The growing proliferation of start-ups in Sweden

The internet infrastructure in Sweden is one of the most robust, even among the developed economies globally. Furthermore, the business environment in Sweden is supportive of the growth of the start-up's culture. In fact, major companies like Skype and Spotify, among others, were founded in Stockholm, and thus, this indicates the prevalence of infrastructure that supports innovators and entrepreneurs. In Sweden, several companies using the digital business model have been founded and attained an estimated value of more than a billion-dollar (source: Ministry of Enterprise and Innovation, Government Offices of Sweden). Moreover, the government of Sweden has recently established a broadband policy to provide broadband access to households and businesses at a minimum capacity of 100 mbit/s by 2020. Furthermore, the government has also announced the tax reduction for businesses to promote start-ups to achieve the target of the lowest unemployment in Europe by 2020. Thus, the prevalence of a sound business environment along with the effort of the government to reduce unemployment in the country is significantly driving the number of start-ups, which in turn is supporting the growth of the software as a service (SaaS) market in Sweden.

COVID-19 Impact on Sweden Software as A Service (SaaS) Market

The COVID-19 pandemic had a positive impact on Sweden’s software as a service market. With the rise in the number of COVID-19 cases in the country, the government had begun to impose lockdowns and travel bans. This has led to an increase in the adoption of cloud-based SaaS services. Since the beginning of the pandemic, working from home has been gaining prominent traction in the country. Several official surveys had been conducted in the country that stated that working from home had enhanced over time. A significant number of participants had stated that there had been more benefits to working from home. The majority of the respondents in the country wanted a flexible way of working, according to the report submitted to the European Union. The adoption of SaaS in the country had been surging, even before the pandemic. The growth towards the adoption had been projected to surge at an exponential rate in the coming years. According to Cloud Capital, one of the key players in the market, the participants in the company’s survey showed significant revenue growth and showcased their strength in the SaaS model.

Key Market Segments

By Deployment Model

- Public

- Private

- Hybrid

- Community

By Enterprise Size

- Small

- Medium

- Large

By End-User

- BFSI

- Communication and Technology

- Retail

- Media and Entertainment

- Government

- Education

- Others

Table of Contents

Companies Mentioned

- Interoute Communications Limited

- Coherence

- Iamip

- Newstag

- Cind

Table Information

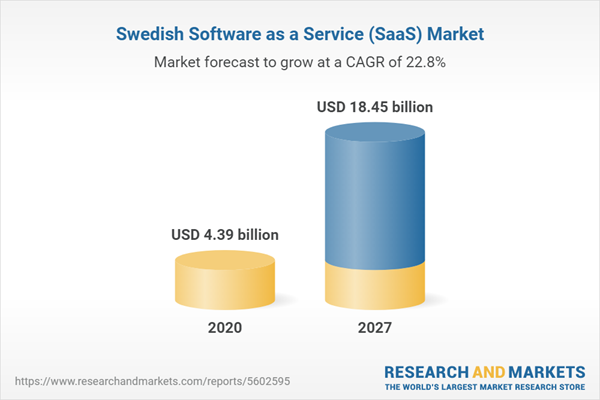

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | May 2022 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 4.39 billion |

| Forecasted Market Value ( USD | $ 18.45 billion |

| Compound Annual Growth Rate | 22.7% |

| Regions Covered | Sweden |

| No. of Companies Mentioned | 5 |