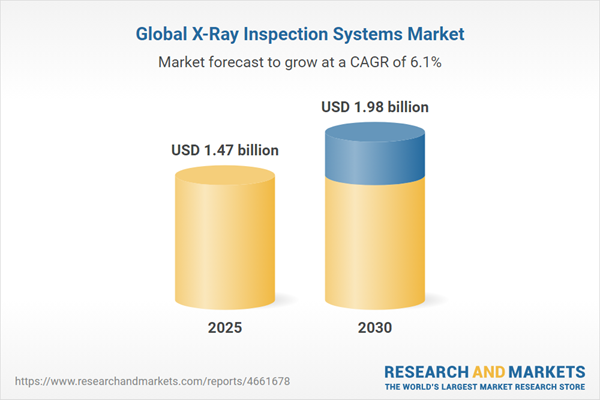

The global X-ray inspection systems market is experiencing robust growth, driven by increasing demand for non-destructive testing across industries such as food and beverage, aerospace, automotive, and manufacturing. These systems, which use radiography to detect corrosion, material defects, and foreign contaminants, are critical for ensuring product quality and safety. The market is propelled by technological advancements, particularly in high-resolution and 3D imaging, and growing consumer awareness of quality standards. However, high costs associated with system implementation pose a challenge to widespread adoption. Despite this, the market is expected to expand rapidly, especially in regions with stringent safety regulations and advanced industrial ecosystems.

Key Growth Drivers

Technological Advancements

Advancements in X-ray inspection technologies, such as high-resolution imaging, 3D capabilities, and faster scanning, are significantly driving market growth. These innovations enhance precision and user-friendliness, making X-ray systems more effective for detecting defects like metal bridges, foreign objects, and structural flaws in applications ranging from semiconductor production to automotive manufacturing. The development of advanced X-ray tubes, including those leveraging micro-electromechanical systems, further improves accuracy and streamlines inspection processes across industries.Rising Adoption in Food and Beverage

The food and beverage industry is a major driver of the X-ray inspection systems market, fueled by increasing demand for safety and quality control. X-ray systems detect contaminants such as metal, glass, or bone fragments, reducing the risk of foodborne illnesses and costly recalls. Stringent regulations, particularly from bodies like the U.S. Food and Drug Administration (FDA), emphasize the need for robust inspection systems to ensure product safety and protect brand reputation, further boosting market demand.Market Segmentation

By Industry Vertical

The X-ray inspection systems market is segmented into food and beverage, aerospace, automotive, manufacturing, and other sectors. The food segment is expected to witness significant growth due to the critical need for brand protection and compliance with safety standards. X-ray systems play a vital role in identifying contaminants and defects in food products, ensuring quality and preventing health risks. Their adoption in manufacturing and automotive industries also supports market growth by enabling precise detection of welding flaws, misalignments, and component issues.By Geography

The market is divided into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. North America holds a dominant share, driven by stringent FDA regulations and a focus on food safety and quality control. The region's advanced industrial infrastructure further supports the adoption of X-ray systems. Asia-Pacific is anticipated to grow rapidly, fueled by increasing use in food and beverage and manufacturing sectors, particularly in countries with expanding industrial bases and rising safety standards.Competitive Landscape

Key players in the X-ray inspection systems market include Mettler-Toledo and other global suppliers of precision instruments. These companies drive innovation through advanced algorithms, machine learning, and novel X-ray technologies, enhancing system performance and market reach.The X-ray inspection systems market is poised for significant growth, driven by technological advancements and increasing adoption in the food and beverage industry. North America leads due to stringent safety regulations, while Asia-Pacific is set for rapid expansion. Despite challenges from high implementation costs, the market's focus on quality control and safety across industries ensures a strong growth trajectory, supported by ongoing innovations and regulatory demands.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Market Segmentation:

By TYPE

- 2D X-ray Inspection System

- 3D X-ray Inspection System

By TECHNOLOGY

- Film based imaging

- Digital Imaging

- Computed Tomography

- Computed Radiography

- Direct Radiography

By INDUSTRY VERTICAL

- Automotive

- Defense

- Medical Device

- Manufacturing

- Food

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Golden Engineering Inc.

- AVONIX IMAGING

- 10.3. Virtual Media Integration

- Gopel Electronic GmbH

- QSA Global Inc.

- Thermo Fisher Scientific Inc.

- General Electric

- Visiconsult GmbH

- CXR Company

- Vidisco Ltd.

- Sesotec GmbH

- North Star Imaging Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.47 billion |

| Forecasted Market Value ( USD | $ 1.98 billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |