Interior Architectural Coatings Market Analysis:

- Major Market Drivers: Key market drivers include the rapid increase in construction activities in both residential and commercial sector generally driven by urbanization and rising disposable incomes. The rising focus on eco-friendly and low-VOC coatings aligns with the strict environmental regulations and consumer preferences for sustainable products. Various technological advancements have also led to the development of more durable, easy to apply and versatile coatings, thereby propelling the market growth.

- Key Market Trends: Key market trends include the rapidly growing demand for eco-friendly and low-VOC products mainly due to the rising environmental awareness and regulatory pressures. Various technological advancements are also leading to innovative, durable and easy to apply coatings. Customization and aesthetic preferences are also driving the development of wide range of finishes and colors. Furthermore, the growth of smart coatings with self-cleaning and antimicrobial properties is also gaining significant traction. These factors are collectively creating a positive outlook for the interior architectural coatings market growth.

- Geographical Trends: The Asia-Pacific region leads the interior architectural coatings market due to rapid urbanization, increasing construction activities, and a growing middle-class population. Countries like China and India are experiencing significant infrastructure development and residential construction, driving demand for high-quality coatings. Additionally, rising disposable incomes and a growing focus on aesthetics and home improvement contribute to market growth. The region's favorable economic conditions and investments in sustainable and eco-friendly coatings also bolster its leadership in the market.

- Competitive Landscape: Some of the major market players in the interior architectural coatings industry include Akzo Nobel N.V., Axalta Coatings Systems, LLC, Asian Paints Limited, BASF SE, Nippon Paint/ Nipsea Group, Kansai Paint Co. Ltd., PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, and The Valspar Corporation, among many others.

- Challenges and Opportunities: The market faces various challenges which includes the strict environmental regulations, high raw material costs and the pressing need for continuous innovation to meet diverse consumer demands. However, these challenges is presents significant opportunities as well which includes the development of ecofriendly, low- VOC coatings and advanced, durable formulations. The growing trends toward smart coatings with self-cleaning and antimicrobial properties offer additional growth prospects. Expansion in construction activities in emerging markets and the rising demand for customized aesthetic solutions further drive the interior architectural coatings market growth.

Interior Architectural Coatings Market Trends:

Technological Advancements

Technological advancements in the interior architectural coatings market analysis focus on developing advanced formulations that provide superior durability, stain resistance, and ease of application. Innovations include self-leveling paints, which ensure a smooth finish, and coatings with enhanced adhesive properties, making them suitable for a variety of surfaces. These advancements reduce maintenance costs and extend the lifespan of coated surfaces. Additionally, the incorporation of nanotechnology and smart materials in coatings enhances their performance, making them more resilient to environmental factors and wear. For instance, BASF introduced IO-Hybrid Technology, revolutionizing architectural coatings with Acronal® EDGE 7073. This innovative paint formulation offers superior coverage, eliminates the need for in-can biocides, and provides anti-microbial protection. Users can expect efficient application and professional results for residential, commercial, and industrial projects. Experience the future today by discovering the transformative benefits of Acronal® EDGE 7073.Rising Prevalence of Smart Coatings

Smart coatings are revolutionizing the interior architectural coatings market with features like self-cleaning properties, which reduce maintenance efforts, and anti-microbial capabilities that promote healthier living environments. Energy-saving properties, such as thermal insulation and reflective finishes, help regulate indoor temperatures, enhancing energy efficiency. These innovative coatings offer functional benefits beyond aesthetics, driving their growing adoption in modern interior design. For instance, in February 2023, PPG and Corning collaborated to introduce Copper Armor paint, integrating Corning's Guardiant technology to offer continuous antimicrobial protection. The paint, EPA registered as virucidal, combines the antimicrobial power of copper with a diverse color palette and is suitable for various environments. With a capacity to kill viruses and bacteria within two hours, the product is ideal for high-traffic areas in both commercial and residential spaces.Growth in the Construction Industry

The expansion in residential and commercial construction, especially in emerging markets, is significantly boosting the demand for interior coatings. Rapid urbanization and increasing disposable incomes are driving new housing projects and commercial developments. This surge in construction activities necessitates high-quality interior coatings for durability, aesthetics, and protection. Additionally, government initiatives promoting infrastructure development further fuel market growth. The rising construction industry thus creates substantial opportunities for interior coating manufacturers to cater to evolving consumer preferences and project requirements. According to the data published by the Invest India, the construction industry in India is expected to reach $1.4 trillion by 2025, with cities projected to generate 70% of India's GDP by 2030. Around 600 million people are anticipated to live in urban areas by 2030, creating a demand for 25 million additional mid-end and affordable housing units. The government has allocated $1.4 trillion for infrastructure under NIP, with additional allocations highlighted in the Union Budget 2023.Interior Architectural Coatings Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on resin type, technology, distribution channel, type of consumer, and end use sector.Breakup by Resin Type:

- Acrylic

- Polyester

- Alkyd

- Epoxy

- Polyurethane

- Others

Acrylic accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes acrylic, polyester, alkyd, epoxy, polyurethane, and others. According to the report, acrylic represented the largest segment.Acrylic coatings account for the majority of the interior architectural coatings market share due to their superior performance characteristics. These coatings offer excellent durability, quick drying times, and resistance to moisture and UV damage, making them ideal for various indoor applications. Acrylic coatings are also valued for their low odor and low VOC content, aligning with the growing consumer demand for environmentally friendly and safe products. Their versatility in finishes and ease of application further contribute to their dominant position in the market.

Breakup by Technology:

- Water-Borne Coatings

- Solvent-Borne Coatings

Water-Borne Coatings holds the largest share of the industry

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes water-borne and solvent-borne coatings. According to the report, water-borne coatings accounted for the largest market share.Water-borne coatings hold the largest share of the Interior Architectural Coatings industry due to their environmental benefits and superior performance. These coatings emit low levels of volatile organic compounds (VOCs), making them safer for indoor air quality and compliant with stringent environmental regulations. Additionally, water-borne coatings offer excellent durability, easy application, and quick drying times. Their ability to maintain color stability and resistance to mold and mildew further enhances their appeal. As consumers and industries increasingly prioritize sustainability, the demand for water-borne coatings continues to grow, solidifying their leading market position.

Breakup by Distribution Channel:

- Company-Owned Stores

- Independent Distributors

- Large Retailers and Wholesalers

Company-owned stores represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes company-owned stores, independent distributors, and large retailers and wholesalers. According to the report, company-owned stores represented the largest segment.Company-owned stores represent the leading segment in the interior architectural coatings market forecast, driven by their ability to offer a consistent brand experience and high-quality customer service. These stores enable manufacturers to directly engage with customers, ensuring they receive expert advice and support tailored to their specific needs. Additionally, company-owned stores allow for better control over product presentation, inventory management, and promotional activities. By maintaining a direct sales channel, companies can effectively build brand loyalty, gather customer feedback, and respond quickly to market trends, further solidifying their market leadership.

Breakup by Type of Consumer:

- Professional Consumers

- DIY Consumers

Professional consumers exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the type of consumer have also been provided in the report. This includes professional and DIY consumers. According to the report, professional consumers accounted for the largest market share.Professional consumers exhibit clear dominance in the Interior Architectural Coatings market due to their significant purchasing power and influence on product trends. These consumers, including contractors, painters, and construction firms, prioritize high-quality, durable, and efficient coatings to ensure the longevity and aesthetic appeal of their projects. Their expertise and preference for premium, performance-oriented products drive demand for specialized coatings. Manufacturers often tailor their product lines and services to meet the specific needs of professional consumers, further reinforcing their dominant position in the market. This segment's consistent and large-scale purchasing behavior underpins its critical role in market dynamics.

Breakup by End Use Sector:

- Residential

- Non-Residential

Residential dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes residential and non-residential. According to the report, residential represented the largest segment.The residential sector dominates the interior architectural coatings market, driven by continuous housing development, renovation, and remodeling activities. Homeowners seek high-quality coatings that offer aesthetic appeal, durability, and environmental safety. The growing trend of DIY home improvement projects also contributes to the demand for user-friendly and versatile interior coatings. Additionally, rising disposable incomes and the increasing importance of home aesthetics and interior design fuel the preference for premium products. This robust demand from the residential sector makes it the leading segment in the interior architectural coatings market, driving innovation and sales growth.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest interior architectural coatings market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia-Pacific represents the largest regional market for interior architectural coatings.Asia Pacific leads the Interior Architectural Coatings market, accounting for the largest market share due to rapid urbanization, industrialization, and economic growth in the region. Countries like China, India, and Southeast Asian nations are witnessing a surge in residential and commercial construction activities, driven by increasing population and rising disposable incomes. For instance, China's construction industry has seen significant transformation and technological advancement. The industry, with an output value exceeding 31 trillion yuan in 2022, has made strides in efficiency and energy reduction. Notable progress includes the development of a "zero-altitude" astronomical observation station and high-precision equipment for ultra-high-rise buildings. The industry's integration with advanced manufacturing and focus on green construction methods indicate a shift towards innovation-driven and sustainable development. Additionally, government initiatives promoting infrastructure development and affordable housing projects further boost demand. The expanding middle class and growing awareness of interior aesthetics and quality also contribute to the preference for premium coatings. These factors collectively position Asia Pacific as the dominant force in the global Interior Architectural Coatings market.

Key Questions Answered in This Report:

- How has the global interior architectural coatings market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global interior architectural coatings market?

- What is the impact of each driver, restraint, and opportunity on the global interior architectural coatings market?

- What are the key regional markets?

- Which countries represent the most attractive interior architectural coatings market?

- What is the breakup of the market based on the resin type?

- Which is the most attractive resin type in the interior architectural coatings market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the interior architectural coatings market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the interior architectural coatings market?

- What is the breakup of the market based on the type of consumer?

- Which is the most attractive type of consumer in the interior architectural coatings market?

- What is the breakup of the market based on the end-use sector?

- Which is the most attractive end-use sector in the interior architectural coatings market?

- What is the breakup of the market based on the region?

- Which is the most attractive region in the interior architectural coatings market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global interior architectural coatings market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Interior Architectural Coatings Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Resin Type

5.5 Market Breakup by Technology

5.6 Market Breakup by Distribution Channel

5.7 Market Breakup by Type of Consumer

5.8 Market Breakup by End-Use Sector

5.9 Market Breakup by Region

5.10 Market Forecast

5.11 SWOT Analysis

5.11.1 Overview

5.11.2 Strengths

5.11.3 Weaknesses

5.11.4 Opportunities

5.11.5 Threats

5.12 Value Chain Analysis

5.13 Porters Five Forces Analysis

5.13.1 Overview

5.13.2 Bargaining Power of Buyers

5.13.3 Bargaining Power of Suppliers

5.13.4 Degree of Competition

5.13.5 Threat of New Entrants

5.13.6 Threat of Substitutes

5.14 Price Analysis

5.14.1 Key Price Indicators

5.14.2 Price Structure

5.14.3 Margin Analysis

6 Market Breakup by Resin Type

6.1 Acrylic

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Polyester

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Alkyd

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Epoxy

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Polyurethane

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Others

6.6.1 Market Trends

6.6.2 Market Forecast

7 Market Breakup by Technology

7.1 Water-Borne Coatings

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Solvent-Borne Coatings

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Distribution Channel

8.1 Company-Owned Stores

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Independent Distributors

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Large Retailers and Wholesalers

8.3.1 Market Trends

8.3.2 Market Forecast

9 Market Breakup by Type of Consumer

9.1 Professional Consumers

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 DIY Consumers

9.2.1 Market Trends

9.2.2 Market Forecast

10 Market Breakup by End-Use Sector

10.1 Residential

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Non-Residential

10.2.1 Market Trends

10.2.2 Market Forecast

11 Market Breakup by Region

11.1 Asia Pacific

11.1.1 Market Trends

11.1.2 Market Forecast

11.2 Europe

11.2.1 Market Trends

11.2.2 Market Forecast

11.3 North America

11.3.1 Market Trends

11.3.2 Market Forecast

11.4 Middle East and Africa

11.4.1 Market Trends

11.4.2 Market Forecast

11.5 Latin America

11.5.1 Market Trends

11.5.2 Market Forecast

12 Interior Architectural Coatings Manufacturing Process

12.1 Product Overview

12.2 Raw Material Requirements

12.3 Manufacturing Process

12.4 Key Success and Risk Factors

13 Competitive Landscape

13.1 Market Structure

13.2 Key Players

13.3 Profiles of Key Players

13.3.1 Akzo Nobel N.V.

13.3.2 Axalta Coatings Systems, LLC

13.3.3 Asian Paints Limited

13.3.4 BASF SE

13.3.5 Nippon Paint/Nipsea Group

13.3.6 Kansai Paint Co. Ltd.

13.3.7 PPG Industries Inc.

13.3.8 RPM International Inc.

13.3.9 The Sherwin-Williams Company

13.3.10 The Valspar Corporation

List of Figures

Figure 1: Global: Interior Architectural Coatings Market: Major Drivers and Challenges

Figure 2: Global: Interior Architectural Coatings Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Interior Architectural Coatings Market: Breakup by Resin Type (in %), 2024

Figure 4: Global: Interior Architectural Coatings Market: Breakup by Technology (in %), 2024

Figure 5: Global: Interior Architectural Coatings Market: Breakup by Distribution Channel (in %), 2024

Figure 6: Global: Interior Architectural Coatings Market: Breakup by Type of Consumer (in %), 2024

Figure 7: Global: Interior Architectural Coatings Market: Breakup by End-Use Sector (in %), 2024

Figure 8: Global: Interior Architectural Coatings Market: Breakup by Region (in %), 2024

Figure 9: Global: Interior Architectural Coatings Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Interior Architectural Coatings Industry: SWOT Analysis

Figure 11: Global: Interior Architectural Coatings Industry: Value Chain Analysis

Figure 12: Global: Interior Architectural Coatings Industry: Porter’s Five Forces Analysis

Figure 13: Global: Interior Architectural Coatings (Acrylic) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Interior Architectural Coatings (Acrylic) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Interior Architectural Coatings (Polyester) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Interior Architectural Coatings (Polyester) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Interior Architectural Coatings (Alkyd) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Interior Architectural Coatings (Alkyd) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Interior Architectural Coatings (Epoxy) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Interior Architectural Coatings (Epoxy) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Interior Architectural Coatings (Polyurethane) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Interior Architectural Coatings (Polyurethane) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Interior Architectural Coatings (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Interior Architectural Coatings (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Interior Architectural Coatings (Water-Borne Coatings) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Interior Architectural Coatings (Water-Borne Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Interior Architectural Coatings (Solvent-Borne Coatings) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Interior Architectural Coatings (Solvent-Borne Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Interior Architectural Coatings Market: Sales through Company-Owned Stores (in Million USD), 2019 & 2024

Figure 30: Global: Interior Architectural Coatings Market Forecast: Sales through Company-Owned Stores (in Million USD), 2025-2033

Figure 31: Global: Interior Architectural Coatings Market: Sales through Independent Distributors (in Million USD), 2019 & 2024

Figure 32: Global: Interior Architectural Coatings Market Forecast: Sales through Independent Distributors (in Million USD), 2025-2033

Figure 33: Global: Interior Architectural Coatings Market: Sales through Large Retailers and Wholesalers (in Million USD), 2019 & 2024

Figure 34: Global: Interior Architectural Coatings Market Forecast: Sales through Large Retailers and Wholesalers (in Million USD), 2025-2033

Figure 35: Global: Interior Architectural Coatings (Professional Consumers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: Interior Architectural Coatings (Professional Consumers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: Interior Architectural Coatings (DIY Consumers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: Interior Architectural Coatings (DIY Consumers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Global: Interior Architectural Coatings (Residential Sector) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Global: Interior Architectural Coatings (Residential Sector) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Global: Interior Architectural Coatings (Non-Residential Sector) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Global: Interior Architectural Coatings (Non-Residential Sector) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Asia Pacific: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Asia Pacific: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Europe: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Europe: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: North America: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: North America: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Middle East and Africa: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Middle East and Africa: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Latin America: Interior Architectural Coatings Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Latin America: Interior Architectural Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Interior Architectural Coatings Manufacturing: Detailed Process Flow

List of Tables

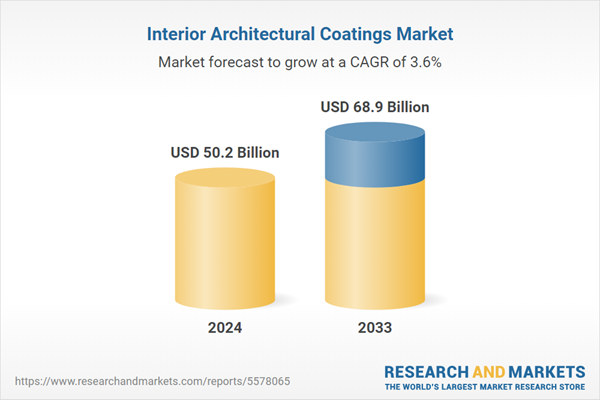

Table 1: Global: Interior Architectural Coatings Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Interior Architectural Coatings Market Forecast: Breakup by Resin Type (in Million USD), 2025-2033

Table 3: Global: Interior Architectural Coatings Market Forecast: Breakup by Technology (in Million USD), 2025-2033

Table 4: Global: Interior Architectural Coatings Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 5: Global: Interior Architectural Coatings Market Forecast: Breakup by Type of Consumer (in Million USD), 2025-2033

Table 6: Global: Interior Architectural Coatings Market Forecast: Breakup by End-Use Sector (in Million USD), 2025-2033

Table 7: Global: Interior Architectural Coatings Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Interior Architectural Coatings Manufacturing: Raw Material Requirements

Table 9: Global: Interior Architectural Coatings Market: Competitive Structure

Table 10: Global: Interior Architectural Coatings Market: Key Players

Companies Mentioned

- Akzo Nobel N.V.

- Axalta Coatings Systems LLC

- Asian Paints Limited

- BASF SE

- Nippon Paint/ Nipsea Group

- Kansai Paint Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 50.2 Billion |

| Forecasted Market Value ( USD | $ 68.9 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |