The global mobile value-added services (MVAS) market is driven by increasing smartphone adoption, expanding 4G/5G networks, and rising mobile internet penetration. Growing demand for digital entertainment, mobile payments, and cloud-based enterprise solutions further accelerates market growth. Advancements in AI, IoT, and big data analytics enhance service personalization and efficiency. Moreover, government initiatives promoting digital inclusion and mobile-based governance support market expansion. The rise of mobile advertising, location-based services, and secure transaction solutions strengthens MVAS adoption across industries. Additionally, increasing consumer preference for on-demand content and seamless communication drives continuous innovation in MVAS offerings.

The United States is one of the major markets for MVAS, resulting from high penetration of smartphones, advanced telecom infrastructures, and strong demand for digital services by American consumers. For example, industry data revealed that 98% of the American people possessed cellphone during the year 2024, with approximately 9 out of 10, i.e., 91% individuals, possessing a smartphone. Moreover, comprehensive deployment of 5G would open more accesses to MVAS, which supports key applications, encompassing enterprise, mobile banking, streaming, and e-commerce. Corporates use MVAS for marketing, customer reach, and easy transactions. In addition, and regulatory adherence would influence the service development with full privacy and reliability guarantee. The entrance of leading-edge technologies like cloud computing, AI, or IoT, significantly enhances the maturity of MVAS. Higher demand for mobile convenience continues to fuel market growth as well as advancements across a wide range of industries.

Mobile Value-Added Services (MVAS) Market Trends:

Rising adoption of smartphones and mobile devices

The rising adoption of smartphones and other mobile devices among the masses, along with the ease of internet facilities around the world, is contributing to the growth of the market. As per research, the global smartphone industry witnessed a year-on-year growth of around 10% during the first quarter of 2024, reaching 296.2 Million units. In addition, smartphones act as a versatile platform that assists in handling daily tasks easily and efficiently. Mobile devices provide individuals with instant access to a wide range of information and services. In line with this, the availability of high-speed internet connectivity allows users to stay connected, access social media platforms, and browse the internet seamlessly without any delay and disruptions. Apart from this, users are increasingly seeking value beyond basic communication, which is offering a positive market outlook. From entertainment and education to productivity and health, MVAS caters to various aspects of users.Increasing demand for personalized and convenient experiences

The magnifying need for user-friendly and tailored experiences amongst consumers globally is substantially accelerating the expansion of the market. According to reports, 80% of the customers are more likely to buy when brands provide customized experiences. In line with this, MVAS provides tailored solutions that cater to individual preferences and needs. Consumers expect seamless access to services that align with their interests and behaviours. Apart from this, MVAS caters to the different needs of individuals by offering services, such as personalized content recommendations, location-based services, and customized notifications. In addition, the ability to access relevant information and services in real time assists in enhancing user satisfaction and engagement, which is positively influencing the market. MVAS providers are continuously innovating their offerings to stay relevant in a competitive landscape.Innovations in mobile technology and connectivity

Several industry giants are advancing mobile technology to appeal a comprehensive customer base across the world. In addition, the rapid employment of 5G networks is amplifying the abilities of mobile devices. For instance, the number of people sing 5G is anticipated to grow to 4.6 Billion by 2028 end, accounting for more than half of all mobile owners worldwide. Besides this, the 5G technology assists in enhancing the potential for delivering more immersive and data intensive MVAS content due to its higher data speeds, lower latency, and increased network capacity. In line with this, these advancements are particularly crucial for services, such as augmented reality (AR), virtual reality (VR), and high-definition video streaming. The improved connectivity allows businesses to create and deliver improved and more interactive MVAS offerings that enhance user experiences.Mobile Value-Added Services (MVAS) Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global mobile value-added services (MVAS) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution, device type, end-user, and vertical.Analysis by Solution:

- Short Messaging Service (SMS)

- Multimedia Messaging Service (MMS)

- Location Based Services

- Mobile Email and IM

- Mobile Money

- Mobile Advertising

- Mobile Infotainment

- Others

Analysis by Device Type:

- Mobile Phone

- Tablet PC

- Laptop or Data-Card

- Others

Analysis by End-User:

- SMBs

- Enterprises

Analysis by Vertical:

- BFSI

- Media and Entertainment

- Healthcare

- Education

- Retail

- Government

- Telecom and IT

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Mobile Value-Added Services (MVAS) Market Analysis

In 2024, the United States accounted for 78.70% of the market share in North America. The growing adoption of mobile value-added services (MVAS) in the United States is significantly driven by the deployment of fifth generation (5G) networks, which enable faster, more reliable, and higher-capacity mobile communication. According to Ericsson, in the US, more than 90% of the individuals, i.e., 300 Million people, dwell in regions provided with 5G low-band from service providers of three tier-1, whereas 210 to 300 Million are provided with mid-band. This enhanced network infrastructure supports the seamless delivery of MVAS, catering to increasing consumer demand for services such as mobile entertainment, cloud applications, and online transactions. As 5G networks expand, the increased bandwidth and reduced latency open new possibilities for innovation, attracting both consumers and businesses to embrace MVAS offerings. Furthermore, the ability of 5G to connect a larger number of devices and handle high data traffic facilitates a more efficient, personalized user experience, driving further MVAS adoption across various sectors.North America Mobile Value-Added Services (MVAS) Market Analysis

North America is a key market for mobile value-added services (MVAS), driven by high smartphone penetration, advanced telecom infrastructure, and widespread adoption of 4G and 5G networks. For instance, the publisher indicates that smartphone market in Canada is anticipated to showcase 3.70% of the growth rate during the time period 2024 to 2032, highlighting the increasing demand for this device in the nation. Moreover, the region benefits from strong consumer demand for digital entertainment, mobile banking, and e-commerce services. Enterprises increasingly integrate MVAS for business communication, marketing, and customer engagement, leveraging AI-driven analytics and cloud-based platforms. Regulatory frameworks promoting data security and user privacy shape market development, encouraging secure mobile transactions and authentication solutions. The expansion of IoT and smart devices further enhances MVAS adoption across industries, including healthcare, retail, and finance. Continuous technological advancements and rising demand for personalized mobile services position North America as a leading market for MVAS innovation and growth.Europe Mobile Value-Added Services (MVAS) Market Analysis

In Europe, mobile value-added services (MVAS) are seeing increased adoption driven by the growth of the banking, financial services, and insurance (BFSI) sector. According to reports, in the year 20201, there were around 784 branches of foreign bank across the European Union, out of which were 165 from third nations and 619 from other European Union Member States. The expansion of digital banking, mobile payment systems, and secure online transactions encourages the use of MVAS to enhance customer experience and streamline services. The BFSI industry's reliance on advanced mobile services, such as mobile wallets, insurance apps, and customer support tools, drives the need for robust mobile platforms and infrastructure. The increasing demand for secure, convenient, and efficient mobile banking services propels the growth of MVAS adoption in this sector, enabling businesses to cater to evolving customer preferences and enhance service delivery.Latin America Mobile Value-Added Services (MVAS) Market Analysis

In Latin America, the growing adoption of mobile value-added services (MVAS) is largely driven by the advancements in mobile technology and connectivity. According to GSMA, at the end of the year 2021, smartphone connections were forecasted to reach around 500 Million in Latin America, with a 74% of the adoption rate. As mobile networks expand and become more reliable, they facilitate the delivery of MVAS that are essential for both consumer and business needs. The widespread availability of mobile internet and increased smartphone penetration across the region contributes to greater access to digital services, such as mobile banking, entertainment, and e-commerce. Enhanced mobile connectivity also supports the growth of MVAS in sectors like healthcare, education, and logistics, where mobile platforms enable real-time access to information, further driving the region’s digital transformation.Middle East and Africa Mobile Value-Added Services (MVAS) Market Analysis

In the Middle East and Africa, the growing utilization of mobile value-added services (MVAS) is closely linked to the increasing investment in IT and telecom infrastructure. For instance, the total expenditure on information and communications technology in the Middle East, Türkiye, and Africa (META) will top USD 238 Billion in the year 2024, an 4.5% elevation over the year 2023. This investment has significantly improved mobile connectivity and the availability of mobile services, encouraging the use of MVAS in various industries, including healthcare, retail, and financial services. As businesses and consumers benefit from improved network capabilities, MVAS adoption continues to rise, with services encompassing mobile banking, messaging, and mobile entertainment playing key roles in enhancing user engagement and business operations.Competitive Landscape:

The market is showcasing significant competition, with leading firms actively gravitating towards alliance formation, innovation, and service diversification. For instance, in February 2025, Axyom.Core announced a collaboration with Cirrus Core Networks under which Cirrus will provide Axyom.Core’s leading-edge technology, facilitating mobile virtual network operators (MVNOs) to offer Internet of Things and differentiated subscriber packages, coupled with advanced service offerings. In addition to this, telecom operators, technology companies, and content providers are expanding their offerings to enhance customer engagement and revenue streams. Major companies invest in AI-driven analytics, cloud-based platforms, and mobile payment solutions to gain a competitive edge. Market consolidation through mergers and acquisitions strengthens industry positioning, while regional players capitalize on localized content and services. Regulatory compliance, cybersecurity, and data privacy remain critical factors influencing market competition.The report provides a comprehensive analysis of the competitive landscape in the mobile value-added services (MVAS) market with detailed profiles of all major companies, including:

- AT&T

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- Comverse Technology Inc.

- Gaana.com

- Gemalto

- Google LLC

- InMobi

- Kongzhong Corp

- Mahindra Comviva

- Mobily

- One97 Communications Ltd.

- OnMobile

- Vodafone Group Plc

Key Questions Answered in This Report

1. How big is the mobile value-added services (MVAS) market?2. What is the future outlook of mobile value-added services (MVAS) market?

3. What are the key factors driving the mobile value-added services (MVAS) market?

4. Which region accounts for the largest mobile value-added services (MVAS) market share?

5. Which are the leading companies in the global mobile value-added services (MVAS) market?

Table of Contents

Companies Mentioned

- AT&T

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- Comverse Technology Inc.

- Gaana.com

- Gemalto

- Google LLC

- InMobi

- Kongzhong Corp

- Mahindra Comviva

- Mobily

- One97 Communications Ltd.

- OnMobile

- Vodafone Group Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | August 2025 |

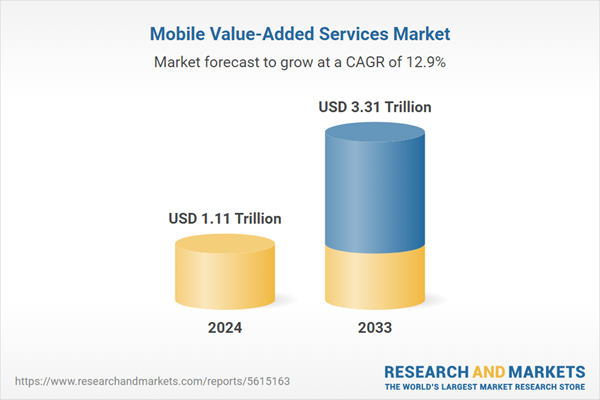

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.11 Trillion |

| Forecasted Market Value ( USD | $ 3.31 Trillion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |