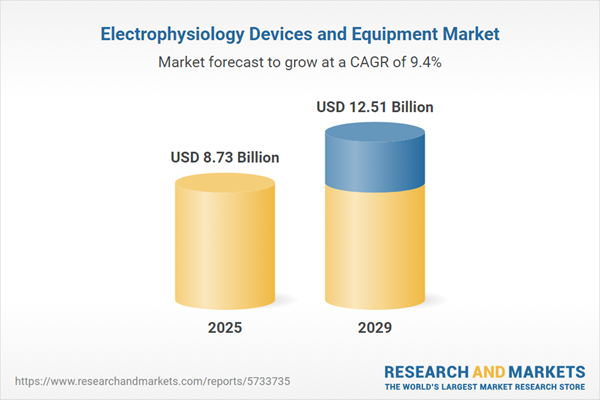

The electrophysiology devices and equipment market size has grown rapidly in recent years. It will grow from $7.7 billion in 2024 to $8.73 billion in 2025 at a compound annual growth rate (CAGR) of 13.3%. The growth in the historic period can be attributed to cardiac arrhythmias prevalence, aging population, minimally invasive procedures, clinical guidelines and research.

The electrophysiology devices and equipment market size is expected to see strong growth in the next few years. It will grow to $12.51 billion in 2029 at a compound annual growth rate (CAGR) of 9.4%. The growth in the forecast period can be attributed to personalized medicine, telehealth integration, global access to healthcare, electrophysiology devices in heart failure management. Major trends in the forecast period include 4d mapping and visualization, remote ablation procedures, hybrid procedures, leadless cardiac pacing.

The escalating prevalence of cardiovascular diseases (CVD) stands as a significant driver impacting the electrophysiology devices and equipment market. With CVD being a leading cause of mortality globally, there's an amplified need for efficient and rapid treatment, spurring the demand for electrophysiology devices. For example, data published by the Minnesota Department of Health, a US-based state health agency, in September 2024 revealed that approximately 30% of adults in Minnesota reported having high blood pressure in 2023, totaling nearly 1.4 million people. In 2022, hypertensive diseases were the underlying or contributing cause of death for 14,225 residents, representing almost 28% of all deaths in the state. As a result, the increasing prevalence of cardiovascular diseases (CVD) is driving the growth of the electrophysiology devices and equipment market.

The surge in demand for minimally invasive procedures is anticipated to steer the growth of the electrophysiology devices and equipment market. These procedures, involving smaller incisions or natural body openings rather than large surgical cuts, offer various advantages such as reduced patient trauma, quicker recovery, and improved outcomes. For example, in June 2024, the American Society of Plastic Surgeons, a US-based specialty organization, reported a 7% growth in minimally invasive procedures in 2023, surpassing surgical procedures by 2%. Notably, neuromodulator injections and hyaluronic acid fillers each saw over 9 million and 5 million treatments, respectively. As a result, the increasing popularity of minimally invasive procedures is driving the growth of the electrophysiology devices and equipment market.

The permissibility of single-use device (SUD) reuse by regulatory agencies like The Medicines and Healthcare Products Regulatory Agency (MHRA) may impact the growth of the electrophysiology devices and equipment market, especially considering the potential reuse of certain products in the industry. The MHRA guidelines permit the reuse of electrophysiology catheters, provided the devices comply with the medical devices directive and possess a CE mark. Reprocessing or reusing such catheters in electrophysiology (EP) labs in the US is known to reduce device costs and minimize the environmental impact associated with discarded bio-waste materials. However, the lack of clear regulations on reuse in developing regions such as Africa, Asia, Eastern Europe, Central America, and South America might present challenges for the electrophysiology devices and equipment market.

Major companies operating in the electrophysiology devices and equipment market are innovating new devices and equipment using advanced technologies, such as mapping catheters with TRUEref Technology, to maintain their competitive edge. A mapping catheter is a medical device used in electrophysiology, particularly during cardiac procedures. For example, in September 2022, Biosense Webster, Inc., a US-based company specializing in heart rhythm abnormality diagnosis and treatment, launched the OCTARAY Mapping Catheter with TRUEref Technology. This system offers enhanced performance and accuracy compared to previous mapping catheters, making it a valuable tool for physicians in diagnosing and treating arrhythmias. The OCTARAY Mapping Catheter features six electrodes per spline rotating, allowing for greater precision and detail when mapping arrhythmias in any chamber.

In August 2022, Medtronic plc, an Ireland-based medical technology company, acquired Affera, Inc. for approximately $1 billion. The acquisition aims to expand Medtronic's cardiac ablation portfolio by integrating an advanced mapping and navigation platform, thereby enhancing its diagnostic and therapeutic capabilities for treating cardiac arrhythmias. This strategic move supports Medtronic's commitment to offering comprehensive and effective solutions for patients with arrhythmias, improving outcomes, and advancing electrophysiology procedures. Affera, Inc. is a US-based medical technology company specializing in innovative solutions for cardiac arrhythmia treatment.

Electrophysiology devices and equipment serve in diagnosing and treating heart rhythm disorders by analyzing electrical activity.

Primary product categories within electrophysiology devices and equipment comprise electrophysiology ablation catheters, diagnostic catheters, and lab systems. Electrophysiology ablation catheters assess heart electrical activity, identifying irregular heart rhythms. Various monitoring tools encompass electrocardiographs (ECG), electroencephalographs (EEG), electrocorticographs (ECoG), electromyographs (EMG), electroretinographs (ERG), electrooculographs (EOG), Holter monitoring devices, X-ray systems, imaging, 3D mapping systems, and diagnostic electrophysiology catheters employed in the analysis of atrioventricular nodal reentry tachycardia (AVERT), Wolff-Parkinson-White syndrome (WPW), atrial flutter, and atrial fibrillation. These devices and equipment cater to hospitals, diagnostic centers, and clinics.

The electrophysiology devices and equipment market research report is one of a series of new reports that provides electrophysiology devices and equipment market statistics, including electrophysiology devices and equipment industry global market size, regional shares, competitors with an electrophysiology devices and equipment market share, detailed electrophysiology devices and equipment market segments, market trends and opportunities, and any further data you may need to thrive in the electrophysiology devices and equipment industry. This electrophysiology devices and equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the electrophysiology devices and equipment market include Boston Scientific Corporation, Abbott Laboratories, GE Healthcare, Philips Healthcare, Biotronik SE & Co. KG, Medtronic PLC, Biosense Webster Inc., Microport Scientific Corporation, Japan Lifeline Co., C.R. Bard, Mennen Medical Ltd., Harvard Bioscience Inc., HeNan HuaNan Medical Science and Technology Co. LTD., Nihon Kohden Corporation, Alere Inc., MedRobotics, Interface Biologics Inc., Meridian Health System Inc., Cardiva Medical Inc., Lombard Medical Technologies, Deltex Medical Group, Biotelemetry, Bioheart Inc., Asahi Intecc Co. Ltd., Siemens Healthineers, Lepu Medical Technology (Beijing) Co. Ltd, Acutus Medical Inc., Imricor Medical Systems, Johnson & Johnson.

North America was the largest region in the global electrophysiology devices and equipment market in 2024. Western Europe was the second-largest region in the global electrophysiology devices and equipment market. The regions covered in the electrophysiology devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the electrophysiology devices and equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The electrophysiology devices and equipment market consist of sales of ablation catheters, diagnostic catheters, mapping system, accessories, and other electrophysiology devices. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Electrophysiology Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on electrophysiology devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for electrophysiology devices and equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The electrophysiology devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Electrophysiology Ablation Catheters; Electrophysiology Diagnostic Catheters; Electrophysiology Lab Systems2) By Monitoring Device Type: Electrocardiograph (ECG); Electroencephalograph (EEG); Electrocorticograph (ECoG); Electromyograph (EMG); Electroretinograph (ERG); Electrooculograph (EOG); Holter Monitoring Devices; X-Ray Systems; Imaging and 3D Mapping Systems; Diagnostic Electrophysiology Catheters

3) By Indication Analysis: Atrioventricular Nodal Reentry Tachycardia (AVNRT); Wolff-Parkinson-White Syndrome (WPW); Atrial Flutter; Atrial Fibrillation

4) By End-Users: Hospitals; Diagnostic Centers; Clinics

Subsegments:

1) By Electrophysiology Ablation Catheters: Radiofrequency Ablation Catheters; Cryoablation Catheters; Laser Ablation Catheters; Ultrasound Ablation Catheters2) By Electrophysiology Diagnostic Catheters: Mapping Catheters; Recording Catheters; Electrode Catheters

3) By Electrophysiology Lab Systems: 3D Mapping Systems; Electrophysiology Recording Systems; Cardiac Ablation Systems; Catheter Navigation Systems

Key Companies Mentioned: Boston Scientific Corporation; Abbott Laboratories; GE Healthcare; Philips Healthcare; Biotronik SE & Co. KG

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Electrophysiology Devices and Equipment market report include:- Boston Scientific Corporation

- Abbott Laboratories

- GE Healthcare

- Philips Healthcare

- Biotronik SE & Co. KG

- Medtronic plc

- Biosense Webster Inc.

- Microport Scientific Corporation

- Japan Lifeline Co.

- C.R. Bard

- Mennen Medical Ltd.

- Harvard Bioscience Inc.

- HeNan HuaNan Medical Science and Technology Co. LTD.

- Nihon Kohden Corporation

- Alere Inc.

- MedRobotics

- Interface Biologics Inc.

- Meridian Health System Inc.

- Cardiva Medical Inc.

- Lombard Medical Technologies

- Deltex Medical Group

- Biotelemetry

- Bioheart Inc.

- Asahi Intecc Co. Ltd.

- Siemens Healthineers

- Lepu Medical Technology (Beijing) Co. Ltd

- Acutus Medical Inc.

- Imricor Medical Systems

- Johnson & Johnson

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.73 Billion |

| Forecasted Market Value ( USD | $ 12.51 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |