Technical foam relies on rubber and polymer blends developed for different industrial and commercial applications, such as filtering, sealing and sound insulation. It is lightweight, durable, robust, mildew resistant, and skin-friendly and offers resistance against heat. As a result, it is employed in the electronics, aviation, marine, and packaging industries. At present, there is a significant increase in the investments made by homeowners to maintain their floors, roofs, and walls, which is catalyzing the demand for technical foam across the globe.

Technical Foam Market Trends:

Rising building and construction activities represent one of the key factors positively influencing the market. Moreover, technical foam is extensively utilized in the automotive industry as it helps reduce the weight of insulation and improve the fuel efficiency of vehicles. It is also used in electric vehicles (EVs) for foam compression and providing protection against shock and rattling in battery components. Moreover, technical foam comprises polyurethane (PU) foam, which has high mechanical strength and low density, heat conduction coefficient, and water absorption properties. As a result, it is employed in catheters, general-purpose tubing, surgical drapes, hospital bedding, wound dressings, and short-term implants in the healthcare industry. In addition, PU foam finds applications as a cushioning material for gymnastics, martial arts, judo, wrestling, and agility mats in schools, sports halls, and leisure and climbing centers. Apart from this, key players are introducing bio-based product variants that are made using renewable resources. This, coupled with rising technological advancements, is fueling the growth of the market. Other factors, including rapid industrialization and the growing requirement for acoustic solutions to tackle noise pollution, are anticipated to create a positive outlook for the market.Market Segmentation:

This report provides an analysis of the key trends in each segment of the global technical foam market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product form, material, and end use industry.Breakup by Product Form:

- Flexible

- Rigid

- Spray

Breakup by Material:

- Elastomeric

- Polyurethane

- Polyethylene

- Others

Breakup by End Use Industry:

- Automotive and Transportation

- Electrical and Electronics

- Building and Construction

- Medical

- Sporting Equipment

- Packaging

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Armacell, BASF SE, Covestro AG, Dow Inc., Huntsman Corporation, Kaneka Corporation, Recticel, Saudi Basic Industries Corporation (Saudi Aramco), Sealed Air Corporation, Sekisui Chemical Co. Ltd., Woodbridge and Zotefoams Plc.Key Questions Answered in This Report

1. How big is the technical foam market?2. What is the future outlook of technical foam market?

3. What are the key factors driving the technical foam market?

4. Which region accounts for the largest technical foam market share?

5. Which are the leading companies in the global technical foam market?

Table of Contents

Companies Mentioned

- Armacell

- BASF SE

- Covestro AG

- Dow Inc.

- Huntsman Corporation

- Kaneka Corporation

- Recticel

- Saudi Basic Industries Corporation (Saudi Aramco)

- Sealed Air Corporation

- Sekisui Chemical Co. Ltd.

- Woodbridge

- Zotefoams Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | May 2025 |

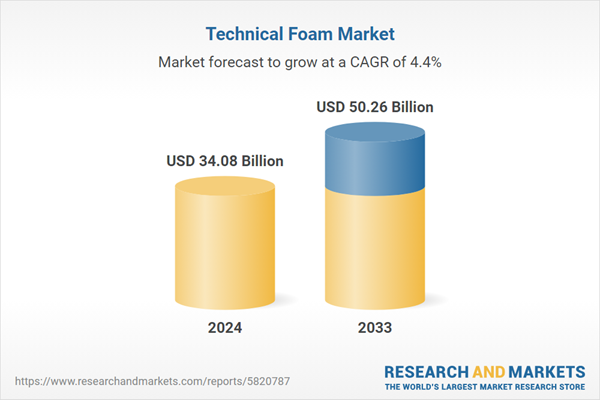

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 34.08 Billion |

| Forecasted Market Value ( USD | $ 50.26 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |