Transaction monitoring software is pivotal in the continuous and real-time oversight of financial institutions' activities. It conducts a comprehensive analysis of historical data and consumer account profiles, aiming to proactively address and mitigate money laundering risks by assessing risk factors at the individual customer level. This software is designed to promptly generate alerts whenever a transaction deviates from predefined rules associated with a customer profile.

The advantages offered by transaction monitoring solutions are manifold, encompassing the broadening of the transaction scope, the detection of financial irregularities, streamlined access to critical information, alignment with evolving regulatory requirements, and the preemptive management of financial sanctions and potential risks. In today's landscape, transaction monitoring solutions find extensive utilization across diverse industries, including government and defense, retail and eCommerce, information technology (IT), telecom, healthcare, energy and utilities, manufacturing, as well as banking, financial services, and insurance (BFSI). With their multifaceted capabilities, these solutions are indispensable tools for maintaining compliance, enhancing security, and ensuring the integrity of financial operations across a wide spectrum of sectors.

The global market is majorly driven by the expansion of digital transactions across industries. In line with this, the increasing need for robust monitoring solutions is significantly contributing to the market growth. Furthermore, the rising online financial activities have amplified the risk of financial crimes, making transaction monitoring software indispensable for detecting and preventing real-time money laundering, fraud, and other illicit activities. Moreover, the ever-evolving regulatory landscape is a significant driver. Governments and regulatory bodies worldwide continuously impose stricter compliance requirements on financial institutions.

This software is pivotal in helping these institutions keep pace with changing regulations and avoid costly penalties. It provides the agility to adapt to new rules and ensures adherence to anti-money laundering (AML) and know-your-customer (KYC) norms. Besides, the growing sophistication of financial crimes necessitates advanced monitoring capabilities.

Transaction monitoring software employs artificial intelligence (AI) and machine learning (ML) algorithms to analyze vast datasets, enabling the identification of complex and previously unseen patterns indicative of illicit activities. Additionally, the escalating integration of transaction monitoring software with other cybersecurity and fraud prevention tools enhances its effectiveness. This convergence streamlines security operations and reduces the response time to potential threats, catalyzing market growth.

Transaction Monitoring Software Market Trends/Drivers:

The rise in digital payments

The exponential rise in digital payments is bolstering market growth. With the expansion of online and mobile payment platforms, consumers and businesses conduct more financial transactions electronically. This rise in digital payment methods has escalated the risk of financial crimes, including money laundering, fraud, and cyberattacks. This software has become an indispensable tool in this landscape, offering real-time and historical analysis of digital transactions to detect and prevent illicit activities. It allows financial institutions and businesses to scrutinize payment data, identify unusual patterns, and generate alerts when potentially fraudulent transactions occur.This proactive approach is critical for maintaining the security and integrity of digital payment ecosystems. Furthermore, regulatory authorities worldwide are mandating stringent compliance standards, requiring financial institutions to implement robust monitoring solutions to ensure adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. As digital payment methods continue to gain prominence, this software stands as a crucial defense against financial crimes, fostering its widespread adoption and driving the growth of this dynamic market.

Increasing instances of money laundering

The increasing instances of money laundering are fostering the market. Money laundering, a complex financial crime, involves disguising the origins of illegally obtained funds by passing them through legitimate financial channels. With the global financial system becoming increasingly interconnected, criminals have found new avenues for money laundering, necessitating a robust response.This software has emerged as a frontline defense against money laundering activities. It leverages advanced data analytics, artificial intelligence, and machine learning algorithms to scrutinize vast volumes of financial transactions in real time. This enables it to detect unusual patterns and behaviors indicative of potential money laundering attempts.

When such irregularities are identified, the software generates alerts, allowing financial institutions and authorities to promptly investigate and take necessary action. Furthermore, regulatory bodies worldwide are tightening anti-money laundering (AML) regulations, mandating transaction monitoring software for compliance. Financial institutions are, therefore, compelled to invest in these solutions to meet regulatory requirements, thereby boosting market demand.

Growing need for managing counter-terrorist financing (CTF) activities

The growing need for managing counter-terrorist financing (CTF) activities is propelling the market growth. In an era marked by heightened security concerns and the global fight against terrorism, authorities, and financial institutions are under increasing pressure to prevent the flow of funds to terrorist organizations and individuals involved in illicit activities.This software plays a pivotal role in CTF efforts by meticulously scrutinizing financial transactions and identifying patterns indicative of suspicious or illegal funding activities. It enables the real-time monitoring of vast volumes of transactions across the financial ecosystem, allowing for the rapid detection and reporting of potentially illicit transfers.

Regulatory bodies worldwide impose stringent requirements for detecting and reporting suspicious transactions linked to terrorist financing. Financial institutions, therefore, rely on advanced transaction monitoring solutions to ensure compliance with these regulations. The software's ability to enhance the identification and prevention of CTF activities is instrumental in maintaining global financial security. As the global community remains committed to combating terrorism and its financial support networks, the demand for this software continues to grow, making it an essential tool in the ongoing battle against terrorist financing and a driving force behind the market's sustained expansion.

Transaction Monitoring Software Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global transaction monitoring software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, enterprise size, application, and end-use industry.Breakup by Component:

- Solution

- Services

Solution dominate the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services. According to the report, solution represented the largest segment.Breakup by Deployment Mode:

- On-premises

- Cloud-based

On-premises dominates the market

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based. According to the report, on-premises represented the largest segment.Breakup by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises dominates the market

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises, and large enterprises. According to the report, large enterprises represented the largest segment.Breakup by Application:

- Anti-Money Laundering

- Customer Identity Management

- Fraud Detection and Prevention

- Compliance Management

Fraud detection and prevention dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes anti-money laundering, customer identity management, fraud detection and prevention, and compliance management. According to the report, fraud detection and prevention represented the largest segment.Breakup by End Use Industry:

- BFSI

- Government and Defense

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Others

BFSI dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes BFSI, government and defense, IT and telecom, retail, healthcare, energy and utilities, manufacturing, and others. According to the report, BFSI represented the largest segment.Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The report has provided a comprehensive analysis of the competitive landscape in the transaction monitoring software market. Detailed profiles of all major companies have also been provided.

- ACI Worldwide Inc.

- BAE Systems plc

- ComplyAdvantage

- Experian plc

- Fair Isaac Corporation

- FIS

- Fiserv Inc.

- NICE Ltd.

- Oracle Corporation

- SAS Institute Inc.

- Software AG

- Thomson Reuters Corporation

Key Questions Answered in This Report:

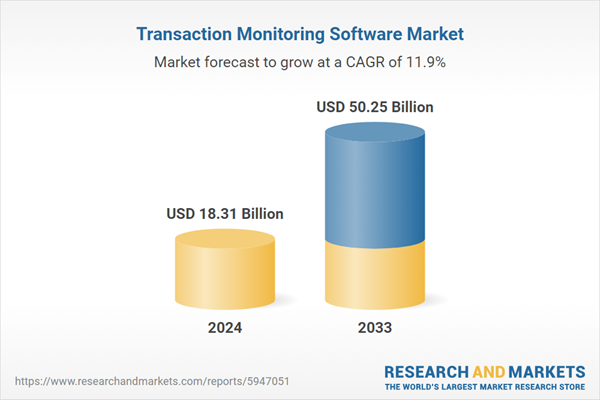

- How big is the transaction monitoring software market?

- What is the future outlook of the transaction monitoring software market?

- What are the key factors driving the transaction monitoring software market?

- Which region accounts for the largest transaction monitoring software market share?

- Which are the leading companies in the global transaction monitoring software market?

- What is the breakup of the global transaction monitoring software market based on the end use industry?

- What are the key regions in the global transaction monitoring software market?

- Who are the key players/companies in the global transaction monitoring software market?"

Table of Contents

Companies Mentioned

- ACI Worldwide Inc.

- BAE Systems plc

- ComplyAdvantage

- Experian plc

- Fair Isaac Corporation

- FIS

- Fiserv Inc.

- NICE Ltd.

- Oracle Corporation

- SAS Institute Inc.

- Software AG

- Thomson Reuters Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 18.31 Billion |

| Forecasted Market Value ( USD | $ 50.25 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |