Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

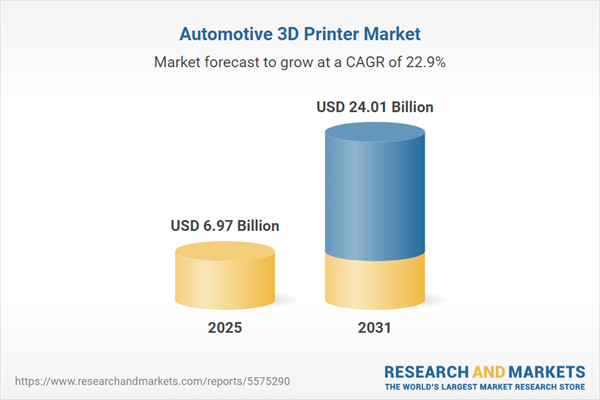

Despite these benefits, the widespread expansion of the market faces significant hurdles, such as high material costs and the stringent certification processes required for safety-critical parts. Nevertheless, the industry remains resilient and maintains a positive outlook regarding future investment. As reported by VDMA, 77% of additive manufacturing companies expected growth in their domestic markets in 2025. This statistic indicates a strong industry confidence that, as technical standards mature, the deployment of 3D printing solutions will continue to rise to satisfy evolving production requirements.

Market Drivers

The acceleration of rapid prototyping to shorten time-to-market serves as a primary catalyst for industry adoption, allowing engineers to validate designs and iterate physical models quickly without the delays inherent in traditional tooling. By eliminating long lead times for molds and dies, manufacturers can significantly compress product development cycles, which is a crucial advantage in the competitive automotive sector. This operational agility facilitates immediate functional testing and design verification, leading directly to faster vehicle launches. For instance, General Motors stated in a January 2025 press release that it executed over 5,400 new additive manufacturing projects in 2024, explicitly highlighting accelerated tooling lead times as a major benefit of this widespread deployment.Additionally, the rising demand for lightweight electric vehicle (EV) components drives market expansion, as automakers utilize topology optimization and complex lattice structures - achievable only via additive manufacturing - to offset heavy battery masses. Reducing vehicle weight is vital for extending EV range and improving overall energy efficiency, prompting a shift away from conventional casting methods for specific high-performance parts. This trend toward lighter, structurally optimized components is exemplified by the BMW Group's May 2024 report, which detailed the deployment of a 3D-printed robot gripper that was 30% lighter than its predecessor. Furthermore, Protolabs' '3D Printing Trend Report 2024' from April 2024 noted that 70% of surveyed businesses printed more parts in 2023 than in the previous year, signaling sustained momentum in industrial adoption.

Market Challenges

High material costs present a formidable barrier to the growth of the Global Automotive 3D Printer Market, largely by limiting the technology's viability for high-volume production. Although additive manufacturing provides significant design flexibility, the specialized proprietary materials required - such as high-grade metal powders and engineering-grade thermoplastic filaments - are considerably more expensive than the raw materials used in traditional methods like stamping or injection molding. In the cost-sensitive automotive industry, where profit margins are often thin, these elevated operational expenses make it difficult for manufacturers to justify switching from conventional processes to 3D printing for mass-produced components, thereby confining the technology mostly to prototyping or low-volume, high-value applications.The financial strain caused by these input costs directly impacts capital expenditure decisions within the sector. Manufacturers are frequently hesitant to scale up their additive capabilities when recurring material expenses erode the return on investment. This caution is reflected in recent industry data; according to the VDMA Additive Manufacturing Working Group in 2024, only 27% of surveyed companies planned to increase their investments in the coming year. This restraint, partly attributed to the need to improve cost levels for better competitiveness, underscores how the high price of essential materials continues to dampen the financial confidence necessary for broader market adoption.

Market Trends

The industry is transitioning toward the direct manufacturing of end-use automotive components, moving technology beyond prototyping into full-scale serial production. As process repeatability improves, automakers are deploying additive systems to fabricate road-ready parts, bypassing the constraints of injection molding for medium-volume runs. This approach allows for the economic production of integrated assemblies without fixed tooling costs, enabling agile responses to fluctuating model demands. The scale of this integration is illustrated by the BMW Group's October 2024 report, which noted that the company's dedicated campus successfully 3D-printed over 300,000 parts in 2023, validating the technology's readiness for industrial applications.Simultaneously, the adoption of digital warehousing for on-demand spare parts production is reshaping supply chains by replacing physical inventory with virtual files. Manufacturers can now produce replacement parts locally and on-demand, eliminating the warehousing costs associated with storing slow-moving stock. This strategy effectively manages service parts for older models, ensuring availability without the financial burden of minimum order quantities. This operational shift is significant; as reported by 3DPrint.com in August 2024, Daimler Truck & Buses has fabricated over 100,000 spare bus parts, demonstrating the commercial viability of substituting physical stockpiles with additive manufacturing.

Key Players Profiled in the Automotive 3D Printer Market

- 3D Systems Corporation

- Stratasys Ltd.

- HP Inc.

- Materialise NV

- EOS GmbH

- Renishaw PLC

- Desktop Metal Inc.

- Voxeljet AG

- Ultimaker BV

- SLM Solutions Group AG

Report Scope

In this report, the Global Automotive 3D Printer Market has been segmented into the following categories:Automotive 3D Printer Market, by Technology:

- Stereolithography

- Fused Disposition Modelling

- Selective Laser Sintering

- Laminated Object Manufacturing

- Three Dimensional Inject Printing

- Others

Automotive 3D Printer Market, by Application:

- Prototyping & Tooling

- Manufacturing Complex Components

- Research

- Development & Innovation

- Others

Automotive 3D Printer Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive 3D Printer Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive 3D Printer market report include:- 3D Systems Corporation

- Stratasys Ltd

- HP Inc

- Materialise NV

- EOS GmbH

- Renishaw PLC

- Desktop Metal Inc

- Voxeljet AG

- Ultimaker BV

- SLM Solutions Group AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.97 Billion |

| Forecasted Market Value ( USD | $ 24.01 Billion |

| Compound Annual Growth Rate | 22.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |