Activewear Market Analysis:

Market Growth and Size: According to activewear market analysis, the market is experiencing robust growth, fueled by increasing health consciousness and a cultural shift towards more active lifestyles. This trend is reflected globally, with significant market expansion in both developed and emerging economies.Major Market Drivers: Key drivers include the rising trend of health and wellness, the influence of social media and celebrity endorsements, and a growing interest in outdoor and fitness activities among all age groups. These factors are contributing to a broader consumer base and higher demand for the products.

Technological Advancements: Innovations in fabric technology and manufacturing processes, such as moisture-wicking materials, temperature control, and wearable technology integration, are enhancing the functionality and appeal, driving consumer interest and market growth.

Industry Applications: It is increasingly being used across various activities, not just traditional sports and fitness. It includes casual wear, professional sports apparel, and specialized gear for outdoor activities, reflecting its versatility and wide-ranging appeal.

Key Market Trends: The market is witnessing an increase in demand for sustainable and eco-friendly apparel, driven by consumer awareness of environmental issues. Additionally, the emergence and rising popularity of athleisure is a significant trend.

Geographical Trends: North America remains the largest market due to high consumer spending power and a strong fitness culture, while the Asia Pacific region is showing rapid growth because of increasing health awareness and economic development. Europe focuses on quality and sustainability, and emerging markets in Latin America and the Middle East and Africa are expanding with rising health consciousness.

Competitive Landscape: The global market is highly competitive, with a mix of established sports brands, luxury fashion labels, and emerging niche players. Key players are focusing on innovation, strategic partnerships, and digital marketing strategies to capture activewear market share.

Challenges and Opportunities: According to the activewear market report, the market faces challenges such as intense competition, changing consumer preferences, and the need for sustainable production practices. However, there are significant opportunities in tapping into emerging markets, leveraging technological innovations, and meeting the growing demand for eco-friendly products.

Activewear Market Trends:

Health and wellness trend

The escalating global interest in health, wellness, and fitness is a predominant driver of the global market. As people increasingly adopt healthier lifestyles, there's a significant shift towards regular exercise, propelling the demand for comfortable, versatile, and high-performance. This trend is further amplified by the rising awareness of the importance of physical health and its impact on mental well-being, influencing consumers to invest in quality wear that supports their fitness journey. The proliferation of fitness apps, online workout communities, and virtual fitness classes during recent times, especially post-pandemic, has made fitness activities more accessible, thereby expanding the consumer base. Brands are responding by innovating with eco-friendly materials, advanced technical features, and fashionable designs, making it suitable for a broad range of physical activities and everyday wear, thus blurring the lines between workout clothes and casual attire.Technological advancements and innovation

The global market is significantly driven by technological advancements and innovations in fabrics and manufacturing processes. Modern consumers demand the product that not only provides comfort and flexibility but also incorporates advanced features such as moisture-wicking, temperature control, anti-odor, and UV protection. The integration of wearable technology, like fitness trackers and smart fabrics that monitor biometrics, has also elevated the functionality of it, making it appealing to tech-savvy consumers. Manufacturers are continuously exploring new materials, such as recycled plastics and biodegradable fabrics, to enhance sustainability and appeal to environmentally conscious consumers. These innovations address the growing consumer expectation for high-performance attire that accommodates an active lifestyle while also aligning with personal values regarding sustainability and ethical manufacturing practices, thus influencing purchasing decisions and driving market growth.Influence of social media and celebrity endorsements

Social media platforms and celebrity endorsements play a crucial role in shaping consumer preferences and driving the global market. Influencers and celebrities showcase the latest activewear market trends, influencing their followers' buying choices and setting fashion trends. The visual nature of platforms like Instagram and TikTok serves as a perfect showcase for brands, enabling them to reach a broad audience by featuring their products in various lifestyle contexts. This visibility not only boosts brand awareness but also encourages a lifestyle that prioritizes fitness and health, further fueling the demand for the product. Collaborations between brands and high-profile personalities in creating signature lines have also become a significant market trend, offering exclusivity and tapping into the fan base of those personalities, thereby attracting a larger customer base and driving sales in the sector.Activewear Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global activewear market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, material type, pricing, age group, distribution channel and end user.Breakup by Product Type:

- Top Activewear

- Bottom Activewear

- Innerwear

- Swimwear

- Outerwear

Breakup by Material Type:

- Nylon

- Polyester

- Cotton

- Neoprene

- Polypropylene

- Spandex

Polyester holds the largest share in the industry

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes nylon, polyester, cotton, neoprene, polypropylene, and spandex. According to the report, polyester accounted for the largest market share.Breakup by Pricing:

- Economy

- Premium

Breakup by Age Group:

- 1 - 15 Years

- 16 - 30 Years

- 31 - 44 Years

- 45 - 64 Years

- More than 65 Years

Breakup by Distribution Channel:

- Online Stores

- Offline Stores

Offline stores represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline stores and online stores. According to the report, offline stores represented the largest segment.Breakup by End User:

- Men

- Women

- Kids

Women represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and kids. According to the report, women represented the largest segment.Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest activewear market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Adidas AG

- ASICS Corporation

- Columbia Sportswear Company

- DICK's Sporting Goods Inc.

- Forever 21

- Gap Inc.

- Nike Inc.

- Puma SE

- PVH Corp.

- Skechers USA Inc.

- The North Face (VF Corporation)

- Under Armour Inc.

Key Questions Answered in This Report

1. How big is the activewear market?2. What is the future outlook of the activewear market?

3. What are the key factors driving the activewear market?

4. Which region accounts for the largest activewear market share?

5. Which are the leading companies in the global activewear market?

Table of Contents

Companies Mentioned

- Adidas AG

- ASICS Corporation

- Columbia Sportswear Company

- DICK's Sporting Goods Inc.

- Forever 21

- Gap Inc.

- Nike Inc.

- Puma SE

- PVH Corp.

- Skechers USA Inc.

- The North Face (VF Corporation)

- Under Armour Inc.

Table Information

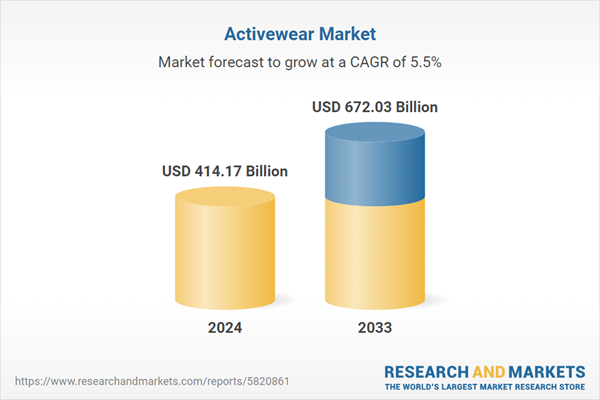

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 414.17 Billion |

| Forecasted Market Value ( USD | $ 672.03 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |