Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces significant hurdles due to the instability of raw material prices and disruptions within the supply chain, which introduce uncertainty regarding production costs and delivery timelines. Manufacturers are tasked with managing these logistical complexities to sustain profitability while satisfying the requirements of large-scale contracts. Data from the Business and Institutional Furniture Manufacturers Association indicates that the North American business and institutional furniture market was projected to reach a value of $21.58 billion in 2024. This statistic highlights the sector's considerable financial scale, even as it navigates persistent external economic pressures.

Market Drivers

The increasing acceptance of hybrid and flexible work models is fundamentally transforming the Global Commercial Furniture Market, pushing organizations to replace density-focused layouts with adaptable, collaborative configurations. As employees adopt rotational office schedules, businesses are directing investments toward modular furniture and technology-enabled pods designed for dynamic use rather than fixed seating. This structural shift is reflected in changing occupancy metrics; according to the CBRE 'European Office Occupier Sentiment Survey 2024' from July 2024, 61% of companies reported average office utilization rates between 41% and 80%, a range that favors agile environments over traditional cubicles. To meet this evolving demand, leading manufacturers are maintaining high production levels, as seen in HNI Corporation's 'Third Quarter 2024 Results' from October 2024, where the Workplace Furnishings segment achieved net sales of $505.1 million, underscoring the sector's financial strength amidst economic uncertainty.At the same time, the surging demand for sustainable and eco-friendly furniture serves as a crucial market differentiator, propelling the industry toward circular design frameworks and carbon neutrality. Corporate tenants, driven by their own Environmental, Social, and Governance (ESG) mandates, now insist on furniture solutions that incorporate recycled materials and ensure end-of-life recyclability to help mitigate Scope 3 emissions.

Manufacturers are responding by actively decarbonizing their supply chains and production processes to meet these strict specifications. According to Steelcase's '2024 Impact Report' released in September 2024, the company achieved a 30% reduction in operational carbon emissions over a four-year period, demonstrating the industry's tangible commitment to these green standards. This shift toward environmental responsibility has evolved from a niche preference into a commercial necessity for securing contracts with major multinational enterprises.

Market Challenges

The fluctuation of raw material costs combined with supply chain interruptions presents a severe constraint on the growth of the Global Commercial Furniture Market. Manufacturers contend with constant unpredictability regarding the prices of essential inputs like steel, lumber, and foam, necessitating frequent pricing adjustments that erode profit margins. This instability makes it difficult for producers to provide competitive, long-term contracts to commercial clients, often resulting in delayed procurement decisions. Additionally, inconsistent delivery schedules caused by logistical bottlenecks hinder the timely completion of large-scale office or hospitality projects, prompting organizations to postpone capital expenditures to avoid operational risks.The consequences of these pressures are evident in the performance of key manufacturing hubs, where output has struggled to maintain momentum. Data from the Association of the German Furniture Industry (VDM) reveals that in the first half of 2024, sales within the German furniture industry declined by 9.7% to €8.3 billion. This contraction illustrates how the cumulative effect of cost uncertainty and logistical friction directly impedes market activity, limiting the sector’s overall revenue potential despite the underlying demand for commercial interiors.

Market Trends

The emergence of Resimercial Design Aesthetics is fundamentally altering commercial interiors as organizations aim to attract employees by mimicking the visual appeal and comfort of residential environments. This trend emphasizes psychological safety and relaxation through the use of warm textures, soft seating, and domestic-style lighting, moving away from the utilitarian focus of traditional offices. Major industry players are leveraging this shift by expanding their portfolios to include lifestyle-oriented brands that blend commercial durability with home-like comfort. The financial success of this "work-from-anywhere" aesthetic is clear; according to Haworth's report 'Haworth Group Posts $2.5 Billion 2024 Global Sales' from March 2025, the company achieved annual global sales of $2.5 billion, highlighting the continued commercial viability of integrating lifestyle elements into workplace solutions.Concurrently, the Standardization of Advanced Ergonomic Support has become a critical requirement, driven by a heightened corporate focus on long-term employee health and productivity. Unlike generic seating, this trend prioritizes high-performance task chairs and adjustable workstations specifically engineered to reduce physical strain during extended work periods. Manufacturers are addressing this need by embedding sophisticated mechanisms and medical-grade support systems into their core product lines to adhere to strict occupational health standards. The economic impact of this demand is reflected in the performance of leading manufacturers; for instance, Okamura Corporation's 'Consolidated Financial Results for the Fiscal Year Ended March 31, 2025', released in May 2025, showed net sales of ¥314.5 billion, indicating strong market appetite for functionally superior, health-centric furniture solutions.

Key Players Profiled in the Commercial Furniture Market

- Steelcase Inc.

- MillerKnoll Inc.

- Haworth Inc.

- HNI Corporation

- Okamura Corporation

- KOKUYO Co., Ltd.

- Teknion Corporation

- Kimball International

- Global Furniture Group

- ACTIU Berbegal y Formas S.A.

Report Scope

In this report, the Global Commercial Furniture Market has been segmented into the following categories:Commercial Furniture Market, by Type:

- Seating

- Storage

- Desks & Tables

- Workstation

- Beds

- Others

Commercial Furniture Market, by End Use:

- Office

- Education

- HoReCa

- Health

- Others

Commercial Furniture Market, by Distribution Channel:

- Offline

- Online

Commercial Furniture Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Commercial Furniture Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Commercial Furniture market report include:- Steelcase Inc.

- MillerKnoll Inc.

- Haworth Inc.

- HNI Corporation

- Okamura Corporation

- KOKUYO Co., Ltd.

- Teknion Corporation

- Kimball International

- Global Furniture Group

- ACTIU Berbegal y Formas S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

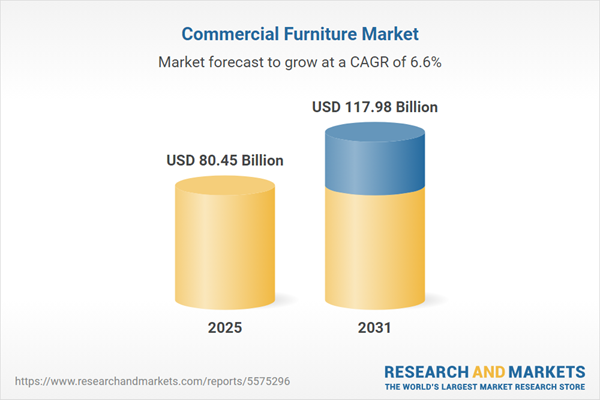

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 80.45 Billion |

| Forecasted Market Value ( USD | $ 117.98 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |