine power segment.

In the market, companies are focusing on strategies, such as expansions and product developments, not just for the domestic market but also for exports. The significant product developments occurred in the 50-75 HP power segment, the country's most popular engine power segment. Deere & Co. and the Hattat Group of Turkey agreed to form a joint venture company for the production of 50-90 hp tractors and the distribution of John Deere agricultural equipment throughout Turkey.

Competitive Landscape

The Turkish agricultural tractor market is consolidated, with the top companies accounting for the majority market share. However, the market has an equal presence of domestic and multinational brands. One of the leading global players, Deere & Co., is a late entrant to the Turkish market, having entered the market only in 2017. The company is building a tractor manufacturing unit in the Aegean region of Turkey. The company signed a joint venture agreement with the domestic manufacturer Hattat Group. Other global companies, such as AGCO Corporation and CNH Industrial, have their continued presence in the country. In Turkey, AGCO operates through its brand Massey Ferguson. CNH’s New Holland brand of tractors is one of the most popular brands in the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Erkunt Traktr Sanayii AS

- CNH Industrial NV

- Tumosan Tractors Europe

- Uzel Corporation

- Hattat Holding AS

- AGCO Corporation

- Turk Tractor and Agricultural Machinery Corporation

- Deere & Company