Key Highlights

- The COVID-19 pandemic had a significant impact on many people who work for building and construction sheet companies, and they are now concentrating on steady, long-term growth.As the global building and construction materials industry and other chemical industries are important to the economic recovery of countries, these companies are likely to see opportunities in the near future.

- Increasing construction spending by governments in different countries, especially China and India, to meet rising industrial and public infrastructure needs is expected to be a major factor driving demand for the product in construction applications over the forecast period. As a result, Asia-Pacific is expected to remain the fastest-growing construction market. For instance, India's construction industry was valued at over three trillion Indian rupees (USD 36.60 billion) in the fourth quarter of 2022. This was a significant increase compared to 2020, when the value shrank due to the coronavirus (COVID-19) pandemic.

- In industrial buildings, metal and polymer sheets are mostly used for roofing, electrical, heating, ventilation, and air conditioning (HVAC) purposes to protect and insulate workers and machines. As developing economies become more industrialized, the number of industrial buildings that need the product is likely to grow. The market for metal sheets in residential air handling and ventilation systems is likely to grow because more modern heating, cooling, and ventilation systems are being put into new buildings. Also, the demand for bio-based polymer sheets in the residential sector is growing because of the trend toward green building.

- In building and construction, polycarbonate sheets are used for things like skylight lenses and safety and security glazing. Architectural glazing has better light diffusion, which helps reduce glare and spread light more evenly across the glazed surface. Polymer sheets are used in a wide range of applications, including greenhouses, sound barriers, furniture, and window glazing in the building and construction sector. Also, the growing popularity of interior design and architecture is likely to increase the demand for polymer sheets and their raw materials, like polyester, PVC, polyamides, and polyurethanes.

Building and Construction Sheets Market Trends

Rising Infrastructural Development Activities

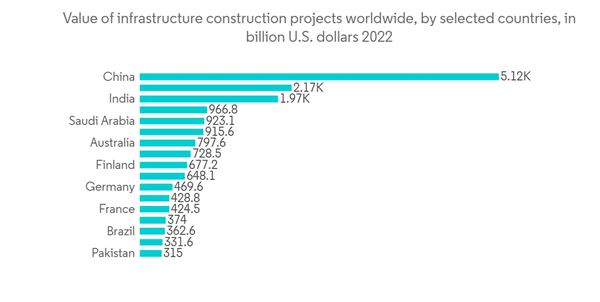

In emerging economies, the government has to speed up its investments in the building and construction materials market because the population is growing and cities and factories are growing quickly. The accelerated investment will further satisfy rising infrastructural needs and ultimately boost the market. Besides, the market is projected to experience significant growth in the construction industry due to the rising disposable income in developing countries.In China, the infrastructure projects in development or execution worth over 25 million U.S. dollars as of May 2022 were worth over 5 trillion U.S. dollars. The United States and India were the next two countries on the list, with around 2 trillion dollars worth of infrastructure projects. Because of the positive developments seen in Germany and the UK, the building industry in Europe is expected to rebound and show positive growth.

Also, many western European economies are expected to see their budget deficits go down, which is likely to be good for the demand for building and construction materials. Over the next few years, Latin America is expected to grow steadily because there is a higher demand for atactic polypropylene, which has better properties like resistance to UV light, durability at low temperatures, and resistance to flow at high temperatures.

So, the building and construction sheets market will grow over the next few years because more infrastructure is being built and more polymer and metal sheets are being used in building applications.

Asia-Pacific is Likely to Dominate the Market

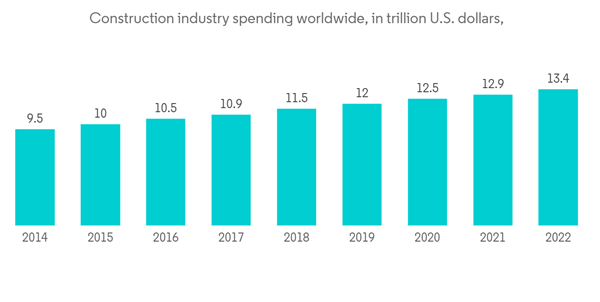

The construction industry grew to a spending value of close to 12 trillion U.S. dollars before the coronavirus pandemic and is expected to grow by three percent per annum. This includes building projects in real estate, either residential or commercial, but also in infrastructure or industrial structures. In 2021, Asia-Pacific will have the highest construction industry output in the world. In that year, the Asia-Pacific region's construction output was 4.8 trillion U.S. dollars. More than half of the total value of new contracts signed by China's construction enterprises in 2022 was worth approximately 36.65 trillion yuan.Steel sheet metal is widely used in multiple end-user industries. For instance, the construction sector accounts for around 50% of global steel consumption. China remains the global leader in crude steel production, with December 2022 reaching 77.9 million metric tons, roughly 10 percent less than its production in December of the year before. India, Japan, the United States, and Russia follow distantly.

During the forecast period, Asia-Pacific is expected to be the largest regional market and the one that grows the fastest. The growth is attributed to rapid industrialization and urbanization in the region. Moreover, the continuously growing population is further expected to boost the production and consumption of building and construction sheets during the forecast period. For instance, India's population was 141.7 crore as of the end of 2022.

The Asia-Pacific market is expected to have the most demand for polyolefins. The region has the presence of many global leaders in polymer sheet manufacturing. The region has a relatively high growth rate as a result of its continuously increasing demand. The demand in the region is mainly due to the increasing appetite for polymer sheets in China.

Governments in several countries, especially the U.S., India, and China, are expected to spend more on construction to meet rising needs for industrial and public infrastructure. This is expected to be a major factor driving the demand for the product in construction applications.

Building and Construction Sheets Industry Overview

The market is very fragmented, but it is also very competitive, with big companies serving the international market and small companies serving the local market. Also, the fact that there are a lot of product suppliers in all of the regions is likely to keep new people from getting into the business. Most of the time, the biggest players in the market sell a wide range of construction products instead of just one type. As a result, these companies mostly compete based on pricing and product portfolios. The companies strive to gain market share by providing specialized installation services.Some of the key players in the building and construction sheet market include Paul Bauder GmbH and Co. KG, GAF Materials Corporation, Atlas Roofing Corporation, CertainTeed Corporation, Owens Corning Corp., Etex, North American Roofing Services, Inc., Fletcher Building Limited, EURAMAX, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Paul Bauder GmbH & Co. KG

- GAF Materials Corporation

- Atlas Roofing Corporation

- CertainTeed Corporation

- Owens Corning Corp.

- Etex

- North American Roofing Services Inc.

- Fletcher Building Limited

- Icopal ApS

- EURAMAX*