GROWING DEMAND FOR FEED PROBIOTIC

Surging meat and poultry consumption have a significant role in increasing the Colombia probiotics market size. The country's meat consumption is rising, with a growth rate of around 3.59% to 4.2% from 2016 to 2019. (source: FAO). In 2017, Colombia's meat consumption reached an all-time high at 32 kgs per person, making it the second most meat-consuming country in the Latin American region after Brazil. In that year, Colombia reached 23rd position in the list of poultry meat consumption out of 155 countries, and 25 ranks above the position observed ten years ago. Moreover, the rise in demand for quality meat has increased the demand for probiotics for animal feed in the country. Probiotics, when included in animal feed, increase the health and nutrients levels and decreases the threat of disease outbreak in the animals, providing better meat for human consumption. Quality product standards have led to a surge in the adoption of probiotics in the animal husbandry industry in the country. Moreover, Colombia’s regulatory conditions provide advantages for the probiotics market, especially dietary supplements and animal feed.

BY FORM, THE COLOMBIA PROBIOTICS MARKET IS SEGMENTED INTO LIQUID AND DRY PROBIOTICS.

Liquid probiotics are increasingly becoming the favorable form for consuming probiotics as they are easy to consume and can be offered in different flavors in different foods. Their ease of use for babies and toddlers is further expected to boost their market demand as parents can now put just a few drops of the probiotic liquid on their child’s tongue or add them to cold food and/or drinks, and the work is done. Therefore, with advantages like ease of consumption and live bacteria, the liquid form of probiotics is expected to witness significant growth in Colombia in the upcoming years.

BY APPLICATION, THE COLOMBIA PROBIOTIC MARKET IS SEGMENTED INTO FUNCTIONAL FOOD AND BEVERAGES, DIETARY SUPPLEMENTS, AND ANIMAL FEED.

With the Colombian population becoming more nutrition-conscious and aware of the health benefits of probiotic supplements, the demand for dietary supplements is increasing in the country. Also, the absence of physical activities and poor eating habits has led to various lifestyle diseases such as obesity, diabetes, blood pressure, cardiovascular problems, and various other diseases, which has led to the Colombian people being increasingly conscious of their health. The rise in disposable income in Colombia is also one of the major factors driving the probiotic supplements market in the country. According to IMF, the gross national disposable income of Colombia was 872,354,000 COP million in 2016, which rose to 922,708,000 COP million in 2017.

In March 2020, The World Bank’s board of executive directors approved the project, Colombia - Improving quality of healthcare services and efficiency in Colombia program. It got an IBRD loan of $150 million with the objective to support improvements in the quality of healthcare services and the efficiency of the Colombian health system. The improving healthcare infrastructure and broader insurance coverage are leading to an increasing number of people opting for medical care, which is leading to an increasing number of people becoming aware of the daily nutrition requirements for their bodies and are therefore recognizing the importance of nutritional supplements to fill in the nutritional gap.

COVID-19 IMPACT

The coronavirus pandemic has severely affected Colombia, affecting 2.34 million people and causing 62,148 deaths. This has, in turn, increased the market for probiotics in the country. Pre-pandemic Colombia was a prime consumer of probiotics, especially dietary supplements, in the Latin American region. The pandemic has skyrocketed the market for probiotics, raising health and nutrients concerns.

Key Market Segments

BY INGREDIENTS

- Bacteria

- Lactobacilli

- Bifidobacterium

- Streptococcus Thermophilus

- Yeast

- Saccharomyces Boulardii

BY FORM

- Liquid

- Dry

BY APPLICATION

- Functional Food and Beverage

- Dietary Supplements

- Animal Feed

BY END-USERS

- Human

- Animal

Table of Contents

Companies Mentioned

- Orffa

- Mastellone Hons SA

- Progurt

- Axon Pharma

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | May 2022 |

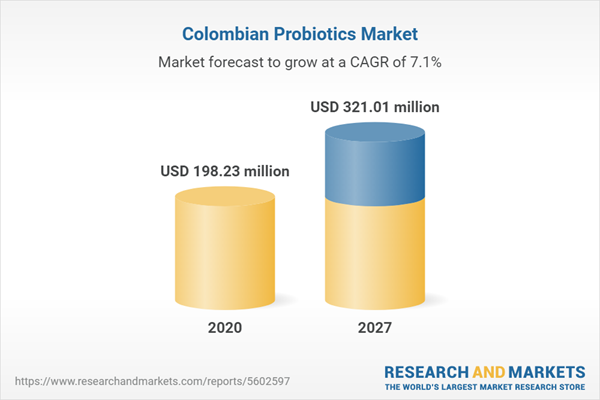

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 198.23 million |

| Forecasted Market Value ( USD | $ 321.01 million |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Colombia |

| No. of Companies Mentioned | 4 |