Usage-based insurance gains momentum as telematics policies surge in Europe and North America driven by digital transformation and cost-of-living pressures

Insurance Telematics in Europe and North America is the ninth strategy report in the series analysing the latest developments on the insurance telematics market. This strategic research report provides you with 220 pages of unique business intelligence including 5-year industry forecasts and expert commentary on which to base your business decisions.

The introduction of telematics technology in the context of automotive insurance is commonly referred to as usage-based insurance (UBI) or insurance telematics. Solutions of this type generally enable automotive insurers to improve pricing mechanisms based on actual driving data, gain better control of claims and differentiate their offerings to current and prospective policyholders. Variants of insurance telematics which have been popularised over the years include behaviour-based pricing models such as Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD) and Manage-How-You-Drive (MHYD).

The addressable market for insurance telematics is significant. A total of around 339 million vehicles were in use in the EU27+EFTA+UK in 2023, including over 294 million passenger cars. In North America, an estimated total of around 328 million vehicles were in use in 2024, out of which passenger cars and light trucks represent around 311 million vehicles. Some kind of basic automotive insurance is mandatory in most developed countries and there are in addition a number of subcategories of insurance that provide coverage for different types of unforeseen events involving motor vehicles. Motor gross written premiums in EU22+3 reached a total of €152.7 billion in 2023. The equivalent number for North America was US$456.7 billion (€422 billion) in 2024.

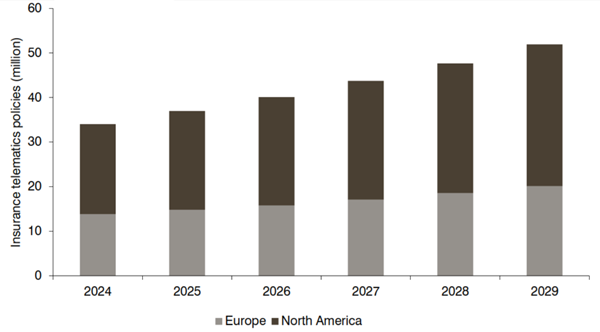

Both Europe and North America are forecasted to be growth markets for insurance telematics adoption in 2024-2029. Uncertain economic conditions and the cost-of-living crisis in many markets and their effects on the world economy are believed to drive demand for digital insurance business models, including insurance telematics. Europe and North America represent two major markets when it comes to insurance telematics programs and active policies, and the front-running national markets include the US, Italy, Germany, Canada and the UK. The analyst estimates that the total number of insurance telematics policies in force on the European market reached 13.8 million at the end of 2024. Growing at a compound annual growth rate of 7.8%, the number of insurance telematics policies in force in Europe is estimated to reach 20.1 million by 2029. In North America, the total number of insurance telematics policies in force is forecasted to increase from an estimated 20.2 million policies at the end of 2024 to reach 31.8 million policies by 2029, representing a compound annual growth rate of 9.5%.

In the US, most of the largest insurers in terms of UBI policies have all introduced smartphone- based solutions to supplement or replace the previously used OBD-II dongles. Several US and Canadian insurers have during recent years reassessed and re-launched their telematics programs. The North American insurance carriers are also exploring claims-related insurance telematics and many are adding distracted driving parameters in their UBI. The European insurance telematics market is dominated by insurers in Italy, Germany and the UK, with an estimated 10.0 million, 1.5 million and 1.3 million policies respectively. Uptake on all other markets is considerably lower, with between 50,000 and 320,000 policies in the Nordics, Iberian Peninsula, France and Benelux, and Central and Eastern Europe.

The insurance telematics value chain spans multiple industries. Insurers with notable presence in the insurance telematics market include Progressive, Unipol, State Farm, Allstate, Generali, Allianz, HUK-Coburg, Liberty Mutual, Nationwide, AXA, Groupama, Intact, Desjardins, Admiral, and Direct Line Group (acquired by Aviva). Insurance players can either develop telematics programs independently or rely on partners to varying degrees. Smartphone-based telematics programs have grown to significant market shares in the past years and insurers that have historically focused on hardware telematics solutions have also increased their focus on smartphone-based solutions or started to migrate to app-based solutions.

Leading providers of UBI based on hardware telematics devices include Octo Telematics, Targa Telematics, Vodafone Automotive and FairConnect. Leading smartphone telematics vendors include Cambridge Mobile Telematics, Arity, IMS and The Floow. Other leading vendors of insurance telematics solutions include Agero, CCC Intelligent Solutions, ClearScore, Dolphin Technologies, DriveQuant, Earnix, Greater Than, Howen Driving Data, LexisNexis Risk Solutions, MOTER Technologies, OSeven Telematics, Redtail Telematics, Scope Technology, Sentiance, Smith System, Sycada, Telematics Technologies and Valtech Mobility. Several traditional fleet telematics players including Azuga, Radius Telematics, Trakm8, Valtech Mobility and Webfleet are also active in the insurance telematics field. Examples of companies that provide hardware telematics devices to the market include Danlaw, Munic and Xirgo. Automotive OEMs are furthermore increasingly taking an active part in the ecosystem. Examples include BMW, General Motors, Ford, Honda, Hyundai, Mercedes-Benz, Stellantis, Tesla and Toyota.

Active Insurance Telematics Policies in Europe and North America 2024-2029

Highlights from the report:

- Insights from 30 new executive interviews with market leading companies.

- Comprehensive overview of the insurance telematics value chain and key applications.

- In-depth analysis of market trends and key developments.

- Case studies of 58 insurance telematics initiatives.

- Summary of the involvement of vehicle OEMs and mobile operators.

- New data on vehicle populations in Europe and North America.

- Market forecasts by country lasting until 2029.

This report answers the following questions:

- What types of insurance telematics products are offered on the market?

- Which are the leading providers of insurance telematics technology?

- Which are the dominant technology form factors on each market?

- Which are the most successful insurance telematics programs today?

- How are the TSPs approaching the insurance telematics market?

- How are the vehicle OEMs involved in the ecosystem?

- Which are the major drivers and barriers for insurance telematics adoption?

- Which are the key future trends in this industry?

Who should read this report?

Insurance Telematics in Europe and North America is the foremost source of information about the insurance telematics markets in these regions. Whether you are a telematics vendor, insurance company, vehicle manufacturer, telecom operator, investor, consultant, or government agency, you will gain valuable insights from this in-depth research.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agero

- Arity

- Azuga (Bridgestone)

- Cambridge Mobile Telematics

- CCC Intelligent Solutions

- ClearScore

- Danlaw

- Dolphin Technologies

- DriveQuant

- Earnix

- FairConnect Group

- Greater Than

- Howden Driving Data (Howden Group)

- IMS

- LexisNexis Risk Solutions

- MOTER Technologies

- Munic

- OCTO Telematics

- OSeven Telematics

- Radius Telematics

- Redtail Telematics

- Scope Technology

- Sentiance

- Smith System

- Sycada

- Targa Telematics

- Telematics Technologies

- The Floow

- Trakm8

- Valtech Mobility

- Vodafone Automotive

- Webfleet

- Xirgo