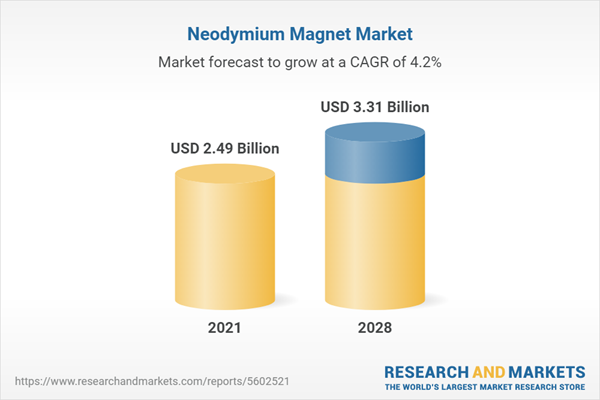

The neodymium magnet market is expected to grow at a compound annual growth rate of 4.15% over the forecast period to reach a market size of US$3.307 billion in 2028, from US$2.487 billion in 2021.

The primary factor driving the market expansion is the rising application of neodymium magnets in consumer electronics. Additionally, the market for neodymium magnets is expanding due to the minimization of automotive parts like power tools, sensors, and other components.The potential of Neodymium Magnets

Neodymium recycling has a significant potential to restructure the sector. Recently, several businesses have begun implementing recycling procedures to recycle materials from end-use sectors. The need for neodymium products is also anticipated to increase due to initiatives like the Traverse Wind Energy Center, Aviator Wind Project, and Goodnight Wind Energy Project. Fluoride-based fused salt electrolysis is a crucial step in the production of metallic neodymium. Neodymium must be separated from other rare earth elements using a lot of energy. A significant amount of energy is required to produce alloy or metal since the feed material utilized in the process is thermodynamically very stable. Therefore, increasing energy prices are anticipated to significantly affect the market's expansion.Rising Interest in Renewable Energy Sources

Rising interest in renewable energy sources and expansion of the neodymium magnet sector is driving the demand for neodymium magnets. For instance, according to current data from the International Energy Agency (IEA), 2021 witnessed a record of 273 TWh (up 17%) wind electricity generation which was 55% higher than that achieved in 2020 and was the highest among all renewable power technologies. In addition, there are further plans to get on track with Net Zero Emission by 2050, which is approximately going to be 7900 TWh of wind electricity generation in 2030.Rising Demand in the Automotive Industry

One of the prime reasons supporting market growth is the rising use of neodymium magnets as an essential part of the electronic systems used extensively in the automotive industry, including the energy transfer system, electronic control unit, multimedia system, and safety and information systems. Different safety control systems, including collision prediction systems and safe driving assistant systems, are employed widely when new energy cars and autonomous technologies are developed. Neodymium magnets, soft magnetic ferrite, and metal soft magnetic materials are the major materials utilized to make the magnetic components for vehicle electrical technology. The demand for magnetic materials is increasing along with the development of lightweight, intelligent, and electric cars. For example, according to the International Energy Agency (IEA), electric car sales including BEVs and PHEVs exceed 10 million, which was up by 55% relative to 2021.Technological Advancements in Electronic Vehicles

The technological developments in electric motors with the use of innovative neodymium magnets are expected to propel the market growth in the long term. According to the US Department of Energy, an estimated 90% to 100% of the battery and hybrid electric vehicles will have synchronous traction motors with neodymium iron boron (NdFeB) magnets by 2025. The source further stated that the global demand for neodymium magnets for electric vehicle applications is projected to increase dramatically from 7.3 thousand tons in 2020 to 114.1 thousand tons by 2030 which will further grow to 266 thousand tons by 2050. The global shares of the neodymium magnets for electric vehicle applications for 2020, 2030, and 2050 are estimated to be 6.1%, 29.5%, and 35.3% respectively.Asia-Pacific is Expected to Grow Significantly

The Asia Pacific neodymium magnet market is predicted to expand during the forecasted period owing to its well-established presence in the field of rare earth magnets. China has established itself as a dominant player in rare earth magnets production owing to the country’s large reserves, low production cost coupled with favourable government policies. According to the US Geological Survey, in 2022, China’s rare earth mining stood at 210, 000 tons which represented an increase of 25% over the production scale of 168, 000 tons recorded in 2021. Moreover, the growing demand for rare earth magnets such as neodymium, both on a domestic and international scale has further propelled China’s rare earth production, thereby further augmenting the market growth.Key Market Developments

- In March 2021, The University of Birmingham created a device that turns waste materials containing magnets into alloy powder. Sintered rare earth magnets can be made using this powder again.

- In March 2021, Guangsheng, a manufacturer of rare earth in China, announced to construct a facility to produce NdFeB permanent magnetic material.

Segmentation:

By Type

- Bonded

- Sintered

By End-User

- Automotive

- Healthcare

- Consumer Electronics

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Others

Table of Contents

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

5. NEODYMIUM MAGNET MARKET ANALYSIS, BY TYPE

6. NEODYMIUM MAGNET MARKET ANALYSIS, BY END-USER

7. NEODYMIUM MAGNET MARKET ANALYSIS, BY GEOGRAPHY

8. COMPETITIVE ENVIRONMENT AND ANALYSIS

9. COMPANY PROFILES

Companies Mentioned

- • Neodymium

- o MP Materials

- o Iluka Resources

- o Phoenix Tailings

- o CVMR Corporation

- o Lynas Rare Earths, Ltd.

- o China Rare Earth Holdings Limited

- • Cerium

- o Iluka Resources

- o MP Materials

- o CVMR Corporation

- o Lynas Rare Earths, Ltd.

- • Lanthanum

- o Iluka Resources

- o MP Materials

- o CVMR Corporation

- o Lynas Rare Earths, Ltd.

- • Neodymium Magnet

- o Adams Magnetic Products

- o DEXTER MAGNETIC TECHNOLOGIES

- o Arnold Magnetic Technologies

- o VACUUMSCHMELZE GmbH & Co. KG

- o TDK Corporation

- o Hitachi Metals, Ltd.Chevron Corporation

- o Baotou Tianhe Magnetics Technology Co., Ltd.

- o GOUDSMIT MAGNETICS

- o Thomas and Skinner Inc.

- o Pacific Metals Co., Ltd.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | October 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 2.49 Billion |

| Forecasted Market Value ( USD | $ 3.31 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |