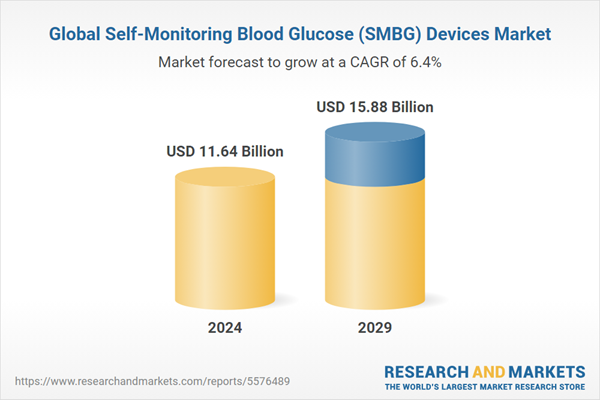

The global self-monitoring blood glucose (SMBG) devices market is anticipated to grow from US$11.644 billion in 2024 to US$15.883 billion in 2029 at a 6.41% (CAGR).

A self-monitoring blood glucose (SMBG) device monitors a person's glucose level. Both high and low blood glucose have the potential to severely impact the human body and hence require regular checks. Diabetes is a chronic disease that results in a disturbance in the body’s insulin production, negatively impacting overall health and other organs' functioning.The rising cases of diabetes owing to complex & stressful lifestyles and work cultures that have disturbed the dietary intake of people have created the requirement of recurring insulin checks in the body, especially for those suffering from the disease. SMBG devices are portable, faster, result-yielding devices that provide the glucose level in the blood within a few minutes and hence have witnessed a wider adoption for monitoring glucose.

Technological advancements in the market also play a vital role in encouraging market growth. Furthermore, increasing healthcare expenditures are expected to drive the market.

Global Self-Monitoring Blood Glucose (SMBG) Devices Market Drivers:

Growing cases of diabetes owing to lifestyle complexities and inaccurate dietary intake have increased the market growth.

Self-monitoring blood glucose devices such as testing strips or glucose meters play an integral in improving a patient’s metabolic control, and medication regime and provide a clear picture of their glycemic status. Furthermore, the necessary information provided by the SMBG devices assists doctors in understanding the patient’s diet intake and what medications are to be prescribed as per their health status.Diabetes has been emerging as a problematic chronic disease causing a great threat to life, according to the International Diabetes Federation, by 2030 nearly 643 million people will be living with diabetes globally and by 2045 it will be nearly 783 million.

With the alarming growth of the diabetic population, the demand for self-monitoring blood glucose devices is expected to show massive growth in the coming years. This can be witnessed especially in developed economies, where disposable income is higher than in underdeveloped nations, stimulating the overall market expansion.

Favorable campaigns and initiatives to spread awareness against diabetes

One of the major health concerns globally, diabetes leads to various other health problems related to the eyes, feet, and kidneys. Hence, various health campaigns and government-backed initiatives are being implemented to reduce the spread of such diseases. For instance, in February 2023, the New York State Department of Health launched a public awareness campaign to encourage Hispanic and black communities for prediabetic tests.Likewise, as per the 7 June 2024 press release, the National Health Service England announced diabetic awareness week in West Midland from 10 June, during which the healthcare system will educate people regarding symptoms, risks, and prevention associated with Type 1 and Type 2 diabetes. Such initiatives and campaigns will shift the focus of people towards self-glucose monitoring thereby driving the demand for SMBG devices.

Global Self-Monitoring Blood Glucose (SMBG) Devices Market Segment Analysis

Testing strips are expected to account for a considerable market share.

Based on product type, the global self-monitoring blood glucose device market is segmented into blood glucose meters, testing strips, and lancets & lancing devices. Testing strips, on the other hand, are disposable, one-time-use strips on which blood is placed so that it can be injected into the blood glucose meter. Since testing strips are single-use, they account for a remarkable market share.Blood glucose meters are electronic devices that calculate and display blood glucose levels using a sample of blood drops injected through a testing strip. Hence, they have a significant share of the market.

Type 2 diabetes is estimated to account for a considerable market share.

Based on indication, the global self-monitoring blood glucose device market is segmented into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 2 diabetes is poised for remarkable growth and will constitute a remarkable share as such diseases are found more commonly in adults and have a high prevalence in countries. According to the November 2023 press release of the Center for Disease Control and Prevention, more than 1 in 3 American adults are at risk of developing type 2 diabetes.North America is predicted to constitute a considerable market share during the forecast period.

Geographically, the SMBG device market is divided into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific regions for the study. North America is expected to grow at a lucrative rate during the forecasted period, fuelled by the growing prevalence of diabetes in major regional economies, namely the United States and Canada, which has surged the adoption of self-monitoring blood glucose devices.Rising disposable income and increasing expenditure on healthcare in the region are also expected to drive the market during the forecast period. The North American and European self-monitoring blood glucose device markets are projected to hold a large market share.

Global Self-Monitoring Blood Glucose (SMBG) Devices Market Restraints

The high associated cost of self-monitoring blood glucose devices will hinder market growth.

One of the prime constraints facing the self-monitoring blood glucose device market is the significant cost of the device. Self-monitoring blood glucose devices involve blood glucose meters, testing strips, and lancets and lancing devices. The initial cost of this device is significant. Furthermore, the device has a recurring cost of testing strips since these strips are single-use and cannot be reused. The notable cost of such a device has the potential to constrain the market in lower-middle and lower-income countries.Global Self-Monitoring Blood Glucose (SMBG) Devices Key Market Developments

- In March 2023, Astella Pharma Inc. partnered with Roche Diabetes Care Japan Co. Ltd to bolster the development & commercialization of the former’s “Accu-Chek® Guide M” blood glucose monitoring system as a combined product with FDA-approved digital health solution “BluStar” in the Japanese market.

The Global Self-Monitoring Blood Glucose (SMBG) Devices market is segmented and analyzed as follows:

By Type

- Blood Glucose Meters

- Testing Strips

- Lancets & Lancing Device

By Indication

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

By End-User

- Hospitals and Clinics

- Ambulatory Care Settings

- Diagnostics Centers

- Home Care Settings

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

Table of Contents

Companies Mentioned

- Abbott

- Hoffmann-La Roche Ltd.

- Lifescan Inc.

- Bayer Corporation

- ARKRAY, Inc.

- B. Braun Melsungen AG

- Sanofi

- Ypsomed AG

- Bionime Corporation

- Ascensia Diabetes Care Holdings AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 11.64 Billion |

| Forecasted Market Value ( USD | $ 15.88 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |