Hydraulic fluids are specialized liquids used in hydraulic systems to transmit power and control machinery. They are essential for the efficient operation of hydraulic machinery, ensuring smooth and precise movement while also providing lubrication and heat dissipation. They act as a medium for transmitting force generated by a pump to a hydraulic cylinder or motor, allowing for the controlled movement of heavy loads, precision positioning of components, and the operation of various mechanisms. They are virtually incompressible, ensuring that the force applied at one end of a hydraulic system is transmitted almost instantaneously to the other end, resulting in precise and responsive control of equipment.

At present, the increasing demand for hydraulic fluids as they act as a medium for transmitting force generated by a pump to a hydraulic cylinder or motor, allowing for the controlled movement of heavy loads, is impelling the growth of the market. Besides this, the rising use of electric vehicles (EVs) and hybrid vehicles as sustainable alternatives to fuel-run cars is contributing to the growth of the market. In addition, key market players are continually developing fluids that offer improved thermal stability, better wear protection, and enhanced lubrication properties. Apart from this, the increasing adoption of predictive maintenance techniques, driven by the Internet of Things (IoT) and data analytics, is supporting the growth of the market. Additionally, the rising utilization of renewable energy sources among businesses to minimize harmful emissions and carbon footprint is bolstering the growth of the market.

Hydraulic Fluids Market Trends/Drivers:

Growing environmental concerns and stringent regulations

The growing environmental concerns and stringent regulations are currently exerting a positive influence on the growth of the hydraulic fluids market. Besides this, manufacturers are increasingly developing and promoting biodegradable and less toxic hydraulic fluid formulations. This shift is in response to heightened environmental awareness and the need to comply with stricter regulations aimed at decreasing the environmental impact of industrial operations. Moreover, the implementation of stringent regulations and standards by governing bodies and environmental agencies is driving the adoption of hydraulic fluids that meet specific criteria for environmental sustainability and safety. Companies are proactively seeking out hydraulic fluid solutions that not only perform effectively but also adhere to these regulations. As a result, manufacturers are investing in research operations to formulate hydraulic fluids that minimize the release of harmful substances into the environment.Rising construction of residential and commercial infrastructure

At present, the rising construction of residential and commercial infrastructure is propelling the utilization of hydraulic fluids. Besides this, the construction projects in the residential and commercial sectors are creating a sustained demand for hydraulic systems and equipment. These systems play a critical role in various construction applications, including heavy machinery, cranes, and elevators, among others. In addition, the need for hydraulic fluids that can deliver high performance and operational reliability is currently driving innovation within the industry. Furthermore, as construction projects become more sophisticated and demanding, there is a growing emphasis on hydraulic fluids that can withstand higher pressures, temperatures, and operational stress.Increasing trend toward industrial automation

The increasing trend toward industrial automation is contributing to the growth of the hydraulic fluids market. Besides this, the rising adoption of industrial automation technologies in manufacturing and industrial processes is necessitating the use of hydraulic systems. These systems are vital for the precise control and efficient operation of various automated machinery and equipment. As the trend toward automation continues, there is a constant and growing demand for hydraulic fluids to lubricate, cool, and transmit power within these systems. Moreover, the complexity and precision required in automated processes are pushing hydraulic fluid manufacturers to develop advanced formulations. Furthermore, the drive towards energy efficiency in automated systems is promoting the use of hydraulic fluids that can minimize energy losses.Hydraulic Fluids Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global hydraulic fluids market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on base oil, point of sale, and end user.Breakup by Base Oil:

- Synthetic Oil

- Mineral Oil

- Bio-based Oil

Mineral oil accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the base oil. This includes synthetic oil, mineral oil, and bio-based oil. According to the report, mineral oil represented the largest segment.Mineral oil is a petroleum-based liquid that serves as a medium for transmitting power in hydraulic systems. It is a stable, high-viscosity fluid that is suitable for an extensive range of hydraulic applications. Mineral oil-based hydraulic fluids are extensively used in various types of hydraulic machinery, including industrial equipment, construction machinery, and agricultural machinery. They are employed to operate hydraulic cylinders, motors, and valves, providing the necessary force for lifting, pushing, and controlling movements. They are also used in automotive power steering systems and shock absorbers. They help facilitate smooth and responsive steering as well as absorb shocks and vibrations in vehicles.

Breakup by Point of Sale:

- Original Equipment Manufacturer (OEM)

- Aftermarket

An original equipment manufacturer (OEM) of hydraulic fluids refers to a company that produces hydraulic fluids or hydraulic fluid systems specifically designed and manufactured for use in various types of machinery and equipment. They manufacture hydraulic fluids which are designed to resist degradation and maintain their properties over time. This can lead to reduced maintenance requirements and lower overall operating costs for the equipment.

The aftermarket encompasses all the businesses and activities related to the maintenance, upgrade, or customization of hydraulic fluids and equipment after they have been purchased by consumers or businesses. This includes the supply of hydraulic fluids, filters, seals, hoses, and other components necessary for the maintenance, repair, and operation of hydraulic systems.

Breakup by End User:

- Oil and Gas

- Marine

- Automotive

- Aerospace and Defense

- Construction

- Others

Oil and gas exhibit a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes oil and gas, marine, automotive, aerospace and defense, construction, and others. According to the report, oil and gas accounted for the largest market share.Hydraulic fluids play a crucial role in the oil and gas industry, where they are used in various applications to power and control machinery and equipment. They are integral to drilling rigs and equipment employed in oil and gas exploration and extraction. They power the various components of drilling rigs, including the draw works, mud pumps, and top drive systems, allowing for precise control and efficient drilling operations. Offshore drilling and production platforms rely on hydraulic systems to operate various machinery and equipment, including cranes, winches, and tensioning systems. Hydraulic fluids are also used to power these systems, ensuring safe and efficient offshore operations.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest hydraulic fluids market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific held the biggest market share due to the rising investments in the construction of residential and commercial infrastructure. Besides this, the increasing adoption of hydraulic equipment in various manufacturing processes, including metalworking, plastic molding, and material handling, is contributing to the growth of the market. Moreover, the rising mechanization of agricultural practices is contributing to the market growth. Additionally, the increasing employment of hydraulic systems in mining and energy exploration activities is supporting the market growth in the region.

North America is estimated to expand further in this domain due to the increasing energy demands in industrial and commercial sectors. Moreover, the rising purchase of passenger cars to commute comfortably is bolstering the growth of the market.

Competitive Landscape:

Key market players are investing in research operations to create innovative items that offer better performance, longer service life, and improved environmental sustainability by developing bio-based and synthetic hydraulic fluids with superior properties. They are also focusing on developing hydraulic fluids that are more environmentally friendly and compliant with environmental regulations. Top companies are exploring new geographic markets and expanding their global reach to tap into emerging economies and regions with growing industrial sectors. They are also offering customized solutions to cater to the specific needs of different industries and applications. Leading companies are optimizing their supply chains to ensure a consistent and reliable supply of hydraulic fluids by streamlining logistics, adopting just-in-time inventory management, and ensuring a robust supplier network.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BASF SE

- bp p.l.c.

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Croda International Plc

- Dow Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co. Ltd.

- Lukoil

- Phillips 66 Company

- Royal Dutch Shell plc

- TotalEnergies SE

Key Questions Answered in This Report

1. How big is the hydraulic fluids market?2. What is the future outlook of hydraulic fluids market?

3. What are the key factors driving the hydraulic fluids market?

4. Which region accounts for the largest hydraulic fluids market share?

5. Which are the leading companies in the global hydraulic fluids market?

Table of Contents

Companies Mentioned

- BASF SE

- bp p.l.c.

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Croda International Plc

- Dow Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co. Ltd.

- Lukoil

- Phillips 66 Company

- Royal Dutch Shell plc

- TotalEnergies SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | May 2025 |

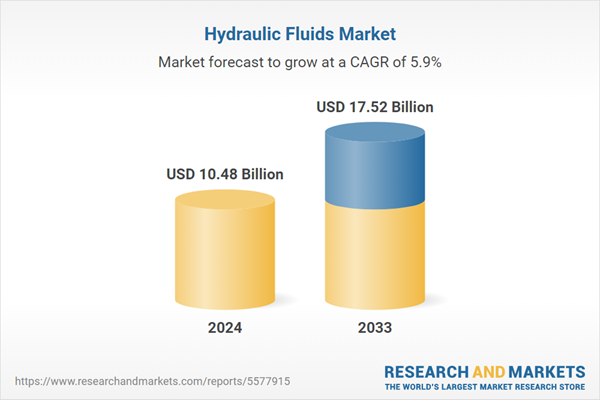

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 10.48 Billion |

| Forecasted Market Value ( USD | $ 17.52 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |