Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Popular substitutes include tofu, tempeh, soy-based meat, and mushroom-based products, often incorporated into traditional Vietnamese dishes. The influence of global vegan trends and an increase in international plant-based food brands entering the market have also fueled awareness and product variety. Additionally, foodservice outlets, including cafes and quick-service restaurants, are increasingly offering meat-free menu options. Despite cultural attachment to meat, the growing appeal of flexitarianism and innovation in local flavors are expanding the reach of meat alternatives in Vietnam.

Key Market Drivers

Rising Health Consciousness and Dietary Shifts

One of the most influential drivers of the meat substitutes market in Vietnam is the growing health consciousness among consumers. As Vietnam experiences rising incidences of non-communicable diseases such as obesity, cardiovascular conditions, and diabetes - particularly in urban areas - consumers are becoming more mindful of their dietary habits. The growing demand for low-fat, cholesterol-free, and high-fiber food alternatives has made plant-based diets more appealing.Meat substitutes, particularly those made from soy, mushrooms, peas, or wheat gluten, are seen as healthier options that offer protein and essential nutrients without the negative impacts of saturated fats and processed meats. Millennials and Gen Z, in particular, are adopting flexitarian lifestyles - reducing meat intake while not fully giving it up. These shifts are further supported by government-backed awareness campaigns around nutrition and by influencers promoting plant-based eating on social media. As knowledge about food ingredients increases and clean-label trends gain traction, meat substitutes are being repositioned not just as alternatives, but as health-forward choices, contributing significantly to their rising acceptance in Vietnam.

Key Market Challenges

Strong Cultural Preference for Traditional Meat-Based Diets

One of the most significant barriers to the widespread adoption of meat substitutes in Vietnam is the deeply rooted cultural preference for traditional meat-based meals. Vietnamese cuisine relies heavily on fresh meats such as pork, beef, chicken, and seafood, which are considered essential components of daily meals across all regions and social classes. Dishes like pho with beef, grilled pork in bánh mì, or fish-based soups are not only widely consumed but are also embedded in family traditions, festivals, and regional identities. As a result, many consumers perceive meat substitutes as lacking in taste, authenticity, or nutritional value compared to conventional meat.While vegetarianism is practiced for religious or spiritual reasons by some segments of the population, it is not yet widely adopted as a permanent or mainstream dietary choice. This cultural attachment makes it challenging for plant-based brands to convince traditional consumers to incorporate meat alternatives into their regular diets. Even among health-conscious or younger demographics, fully replacing meat with substitutes remains a gradual transition. Overcoming this mindset requires significant investment in consumer education, taste adaptation, and product positioning that aligns with local culinary values.

Key Market Trends

Premiumization and Clean Label Movement

A prominent trend emerging in Vietnam’s meat substitutes market is the growing consumer demand for premium, clean-label products. As awareness around food safety and ingredient transparency deepens, especially among urban, educated consumers, there is increasing scrutiny over what goes into plant-based alternatives. Shoppers are no longer satisfied with just “meat-free” claims; they want products free from artificial additives, preservatives, GMOs, and allergens. This has led to a visible shift toward offerings with shorter ingredient lists, organic certifications, and clear nutritional labeling.Premiumization is also evident in texture innovation - such as products mimicking marbled meat or juicy burgers - and the use of functional ingredients like mushrooms, lentils, chickpeas, seaweed, and fortified proteins. Consumers are willing to pay more for substitutes that offer not just meat-like sensory experience but also high nutritional value and health-enhancing benefits. As a result, both local and international brands are reformulating their products to align with this trend, introducing organic, allergen-free, and high-protein variants to meet evolving expectations of quality, safety, and wellness.

Key Market Players

- The Viet Vegan

- Green Vietnam Foods Joint Stock Company

- CJ Vietnam Co. Ltd.

- TBK Green Food

- Tan Nhat Huong Company Limited

- EMMAY

- Vissan Joint Stock Company

- Nutifood Nutrition Food Joint Stock Company

- VBites

- Saigon Food Joint Stock Company

Report Scope:

In this report, the Vietnam Meat Substitutes Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Meat Substitutes Market, By Type:

- Plant-based Protein

- Mycoprotein

- Soy-based

- Others

Vietnam Meat Substitutes Market, By Distribution Channel:

- Online

- Offline

Vietnam Meat Substitutes Market, By Region:

- Northern Vietnam

- Southern Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Meat Substitutes Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- The Viet Vegan

- Green Vietnam Foods Joint Stock Company

- CJ Vietnam Co. Ltd.

- TBK Green Food

- Tan Nhat Huong Company Limited

- EMMAY

- Vissan Joint Stock Company

- Nutifood Nutrition Food Joint Stock Company

- VBites

- Saigon Food Joint Stock Company

Table Information

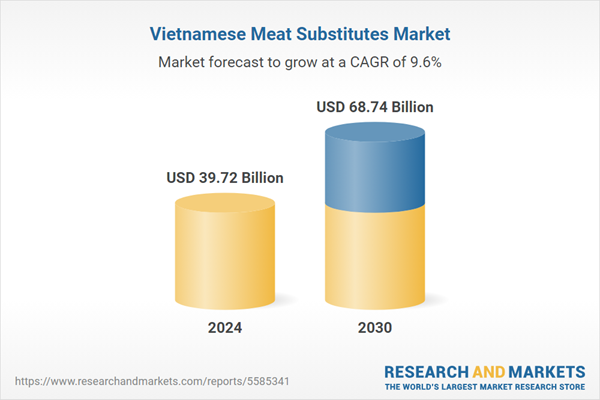

| Report Attribute | Details |

|---|---|

| No. of Pages | 83 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 39.72 Billion |

| Forecasted Market Value ( USD | $ 68.74 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |