Peer to Peer (P2P) Lending Market Trends:

Continual technological advancements

The exponential growth in the market is significantly attributed to rapid advancements in technology. Additionally, the integration of artificial intelligence and machine learning algorithms is streamlining the lending process, enhancing the efficiency and accuracy of credit assessments. These technologies enable platforms to analyze vast amounts of data, including non-traditional credit indicators, offering a more comprehensive risk assessment. In addition, blockchain technology is increasingly being adopted for its ability to ensure secure and transparent transactions, fostering trust among users. Moreover, the advent of mobile technology and user-friendly applications is making P2P lending more accessible, allowing a broader range of borrowers and lenders to participate. This technological evolution is improving the user experience and expanding the market reach, attracting a diverse demographic of participants.Changing consumer behavior

The rise in the market is closely linked to a shift in consumer behavior. Modern borrowers are increasingly seeking alternatives to traditional banking and financial institutions, driven by the desire for more simplified, faster, and more personalized financial services. They cater to this demand by offering a more streamlined and convenient borrowing experience. They provide quicker loan approvals, competitive interest rates, and a more straightforward application process compared to conventional banks. Furthermore, these platforms often serve niche markets and individuals with lower credit ratings, who might otherwise struggle to secure loans from traditional sources. Along with this, the trend towards digitalization in personal finance, coupled with a growing awareness and acceptance of fintech solutions among consumers, is fueling the expansion of the sector.Continuous regulatory developments

The evolution of regulatory frameworks across various regions plays a critical role in shaping the P2P lending landscape. Governments and financial regulatory bodies are increasingly recognizing the importance of P2P lending in the financial ecosystem. In response, they are developing and implementing regulations that ensure a balance between fostering innovation and protecting the interests of borrowers and lenders. These regulatory measures are essential in maintaining the integrity and stability of the market. They provide a structured environment that mitigates risks such as fraud and defaults, thereby enhancing consumer confidence in these platforms. Furthermore, clear regulations help legitimize P2P lending as a credible alternative to traditional financing, encouraging more participants to enter the market.Peer to Peer (P2P) Lending Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on loan type, business model, and end user.Breakup by Loan Type:

- Consumer Lending

- Business Lending

Business lending accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the loan type. This includes consumer lending and business lending. According to the report, business lending represented the largest segment.The business lending segment, which constitutes the largest portion of the P2P lending market, targets small and medium-sized enterprises (SMEs) seeking capital for various business purposes such as expansion, inventory purchase, or working capital management. This segment addresses a critical gap in the market, as SMEs often struggle to secure financing from traditional financial institutions due to stringent credit requirements and lengthy processes. P2P platforms offer a more accessible and flexible financing solution for these businesses, often with less bureaucratic hurdles and a more tailored approach to loan structuring. Business lending through P2P platforms supports the growth and sustainability of SMEs and contributes significantly to economic development.

On the other hand, the consumer lending segment encompasses personal loans availed by individuals for various purposes such as debt consolidation, home improvement, medical expenses, or education. This segment is gaining popularity due to its simplified application processes, quick loan approvals, and competitive interest rates compared to traditional banks. Consumer lending through P2P platforms appeals to a broad demographic, including those who might have lower credit ratings or are underserved by conventional financial institutions. Along with this, the flexibility and convenience offered by these platforms, coupled with the ability to secure smaller loans that might not be viable in a traditional banking context, contribute to the steady growth of this segment. While consumer lending is significant, it is typically smaller in loan size compared to business lending and caters to individual financial needs.

Breakup by Business Model:

- Marketplace Lending

- Traditional Lending

Traditional lending holds the largest share in the industry

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes marketplace lending and traditional lending. According to the report, traditional lending accounted for the largest market share.Traditional lending, as applied in the context of the market, refers to a model where the P2P platform operates more such as a conventional financial intermediary. In this segment, the platform itself might use its capital to fund loans, essentially acting as a bank, or it might work with institutional investors or financial entities to fund loans, instead of individual retail investors. This model offers the benefits of P2P lending, such as easier application processes and potentially quicker loan approvals, but with a structure more akin to traditional banking. This segment tends to be larger due to the higher level of trust and stability associated with established financial practices and the involvement of institutional funding.

On the contrary, marketplace lending segment of the market represents a model where borrowers are directly matched with lenders through an online platform. This model embodies the true essence of P2P lending by facilitating a decentralized financial exchange, bypassing traditional financial intermediaries. Marketplace lending platforms typically leverage advanced technology for credit evaluation, often using algorithms and big data analytics to assess borrower risk. This model is characterized by its efficiency, streamlined processes, and often lower operational costs, making it attractive to a tech-savvy audience and investors seeking direct lending opportunities.

Breakup by End User:

- Consumer (Individual/Households)

- Small Businesses

- Large Businesses

- Real Estate

- Others

Small Businesses represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes consumer (individual/households), small businesses, large businesses, real estate, and others. According to the report, small businesses represented the largest segment.Small business is the largest in the market, addressing the financing needs of small and medium-sized enterprises (SMEs). This segment fills a crucial gap left by traditional financial institutions, which often perceive SMEs as high-risk due to their smaller size and limited credit history. They offer these businesses an alternative avenue for securing capital for various purposes like expansion, inventory management, or bridging cash flow gaps. In addition, the appeal of this segment lies in its tailored approach to loan structuring, relatively straightforward application processes, and quicker funding compared to conventional banking channels.

On the other hand, the consumer segment caters to individuals and households seeking personal loans. This segment typically includes loans for debt consolidation, home renovation, medical expenses, education, or other personal investments. Consumers are drawn to P2P lending due to its convenience, speedier loan processing, and often more competitive interest rates compared to traditional banking.

In the large business segment, they cater to the financing needs of bigger corporations with substantial capital requirements. While not as common as small business lending in the P2P market, this segment serves companies seeking alternative financing routes, often for large-scale projects, expansion, or significant operational expenditures. The involvement of large businesses in P2P lending highlights the versatility of these platforms, capable of handling substantial and complex financial transactions.

In addition, the real estate segment involves loans for property purchases, development, or renovation. This sector has become increasingly popular, offering an alternative to traditional real estate financings methods such as mortgages or commercial property loans. P2P platforms in this segment attract investors and developers seeking more flexible terms, quicker fund disbursal, and potentially higher returns on investment.

Moreover, the 'Others' segment in the market encompasses various niche markets and specialized loan types that do not fit neatly into the aforementioned categories. This can include loans for educational purposes, renewable energy projects, medical financing, and other unique or emerging market needs. This segment is significant for its ability to cater to specialized and often underserved markets, demonstrating the adaptability and innovative potential of the P2P lending model.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest peer to peer (P2P) lending market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America, particularly the United States, represents the largest segment of the market. This dominance can be attributed to a combination of factors including high technological adoption, a mature financial market, and a regulatory environment that, while complex, has gradually evolved to accommodate P2P lending models. The region has a significant number of P2P platforms, with a broad user base ranging from individual consumers to businesses. The market is characterized by its innovative approaches to lending, high consumer digital literacy, and the presence of a well-developed credit system.

Additionally, the Asia Pacific region is a rapidly growing segment in the market, driven by high digital penetration, an expanding middle class, and supportive government policies in countries such as China and India. This region is characterized by its vast population, which includes a significant number of underbanked or unbanked individuals, presenting a massive potential user base for P2P platforms. The market is also bolstered by regional innovations in mobile technology and digital payment systems.

In addition, Europe’s market is marked by a high degree of diversity due to varying financial regulations and market maturity levels across different countries. The European market benefits from a generally favorable regulatory stance towards fintech innovations, particularly in the European Union, which has been working towards harmonizing regulations across member states. Countries such as the UK have established themselves as leaders in the P2P lending space, with a well-developed ecosystem of lenders and borrowers.

Apart from this, the Latin American segment of the P2P lending market is in a relatively nascent stage but shows significant growth potential. This growth is driven by the need for alternative financing options in a region where a large portion of the population is unbanked and where traditional banking systems are often inaccessible or unaffordable for many. The region's increasing internet penetration and mobile phone usage are key factors supporting this growth.

Moreover, the Middle East and Africa (MEA) region, while currently smaller in terms of P2P lending market size, presents a unique growth opportunity. The market is being driven by increasing technological adoption, a young and rapidly growing population, and efforts to improve financial inclusion. Africa's market potential is underscored by its large unbanked population and the success of mobile money platforms, indicating a readiness for alternative financial services.

Leading Key Players in the Peer to Peer (P2P) Lending Industry:

Key players in the market are actively engaging in strategies to enhance their market presence and meet the evolving needs of borrowers and investors. Many are leveraging advanced technologies like artificial intelligence and blockchain to improve risk assessment models and ensure secure, transparent transactions. Additionally, they are also expanding their service offerings to cater to diverse market segments, including specialized loans for small businesses and real estate. Strategic partnerships with traditional financial institutions are becoming increasingly common, aimed at combining the strengths of conventional banking with the innovative approaches of P2P lending. Moreover, these players are focusing on global expansion, particularly in emerging markets, while navigating the complexities of varied regulatory environments.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Avant Inc.

- Commonbond Inc.

- Funding Circle Ltd.

- LendingClub Corporation

- Lendingtree Inc. (InterActiveCorp and Tree.com Inc.)

- On Deck Capital Inc.

- Prosper Marketplace Inc.

- Retail Money Market Ltd.

- Social Finance Inc.

- Upstart Network Inc.

- Zopa Limited

Key Questions Answered in This Report

1. How big is the global Peer to Peer (P2P) lending market?2. What is the expected growth rate of the global Peer to Peer (P2P) lending market during 2025-2033?

3. What are the key factors driving the global Peer to Peer (P2P) lending market?

4. What has been the impact of COVID-19 on the global Peer to Peer (P2P) lending market?

5. What is the breakup of the global Peer to Peer (P2P) lending market based on the loan type?

6. What is the breakup of the global Peer to Peer (P2P) lending market based on the business model?

7. What is the breakup of the global Peer to Peer (P2P) lending market based on the end user?

8. What are the key regions in the global Peer to Peer (P2P) lending market?

9. Who are the key players/companies in the global Peer to Peer (P2P) lending market?

Table of Contents

Companies Mentioned

- Avant Inc.

- Commonbond Inc.

- Funding Circle Ltd.

- LendingClub Corporation

- Lendingtree Inc. (InterActiveCorp and Tree.com Inc.)

- On Deck Capital Inc.

- Prosper Marketplace Inc.

- Retail Money Market Ltd.

- Social Finance Inc.

- Upstart Network Inc.

- Zopa Limited

Table Information

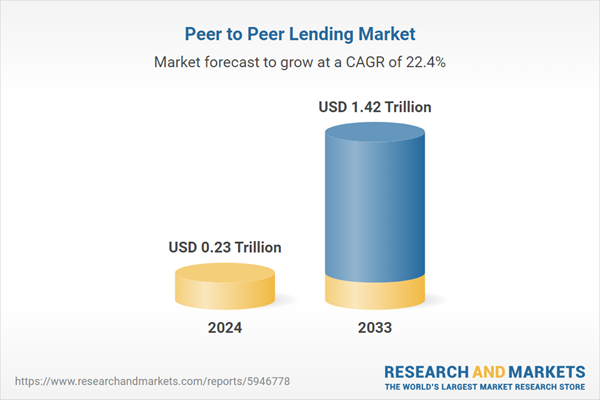

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.23 Trillion |

| Forecasted Market Value ( USD | $ 1.42 Trillion |

| Compound Annual Growth Rate | 22.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |