Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite their essential role in specific vehicle segments, the market faces significant headwinds from the broader technological shift toward disc braking systems and advanced electronic transmissions. The rapid uptake of electric vehicles creates a substantial challenge, as these platforms utilize regenerative braking and distinct drivetrain architectures that frequently eliminate the need for traditional bands. This structural transition fundamentally lowers the reliance on legacy friction components, thereby impeding the potential for long-term volume growth in the sector.

Market Drivers

The enduring prevalence of automatic transmission systems serves as the primary catalyst for the global brake band market. These friction components are essential for the functioning of epicyclic gearing mechanisms found in traditional step-automatic transmissions, where they hold specific drivetrain elements stationary to facilitate desired gear ratios. This dependency is especially strong in the North American light-duty vehicle market, where the transition away from manual gearboxes is nearly total, establishing a vast installed base for transmission friction parts. Highlighting this dominance, the National Automobile Dealers Association (NADA) reported in its '2025 Mid-Year Data Report' from August 2025 that franchised dealers in the United States sold 8.1 million light-duty vehicles in the first half of the year, ensuring a steady need for these holding mechanisms in new assemblies.Simultaneously, rapid industrialization within the automotive sectors of emerging markets offers a critical avenue for growth, helping to offset saturation in developed regions. Developing economies in Asia are experiencing significant expansion in domestic component manufacturing to cater to both local vehicle production and global exports, boosting the consumption of durable drivetrain parts. For example, the Automotive Component Manufacturers Association of India (ACMA) noted in its July 2025 'Industry Performance Review for Fiscal 2024-25' that the Indian automotive component industry's turnover hit USD 80.2 billion, a 9.6% year-on-year increase. Furthermore, specific heavy-duty segments show resilience; the European Automobile Manufacturers’ Association (ACEA) reported that new bus registrations in the European Union increased by 3.6% during the first three quarters of 2025, reinforcing demand for heavy-duty braking solutions.

Market Challenges

The swift industry-wide transition toward electric vehicle (EV) architectures and advanced electronic braking systems poses a fundamental threat to the global automotive brake band market. While traditional brake bands are mechanically vital for gear shifting in conventional automatic transmissions and for static holding in heavy-duty drum configurations, the design of electric vehicles largely negates this dependency. EVs primarily employ regenerative braking systems to decelerate by converting kinetic energy into electricity, which significantly diminishes wear and the need for friction-based components. Additionally, electric drivetrains generally use single-speed reduction gears instead of the complex multi-speed planetary gearboxes that require bands for gear engagement, effectively removing a core application for these parts.This structural displacement is highlighted by the skyrocketing adoption of electrified platforms in key automotive markets, indicating a contracting addressable market for legacy transmission components. According to the China Association of Automobile Manufacturers (CAAM), sales of New Energy Vehicles (NEVs) reached 12.87 million units in 2024, accounting for 40.9% of the country's total new car sales. This significant influx of vehicles featuring drivetrains that largely omit traditional brake bands underscores the severity of the challenge. As manufacturers focus on these modern platforms to meet electrification goals, the demand for conventional friction strips within the passenger vehicle sector is poised to undergo a sustained decline.

Market Trends

The growth of the transmission remanufacturing sector is actively reshaping the brake band market, as vehicle owners increasingly choose to rebuild existing drivetrains rather than incur the high costs of replacement. This trend is driving demand for transmission overhaul kits and individual brake bands in the aftermarket, providing a crucial supply line for aging vehicle fleets necessitating cost-effective maintenance. The economic feasibility of these repair and remanufacturing options is evident in the wider expansion of the aftermarket industry, which ensures the continued availability of these legacy friction parts. As reported by the Auto Care Association in its '2026 Auto Care Factbook' from June 2025, total U.S. light-duty aftermarket sales rose by 5.7% in 2024 to USD 413.7 billion, demonstrating a persistent reliance on component replacement and overhaul services.Concurrently, the digitization of aftermarket supply chains is revolutionizing the global sourcing and distribution of niche transmission components such as brake bands. Manufacturers and distributors are utilizing e-commerce platforms and digital B2B marketplaces to improve the accessibility of specific brake band sizes and specifications, effectively reducing lead times for mechanics and transmission specialists. This migration toward digital procurement is securing strong support among industry stakeholders by simplifying the logistics involved in acquiring hard-to-find parts. According to the '2025 Joint E-commerce Trends and Outlook Forecast' by the Auto Care Association and MEMA Aftermarket Suppliers released in November 2025, e-commerce sales for automotive parts - excluding third-party marketplaces - are anticipated to increase by 4.6% in 2025, emphasizing the growing shift toward online sourcing strategies for essential vehicle components.

Key Players Profiled in the Automotive Brake Band Market

- Bosch GmbH

- Continental AG

- Aisin Seiki Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- Brembo S.p.A.

- ZF Friedrichshafen AG

- Nissin Kogyo Co., Ltd.

- Mando Corporation

- Haldex AB

- Knorr-Bremse AG

Report Scope

In this report, the Global Automotive Brake Band Market has been segmented into the following categories:Automotive Brake Band Market, by Transmission Type:

- Automatic Transmission (AT)

- Automated Manual Transmission (AMT)

- Dual-Clutch Transmission (DCT)

- Continuously Variable Transmission (CVT)

- Others

Automotive Brake Band Market, by Vehicle Type:

- Passenger Cars

- LCV

- M&HCV

Automotive Brake Band Market, by Propulsion:

- Petrol/CNG

- Diesel

- Electric

- Hybrid

Automotive Brake Band Market, by Demand Category:

- OEM

- Replacement

Automotive Brake Band Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Brake Band Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Brake Band market report include:- Bosch GmbH

- Continental AG

- Aisin Seiki Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- Brembo S.p.A.

- ZF Friedrichshafen AG

- Nissin Kogyo Co., Ltd.

- Mando Corporation

- Haldex AB

- Knorr-Bremse AG

Table Information

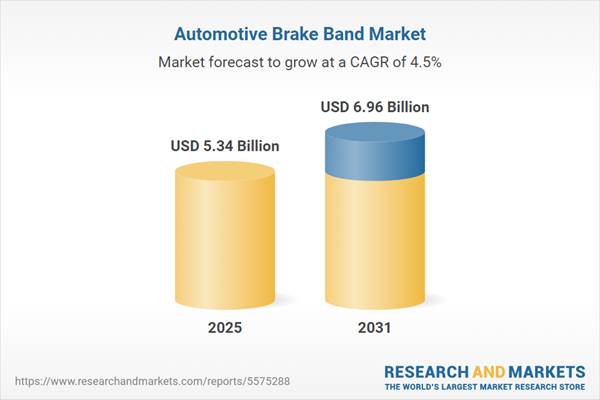

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.34 Billion |

| Forecasted Market Value ( USD | $ 6.96 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |