Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

- Earthmoving equipment accounted for the largest market share in the Oman construction equipment market in 2022. Excavators in the earthmoving segment accounted for the largest share. Rising investment in housing, warehouse expansion, and public infrastructure projects is expected to drive the demand for excavators in the market.

- In December 2021, the government opened a new road through the Empty Quarter connecting Riyadh with Muscat and other major Omani cities, including Duqm and other Omani ports. Oman is fully focused on expanding its bus and private taxi systems. In addition, several transport projects are underway across regions in Oman.

- In May 2022, Oman’s Public Establishment for Industrial Estates announced 30 consultancy works and infrastructure projects distributed over 11 industrial cities across the Sultanate at a total cost of over USD 518 million. The company also attracted 130 industrial, commercial, and service projects in 2022.

Increased Investment in Public Infrastructure Projects

- The Oman Airport Company included the Khasab Airport project 'Phase One' in the tenth five-year plan (2021-2025). With this project, the government aims to attract 1.2 million tourists annually by 2040 to the governorate. The first phase will develop the airport network alongside Muscat, Salalah, Sohar, and Duqm airports.

- In November 2021, Oman Investment Authority announced the opening of 13 national projects valued at approximately USD 9.09 billion. The projects cover several key sectors: energy, food security, manufacturing, mining, health, and tourism.

- In Nov 2022, the former US president’s family business signed a USD 1.6 billion deal with Saudi real estate developer Dar Al Arkan to build a resort in Oman. The resort will include 3,500 new homes, two hotels comprising 450 rooms, and a golf course.

MARKET TRENDS & DRIVERS

Oman’s Vision 2040 to Boost the Oman Construction Equipment Market Growth

- Oman’s Investment Authority (OIA), in Dec 2022, announced to spend USD 4.95 billion on investment projects in 2023. Therefore, the investments will include about 65 new and existing projects in logistics, food and fisheries, energy, mining, services, communications, and IT.

- Rakiza (Muscat-based infrastructure fund) granted over USD 1 billion, with 25% of the fund deployed in three Omani projects. Further, in Feb 2023, Saudi Fund for Development signed an agreement to invest in infrastructure development worth USD 320 million in Oman. The project includes the construction of infrastructure, roads, electrical installations, water and sewage networks, treatment of industrial waste, and the setting up of basic facilities in the region.

Increased Water Infrastructure Projects in the Country Will Propel the Demand for Crawler Excavators

- In 2021, the Ministry established 12 artificial rain stations to enhance the rainfall, increasing groundwater levels. The government implemented dam projects, due to which the number of dams in Oman reached 174 by the end of 2021. The number of new permits issued in 2021 reached 1,274, including 876 for digging new water wells.

- Oman Water and Wastewater Services Co (OWWSC) is focused on completing three key notable water transmission schemes. Moreover, the Minister of Housing and Urban Planning launched Jabal Akhdhar Water Project worth USD 107 million in Feb 2023.

Robust Growth in the Real Estate Sector to Boost the Sales of Construction Equipment

- In 2022, the government opened five of Oman’s new sites for real estate developers in Musandam, Dhofar, South Al Sharqiyah, North Al Batinah, and South Al Batinah. The Al Naseem neighborhood project in Sorouh is among the first projects to be initiated, including 1,000 housing units with 320 apartments, 120 villas, and 475 twin villas on an area of 350,000 sq. meters.

- In Jan 2023, the Housing Ministry & Urban Planning signed eight agreements worth USD 390 million in real estate development and integrated service stations covering the Governorates of Muscat, North Al Batinah, and South Al Batinah.

Oman’s Shift Toward Hydrogen Fuel-Based Construction Equipment

- The country has signed over USD 51 billion agreements for Green Hydrogen projects. Moreover, Hydrom announced that it had signed six term-sheet agreements with several developers to invest in green hydrogen projects in the Sultanate of Oman.

- The “Hydrogen-Centric Economy by 2040” program, which is the shift towards hydrogen fuel-based construction equipment, has stimulated the demand for green hydrogen fuel-based equipment in the Oman construction equipment market.

INDUSTRY RESTRAINTS

The Decline in Oil Prices Hampers the Growth of the Oman Construction Equipment Market

According to government projections, energy prices are expected to remain high over half of 2023 and then gradually fall in the coming few years. Falling oil prices may drive Oman to curtail or postpone government investment, restricting the construction industry's expansion and resulting in lower demand for construction equipment. Recently, in Jan 2023, the oil demand from China (one of the largest buyers of oil from Oman) declined, which led to a fall in exports by 6.9%. This fall in exports decreased the oil prices in the country. Moreover, the Jan 2023 price remained lower than Dec 2022 when Oman crude averaged $90.8 per barrel.SEGMENTATION ANALYSIS

Segmentation by Type

- Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Other Construction Equipment

- Dumper

- Tipper

- Concrete Mixer

- Concrete Pump Truck

- End Users

- Construction

- Mining

- Manufacturing

- Others (Power Generation, Utilities Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

VENDOR LANDSCAPE

- Caterpillar, Volvo CE, Komatsu, Liebherr, Hitachi Construction Equipment, and XCMG are leaders in the Oman construction equipment market. These companies have a strong industry share and offer diverse sets of equipment.

- In 2019, XCMG hosted a new product release ceremony in Muscat, Oman, to introduce the new Middle East series, including cranes, truck cranes, crawler cranes, tower cranes, and aerial work platforms.

Prominent Vendors

- Caterpillar

- Hitachi Construction Machinery

- Komatsu

- Liebherr

- Volvo Construction Equipment

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Zoomlion Heavy Industry Science & Technology Co. Ltd

- JCB

- SANY

Other Prominent Vendors

- Hyundai Construction Equipment

- Kobelco

- Liu Gong

- Tadano

- CNH Industrial

- Terex Corporation

- Manitou

- SDLG

- Fushun Yongmao Construction Machinery Co., Ltd.

Distributor Profiles

- International Heavy Equipment (IHE)

- HOE For Construction Equipment & Machinery Trading Co. LLC

- Teejan Equipment LLC

- Mohamed Abdulrahman Al-Bahar

- International Integrated Equipment LLC

- General Engineering Services LLC

- Nordic Machinery

KEY QUESTIONS ANSWERED:

- How big is the Oman construction equipment market?

- What is the growth rate of the Oman construction equipment market?

- Who are the key players in the Oman construction equipment market?

- What are the trends in the Oman construction equipment market?

- Which are the major distributor companies in the Oman construction equipment market?

Table of Contents

Companies Mentioned

- Caterpillar

- Hitachi Construction Machinery

- Komatsu

- Liebherr

- Volvo Construction Equipment

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Zoomlion Heavy Industry Science & Technology Co. Ltd

- JCB

- SANY

- Hyundai Construction Equipment

- Kobelco

- Liu Gong

- Tadano

- CNH Industrial

- Terex Corporation

- Manitou

- SDLG

- Fushun Yongmao Construction Machinery Co., Ltd.

- International Heavy Equipment (IHE)

- HOE For Construction Equipment & Machinery Trading Co. LLC

- Teejan Equipment LLC

- Mohamed Abdulrahman Al-Bahar

- International Integrated Equipment LLC

- General Engineering Services LLC

- Nordic Machinery

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2023 |

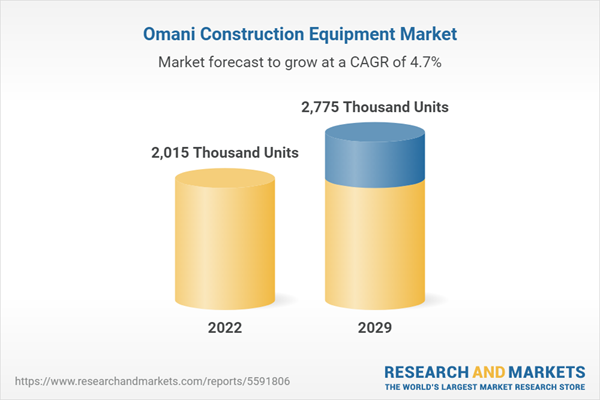

| Forecast Period | 2022 - 2029 |

| Estimated Market Value in 2022 | 2015 Thousand Units |

| Forecasted Market Value by 2029 | 2775 Thousand Units |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Oman |

| No. of Companies Mentioned | 25 |