The high prevalence of lactose-intolerant individuals is one of the most significant drivers for market growth in the world. Getting some sort of suitable dairy alternatives to those suffering from lactose intolerance is much needed in order for them manage its symptoms. This illustrates that almond milk has an incredible potential across the world. Almond milk is suitable for individuals suffering with hypercholesterolemia, owing to its polyunsaturated fatty acid content, which also helps lessen blood cholesterol levels and inflammation. This significantly contributes to the revenue growth of the almond milk market. The versatility of almond milk is expected to further fuel the global almond milk market growth over the forecast period. The increasing production of almond milk beverages is creating growth opportunities for market players. Almond milk is a beneficial ingredient in many personal hygiene and organic cosmetic products, which expands the market scope.

The United States stands out as an important market due to significant development in product range and varieties. The manufacturers in the market are coming up with almond milk in vanilla and chocolate varieties to create diversities in formulation and taste. Besides, some others are trying to incorporate AI and other advanced technologies in the production processes. For instance, in June 2024 Hewlett Packard Enterprise (HPE) announced Blue Diamond Growers - the U.S. brand for almonds and almond milk production - modernized its wireless networking infrastructure with an HPE Aruba Networking Wi-Fi 6E-enabled solution. This in turn improves connectivity for mobile and IoT devices as part of its support for three manufacturing sites that handle one billion pounds of almonds annually for both domestic and international consumption.

Almond Milk Market Trends:

Growing Demand for Organic and Non-GMO Almond Milk

The demand for organic and non-GMO almond milk is on the rise as consumers become more health-conscious and environmentally aware. Organic almond milk is perceived as a healthier option, free from synthetic pesticides and genetically modified organisms, appealing to consumers looking for clean-label products. According to Organic Trade Association, U.S. sales of certified organic products approached USD 70 Billion in 2023. Moreover, brands are increasingly offering organic variants to cater to this growing segment, emphasizing sustainable farming practices and transparent sourcing to build consumer trust and loyalty.Innovations in Flavor and Nutritional Fortification

New trends in almond milk formulation, such as a range of flavors and the addition of nutrients, support the growth of this market. In order to meet differing tastes, companies are rolling out flavored and seasonally inspired products. Furthermore, adding vitamins A, B, D as well as protein and calcium to the almond milk expands its consumers by making it a viable dairy replacement. For instance, in 2024, Maiva Fresh launched Maiva Unsweetened Almond Milk, its flagship brand of unsweetened almond milk. This range of health drink contains no cholesterol, low G1, and is combined with Vitamin B12, and Vitamin D.Adoption of Sustainable Packaging Solutions

The almond milk market is increasingly embracing sustainable packaging solutions in response to growing environmental concerns. Brands are shifting towards eco-friendly packaging materials, such as recyclable cartons and biodegradable plastics, to reduce their environmental footprint. This trend aligns with global sustainability goals and consumer demand for environmentally responsible products. According to reports, 60% of consumers are willing to pay more for sustainable packaging. This shift helps brands meet regulatory requirements and consumer expectations and enhances their market positioning as environmentally conscious companies. Almond milk market business opportunities are driven by sustainable packaging innovations, which are becoming a key differentiator in the competitive almond milk market.Almond Milk Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global almond milk market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, category, packaging type, application, distribution channel, and region.Analysis by Type:

- Plain

- Flavored

Analysis by Category:

- Organic

- Conventional

Analysis by Packaging Type:

- Carton

- Glass

- Others

Analysis by Application:

- Beverages

- Frozen Desserts

- Personal Care

- Others

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Stores

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

North America Almond Milk Market Analysis

The North America almond milk market is driven by high consumer awareness and increasing demand for plant-based alternatives. The region's robust market growth is largely attributed to the widespread adoption of vegan and flexitarian diets, coupled with a growing prevalence of lactose intolerance and dairy allergies. According to the National Institutes of Health, approximately 65% of the human population has a reduced ability to digest lactose after infancy, with significant numbers in the United States. The presence of major almond milk brands, coupled with continuous product innovations and marketing efforts, further propels the market in North America. The region also benefits from a well-established retail infrastructure, including supermarkets, hypermarkets, and online platforms, ensuring widespread availability and accessibility of almond milk products. Additionally, strong consumer trends toward health and wellness, supported by a high disposable income, contribute to the dominance of North America in the almond milk market.United States Almond Milk Market Analysis

The demand for almond milk witnessed incredible growth in North America, and this growth can be attributed to strategic initiatives like acquisitions and mergers by key industry players. For instance, in April 2021, SunOpta announced the acquisition of Dream and WestSoy from the Hain Celestial Group - two of the largest and established brands in the shelf-stable plant-based dairy space - in an agreement worth USD 33 Million. Besides, in North American countries, online demand constitute for a significant market share for almond milk owing to the high internet penetration in the region. As per GSMA, mobile internet penetration is expected to expand from 76% in 2019 to 80% by 2025. In addition, 5G internet broadband will account for nearly two-thirds of total mobile connections by 2025. Thus, increasing internet penetration is aiding in the expanding demand for almond milk in the region.To gain a competitive edge in the market, many new products are being introduced by the key operating players of the market, which in turn is expected to contribute towards the market growth. For instance, in December 2023, Blue Diamond, one of the regional renowned players of almond marketers and processors, expanded its selection by announcing a new addition to its selection of Almond Breeze products with the launch of Almond Breeze Original Almond & Oat Blend. Also, many players are collaborating with local companies in the region to cater to the rising demand for almond milk among lactose-intolerant consumers. According to the National Institutes of Health (NIH), around 36% of the population in the country were lactose intolerant in 2017. This in turn is expected to bolster the demand in the forecast period.

Europe Almond Milk Market Analysis

Europe’s almond milk market is expanding on the backdrop of increasing vegan adoption in European countries like Germany, Italy, France, etc. According to the “Good Food Institute Europe” reports, a 22% increase was observed in plant-based food sales across 13 European countries, reaching € 5.7 Million in 2022, thereby posing a positive impact on the market’s growth. Moreover, the increasing penetration of newly developed smartphones with fast internet connections is further proliferating the market growth. In addition, the strategic activities implemented by the key players, along with the rise in new player penetration, are catapulting the market in the region. For example, in 2019, Nestle brand launched its branded line of almond milk products in the European market under the brand name “Nesquik”. Through this, the company was able to expand the variety of almond milk options that are available in European countries for consumers.The introduction of new innovative products to cater to the rising demand for almond milk in Europe is expected to drive the growth of the market in the coming years. For instance, the prominent dairy alternative brand "Silk" reported that 73% of consumers interested in plant-based foods begin their journey by purchasing almond milk. In January 2022, the company further expanded its offerings by introducing a new almond milk line, showcasing three different almond varieties.

Latin America Almond Milk Market Analysis

Growing vegetarianism, health consciousness, and worries about lactose intolerance are driving the almond milk business in Latin America. The main markets are Brazil and Mexico, where consumers are choosing plant-based substitutes because of dietary trends and their health advantages. The expanding middle class in the area is becoming increasingly interested in high-end, healthful foods like almond milk. Additionally, local production and product marketing improvements are lowering the cost and expanding the availability of almond milk.Middle East and Africa Almond Milk Market Analysis

The growth of the Middle East and Africa almond milk industry can be accredited to the growing expenditure on the dairy alternatives sector by consumers in the region. This situation has created a demand for different dairy alternatives in the food and beverage sector, including almond milk. In addition, the market is growing in the Middle East due to the demand from the region’s increasing expatriate population for healthy dairy-alternative milk. Moreover, the international brands are collaborating with local players and distributors in order to penetrate in the region. For example, a European almond milk manufacturer named “Nutriops”, exports and sells its products in the UAE through Al Accad C & G Trading, in Kuwait through Nab General Trading & Contracting Establishment, in Lebanon through Eatwell Sarl, and in Saudi Arabia through Organic Food Trading Establishment. Such developments are automatically supporting the market growth.Competitive Landscape:

The competitive landscape of the almond milk market is characterized by a mix of established players and innovative newcomers, driving market growth through continuous product development and strategic initiatives. The diverse competitive landscape fosters a dynamic market environment, promoting consumer choice and market expansion.The market research report provides a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the almond milk industry include:

- Blue Diamond Growers

- Califia Farms LLC

- Daiya Foods Inc

- Earth's Own Food Company

- Hain Celestial Group

- Hiland Dairy Foods

- Malk Organics LLC

- Pacific Foods of Oregon LLC,

- Sanitarium

- SunOpta Inc

- The WhiteWave Foods Company

Key Questions Answered in This Report

1. How big is the almond milk market?2. What is the future outlook of the almond milk market?

3. What are the key factors driving the almond milk market?

4. Which region accounts for the largest almond milk market share?

5. Which are the leading companies in the global almond milk market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Almond Milk Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Plain

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Flavored

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Category

7.1 Organic

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Conventional

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Packaging Type

8.1 Carton

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Glass

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Others

8.3.1 Market Trends

8.3.2 Market Forecast

9 Market Breakup by Application

9.1 Beverages

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Frozen Desserts

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Personal Care

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Market Trends

9.4.2 Market Forecast

10 Market Breakup by Distribution Channel

10.1 Hypermarkets and Supermarkets

10.1.1 Market Trends

10.1.2 Market Forecast

11.5 Convenience Stores

11.5.1 Market Trends

11.5.2 Market Forecast

10.3 Online Stores

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Others

10.4.1 Market Trends

10.4.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 United States

11.1.1.1 Market Trends

11.1.1.2 Market Forecast

11.1.2 Canada

11.1.2.1 Market Trends

11.1.2.2 Market Forecast

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Market Trends

11.2.1.2 Market Forecast

11.2.2 Japan

11.2.2.1 Market Trends

11.2.2.2 Market Forecast

11.2.3 India

11.2.3.1 Market Trends

11.2.3.2 Market Forecast

11.2.4 South Korea

11.2.4.1 Market Trends

11.2.4.2 Market Forecast

11.2.5 Australia

11.2.5.1 Market Trends

11.2.5.2 Market Forecast

11.2.6 Indonesia

11.2.6.1 Market Trends

11.2.6.2 Market Forecast

11.2.7 Others

11.2.7.1 Market Trends

11.2.7.2 Market Forecast

11.3 Europe

11.3.1 Germany

11.3.1.1 Market Trends

11.3.1.2 Market Forecast

11.3.2 France

11.3.2.1 Market Trends

11.3.2.2 Market Forecast

11.3.3 United Kingdom

11.3.3.1 Market Trends

11.3.3.2 Market Forecast

11.3.4 Italy

11.3.4.1 Market Trends

11.3.4.2 Market Forecast

11.3.5 Spain

11.3.5.1 Market Trends

11.3.5.2 Market Forecast

11.3.6 Russia

11.3.6.1 Market Trends

11.3.6.2 Market Forecast

11.3.7 Others

11.3.7.1 Market Trends

11.3.7.2 Market Forecast

11.4 Latin America

11.4.1 Brazil

11.4.1.1 Market Trends

11.4.1.2 Market Forecast

11.4.2 Mexico

11.4.2.1 Market Trends

11.4.2.2 Market Forecast

11.4.3 Others

11.4.3.1 Market Trends

11.4.3.2 Market Forecast

11.5 Middle East and Africa

11.5.1 Market Trends

11.5.2 Market Breakup by Country

11.5.3 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Indicators

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 Blue Diamond Growers

16.3.1.1 Company Overview

16.3.1.2 Product Portfolio

16.3.2 Califia Farms LLC

16.3.2.1 Company Overview

16.3.2.2 Product Portfolio

16.3.3 Daiya Foods Inc.

16.3.3.1 Company Overview

16.3.3.2 Product Portfolio

16.3.4 Earth's Own Food Company Inc.

16.3.4.1 Company Overview

16.3.4.2 Product Portfolio

16.3.5 Hain Celestial Group

16.3.5.1 Company Overview

16.3.5.2 Product Portfolio

16.3.6 Hiland Dairy Foods

16.3.6.1 Company Overview

16.3.6.2 Product Portfolio

16.3.7 Malk Organics LLC

16.3.7.1 Company Overview

16.3.7.2 Product Portfolio

16.3.8 Pacific Foods of Oregon LLC

16.3.8.1 Company Overview

16.3.8.2 Product Portfolio

16.3.9 Sanitarium

16.3.9.1 Company Overview

16.3.9.2 Product Portfolio

16.3.10 SunOpta Inc.

16.3.10.1 Company Overview

16.3.11.5 Product Portfolio

16.3.10.3 Financials

16.3.10.4 SWOT Analysis

16.3.11 The WhiteWave Foods Company

16.3.11.1 Company Overview

16.3.11.2 Product Portfolio

List of Figures

Figure 1: Global: Almond Milk Market: Major Drivers and Challenges

Figure 2: Global: Almond Milk Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Almond Milk Market: Breakup by Type (in %), 2024

Figure 4: Global: Almond Milk Market: Breakup by Category (in %), 2024

Figure 5: Global: Almond Milk Market: Breakup by Packaging Type (in %), 2024

Figure 6: Global: Almond Milk Market: Breakup by Application (in %), 2024

Figure 7: Global: Almond Milk Market: Breakup by Distribution Channel (in %), 2024

Figure 8: Global: Almond Milk Market: Breakup by Region (in %), 2024

Figure 9: Global: Almond Milk Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Almond Milk (Plain) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Almond Milk (Plain) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Almond Milk (Flavored) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Almond Milk (Flavored) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Almond Milk (Organic) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Almond Milk (Organic) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Almond Milk (Conventional) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Almond Milk (Conventional) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Almond Milk (Carton) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Almond Milk (Carton) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Almond Milk (Glass) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Almond Milk (Glass) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Almond Milk (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Almond Milk (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Almond Milk (Beverages) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Almond Milk (Beverages) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Almond Milk (Frozen Desserts) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Almond Milk (Frozen Desserts) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Almond Milk (Personal Care) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Almond Milk (Personal Care) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Almond Milk (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Almond Milk (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Almond Milk (Hypermarkets and Supermarkets) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Almond Milk (Hypermarkets and Supermarkets) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Almond Milk (Convenience Stores) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Almond Milk (Convenience Stores) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Almond Milk (Online Stores) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Almond Milk (Online Stores) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Almond Milk (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Almond Milk (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: North America: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: North America: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: United States: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: United States: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Canada: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Canada: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Asia Pacific: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Asia Pacific: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: China: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: China: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Japan: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Japan: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: India: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: India: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: South Korea: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: South Korea: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Australia: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Australia: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Indonesia: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Indonesia: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Others: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Others: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Europe: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Europe: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Germany: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Germany: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: France: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: France: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: United Kingdom: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: United Kingdom: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Italy: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Italy: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Spain: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Spain: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Russia: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Russia: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Others: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Others: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Latin America: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Latin America: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Brazil: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Brazil: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Mexico: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Mexico: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Others: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Others: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Middle East and Africa: Almond Milk Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Middle East and Africa: Almond Milk Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Global: Almond Milk Industry: SWOT Analysis

Figure 89: Global: Almond Milk Industry: Value Chain Analysis

Figure 90: Global: Almond Milk Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Almond Milk Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Almond Milk Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: Almond Milk Market Forecast: Breakup by Category (in Million USD), 2025-2033

Table 4: Global: Almond Milk Market Forecast: Breakup by Packaging Type (in Million USD), 2025-2033

Table 5: Global: Almond Milk Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 6: Global: Almond Milk Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 7: Global: Almond Milk Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Almond Milk Market: Competitive Structure

Table 9: Global: Almond Milk Market: Key Players

Companies Mentioned

- Blue Diamond Growers

- Califia Farms LLC

- Daiya Foods Inc.

- Earth's Own Food Company Inc.

- Hain Celestial Group

- Hiland Dairy Foods

- Malk Organics LLC

- Pacific Foods of Oregon LLC

- Sanitarium

- SunOpta Inc.

- The WhiteWave Foods Company

Table Information

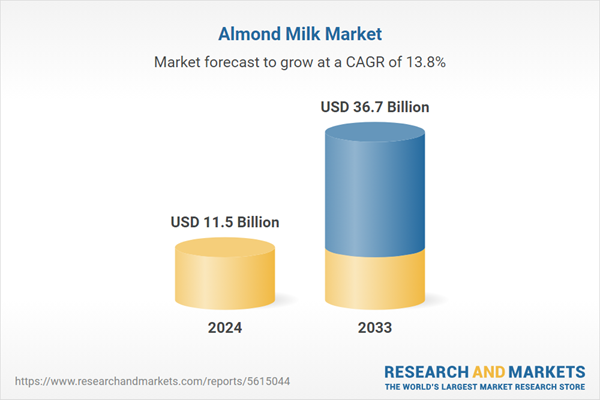

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 11.5 Billion |

| Forecasted Market Value ( USD | $ 36.7 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |