Thermoplastic polyurethane (TPU) refers to a melt-processable thermoplastic elastomer that is manufactured by extrusion, injection, blow and compression molding equipment. It is widely available as polyester, polyether, and polycaprolactone and has good tensile strength and high load bearing capacity. It is lightweight, transparent, flexible, highly durable, non-toxic, and resistant to oil, grease, abrasion, high-energy radiation, ultraviolet (UV) rays, weather. It is environmentally friendly, recyclable, and can be soft as a rubber or hard as rigid plastic. It is capable of providing many combinations due to its physical properties and flexibility. It can be easily washed, sterilized, welded, painted, and die-cut while having high damping capacity. As a result, thermoplastic polyurethane (TPU) is employed in the automotive, construction, medical, textiles, and electrical and electronics industries across the globe.

Thermoplastic Polyurethane (TPU) Market Trends:

Presently, the rising adoption of TPU in the automotive industry to produce various automobile components, such as airbags, doors, bumper, seats, vehicle wiring and antivibration panels, and attachment clips, represents one of the key factors strengthening the growth of the market. Besides this, the growing utilization of TPU in the footwear industry to manufacture anti-slip and abrasion-resistance soles is positively influencing the market. In addition, the increasing demand for biodegradable and eco-friendly plastics is offering lucrative growth opportunities to industry investors. Apart from this, the rising adoption of TPU as a substitute for PVC in various medical applications, such as mattresses, dental materials, and gel shoe orthotics, is impelling the growth of the market. Moreover, governing agencies of various countries are encouraging the adoption of environmentally friendly products that do not harm the environment and decrease carbon footprint, which is offering a positive market outlook. This, coupled with the increasing employment of TPU to manufacture conveyor belts, electrical wires, power cable sheathing, equipment connectors, and drive belts, is supporting the growth of the market. In addition to this, the rising utilization of TPU-based sealants and adhesives in several industries due to high green strength is contributing to the growth of the market. Furthermore, the increasing adoption of TPU in textile products to produce heat-sealable fabrics is strengthening the market growth.Market Segmentation:

This report provides an analysis of the key trends in each segment of the global thermoplastic polyurethane (TPU) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, raw material, application, and end use industry.Type Insights:

- Polyester

- Polyether

- Polycaprolactone

Raw Material Insights:

- Polyols

- Diisocyanate

- Diols

Application Insights:

- Extruded Products

- Injection Molded Products

- Adhesives

- Others

End Use Industry Insights:

- Construction

- Automotive

- Footwear

- Medical

- Electrical and Electronics

- Heavy Engineering

- Others

Regional Insights:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global thermoplastic polyurethane (TPU) market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include American Polyfilm Inc., BASF SE, Coim Group, Covestro AG, Epaflex Polyurethanes Spa, Hexpol AB, Huntsman International LLC, Kuraray Co. Ltd., Mitsui Chemicals Inc., Sumei Chemical Co. Ltd., The Lubrizol Corporation (Berkshire Hathaway Inc.), Wanhua Chemical Group Co. Ltd.., etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report

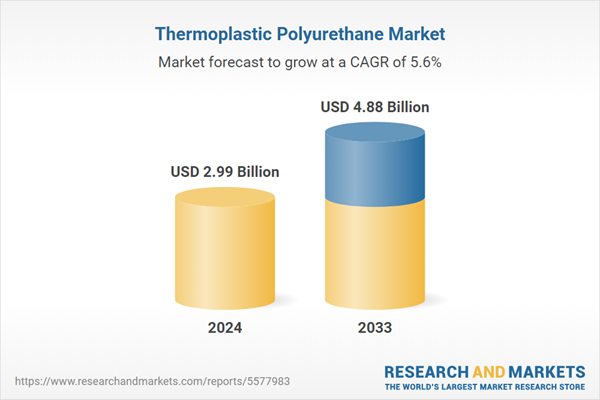

1. How big is the thermoplastic polyurethane (TPU) market?2. What is the future outlook of thermoplastic polyurethane (TPU) market?

3. What are the key factors driving the thermoplastic polyurethane (TPU) market?

4. Which region accounts for the largest thermoplastic polyurethane (TPU) market share?

5. Which are the leading companies in the global thermoplastic polyurethane (TPU) market?

Table of Contents

Companies Mentioned

- American Polyfilm Inc.

- BASF SE

- Coim Group

- Covestro AG

- Epaflex Polyurethanes Spa

- Hexpol AB

- Huntsman International LLC

- Kuraray Co. Ltd.

- Mitsui Chemicals Inc.

- Sumei Chemical Co. Ltd.

- The Lubrizol Corporation (Berkshire Hathaway Inc.)

- Wanhua Chemical Group Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.99 Billion |

| Forecasted Market Value ( USD | $ 4.88 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |