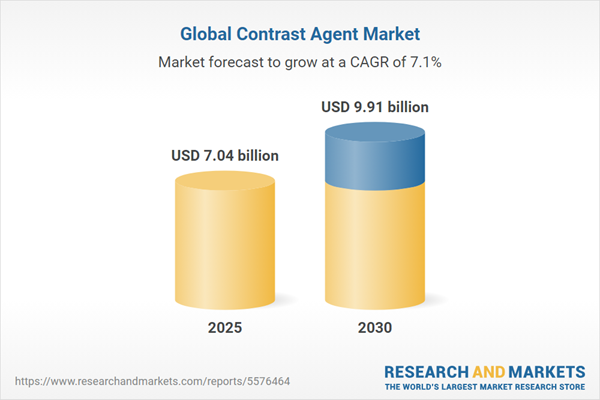

The global contrast agent market is poised for significant growth from 2025 to 2030, driven by the rising prevalence of chronic diseases and increasing demand for diagnostic imaging procedures such as ultrasonography, X-rays, MRI, and CT scans. Contrast agents, critical for enhancing image clarity in medical imaging, support accurate diagnosis and treatment, particularly in image-guided procedures (IGS). The market is propelled by advancements in imaging technology, growing healthcare investments, and rising R&D initiatives for innovative contrast agents. North America holds a significant market share, while Asia-Pacific is expected to grow rapidly due to expanding healthcare infrastructure. Challenges include high costs and potential adverse effects of contrast agents.

Market Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic conditions, such as cancer, cardiovascular diseases, and diabetes, is a primary driver of the contrast agent market. In 2023, the American Cancer Society reported 1,010,310 new cancer cases in males and 948,000 in females in the United States, highlighting the growing need for advanced diagnostic tools. Conditions like these require precise imaging for diagnosis and treatment planning, boosting demand for contrast agents in procedures like CT and MRI scans. The high prevalence of comorbidities necessitates enhanced imaging capabilities, further driving market growth.Growing Demand for Diagnostic Imaging

The surge in demand for diagnostic imaging, driven by public awareness and improved accessibility to modalities like CT and MRI, is fueling the contrast agent market. Image-guided procedures are gaining popularity due to their ability to provide real-time visualization, improving surgical outcomes and diagnostic accuracy. Innovations in contrast media, such as iso-osmolar agents, enhance imaging quality and patient safety, supporting market expansion. The growing adoption of minimally invasive procedures further amplifies the need for contrast agents to ensure precise diagnostics.Rising R&D Initiatives

Increased investment in research and development is creating opportunities for novel contrast agent applications. Collaborative efforts between companies, research institutions, and academic bodies are focused on developing safer, more effective agents with fewer side effects. These initiatives aim to expand the use of contrast agents in emerging applications, such as advanced MRI and spectral CT imaging, driving market growth by addressing unmet clinical needs and improving patient outcomes.Market Restraints

The contrast agent market faces challenges due to the high cost of advanced imaging procedures and contrast media, which can limit accessibility in cost-sensitive regions. Potential adverse effects, such as allergic reactions or nephrotoxicity associated with certain contrast agents, pose safety concerns, necessitating rigorous testing and regulatory compliance. Additionally, supply chain constraints and regulatory complexities may hinder market scalability. Addressing these challenges through cost-effective innovations and safer formulations will be critical for sustained growth.Market Segmentation

By Type

The market is segmented into iodinated, gadolinium-based, barium-based, and microbubble contrast agents. Iodinated agents dominate due to their widespread use in CT imaging, while gadolinium-based agents are critical for MRI scans. Microbubble agents are gaining traction in ultrasound imaging for their ability to enhance vascular visualization.By Application

The market includes diagnostic imaging (CT, MRI, ultrasound) and image-guided procedures. Diagnostic imaging holds the largest share, driven by the rising need for accurate diagnosis in chronic disease management. Image-guided procedures are a fast-growing segment due to their increasing use in minimally invasive surgeries.By Geography

The market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America leads, driven by a robust healthcare sector, high cancer prevalence, and product innovations like Fresenius Kabi's FDA-approved generic iodixanol contrast agent launched in 2023. Asia-Pacific is expected to grow rapidly, fueled by expanding healthcare infrastructure and rising chronic disease rates in countries like China and India.The contrast agent market is set for robust growth from 2025 to 2030, driven by the rising prevalence of chronic diseases, increasing demand for diagnostic imaging, and R&D advancements. Despite challenges like high costs and safety concerns, the market's outlook is positive, particularly in North America and Asia-Pacific. Industry players must focus on developing safer, cost-effective agents and leveraging collaborations to meet the growing demand for advanced imaging solutions.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Segmentation:

By Type

- Iodinated

- Barium-based

- Microbubble

- Gadolinium-based

By Modality

- X-ray/CT

- MRI

- Ultrasound

By Route of Administration

- Intravascular

- Oral

- Rectal

- Others

By Indication

- Oncology

- Cardiovascular Disease

- Neurological Disorders

- Gastrointestinal Disorders

- Nephrological Disorders

- Musculoskeletal Disorders

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Guerbet Group

- Bayer AG

- Lantheus Medical Imaging, Inc.

- Bracco Diagnostic, Inc.

- GE

- Curadel, LLC

- Daiichi Sankyo Company, Limited

- Magnus Health

- Spago Nanomedical AB

- J.B. Chemicals & Pharmaceuticals Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 7.04 billion |

| Forecasted Market Value ( USD | $ 9.91 billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |