Dominant Segments:

- Analysis Type: On the basis of analysis type, the market has been segmented into structural proteomics, functional proteomics, and protein expression proteomics.

- Component Type: Based on component type, the market has been bifurcated into core proteomics services and bioinformatics software and related services.

- Technology: Protein microarrays lead the market as they enable rapid, large-scale analysis of protein interactions, expressions, and functions. Their high-throughput nature makes them ideal for biomarker discovery and disease diagnostics.

- Application: On the basis of application, the market has been classified into protein expression profiling, protein mining, and post-translational modifications.

- End-User: Research organizations (drug discovery) hold the biggest market share because of their focus on biomarker identification and disease mechanism studies. They are heavily investing in advanced proteomic technologies to accelerate research and development (R&D) activities.

- Region: North America leads the proteomics market due to high R&D investments and a large presence of biotech and pharmaceutical companies. Government support, advanced healthcare systems, and early adoption of innovative technologies are further driving market leadership in the region.

Key Players:

- The leading companies in proteomics market include Agilent Technologies Inc., Bio-RAD Laboratories Inc., Bruker Corporation, Creative Proteomics, Danaher Corporation, GE Healthcare Inc., Horiba Ltd., Luminex Corporation, Merck Group, Perkinelmer Inc., Promega Corporation, Thermo Fisher Scientific Inc., Waters Corporation, etc.

Key Drivers of Market Growth:

- Growing Demand for Personalized Medicine: The personalized approach fosters greater adoption of proteomic tools in clinical and pharmaceutical settings. Proteomics identifies specific biomarkers, supporting targeted drug development and improving therapeutic outcomes.

- Rising Focus on Cancer Research: Proteins play a crucial role in tumor biology, progression, and drug resistance. Proteomic analysis helps identify cancer-specific biomarkers, supports early diagnosis, and guides targeted therapy. This research demand is enhancing investments in proteomic technologies across oncology studies.

- Collaborations Between Academic Institutes and Biotech Companies: Partnerships are facilitating faster development of proteomic tools, diagnostic solutions, and therapeutics. Joint efforts also attract more funding, expand research capacity, and strengthen commercialization pipelines.

- Emergence of Single-Cell Proteomics: The development of single-cell proteomics is allowing researchers to study protein expression at the individual cell level. This innovation reveals cellular diversity and rare populations, enhancing disease understanding and drug targeting.

- Technological Advancements in Next-Generation Sequencing (NGS): Advancements in next-generation sequencing are enabling multi-omics approaches. NGS data provides genomic context for protein expression studies, improving biomarker discovery and precision medicine.

Future Outlook:

- Strong Growth Outlook: The proteomics market is expected to see sustained expansion, due to high demand for personalized medicine and innovations in mass spectrometry and bioinformatics. Ongoing research in drug discovery and biomarker identification is further supporting the market expansion.

- Market Evolution: The sector is anticipated to shift from basic protein analysis to advanced techniques like protein microarrays and bioinformatics tools. It is playing a significant role in diagnostics and personalized medicine, reflecting a shift towards more targeted and data-based biological investigations.

Proteomics Market Trends:

Growing incidence of chronic and infectious diseases

High incidence of chronic and infectious ailments is significantly fueling the growth of the market. As conditions like cancer, diabetes, cardiovascular disorders, and infectious diseases are becoming more widespread, there is a rising need to understand disease mechanisms at the molecular level. As per the NIH, in 2024, it was anticipated that there would be 2,001,140 new cancer cases in the United States. Proteomics enables researchers and clinicians to identify disease-specific biomarkers, monitor disease progression, and develop targeted therapies. It also aids in early diagnosis, which is critical in managing chronic illnesses effectively. The demand for personalized medicine and precision treatment is further promoting the use of proteomics tools, as they allow a deeper analysis of protein interactions and functions.Increasing pharmaceutical R&D activities

The growing pharmaceutical R&D activities are positively influencing the market. As stated in the Swiss Biotech Report 2025, R&D expenditure in Switzerland amounted to SFr2.6 Billion (USD 3.16 Billion) in 2024, with SFr1.4 Billion contributed by private companies. As pharmaceutical companies are wagering on drug discovery and development, there is a rising demand for advanced tools that can offer insights into protein structures, functions, and interactions. Proteomics enables researchers to identify and validate potential drug targets, understand disease pathways, and assess drug efficacy and toxicity at the molecular level. With a strong focus on developing targeted therapies, proteomics is becoming essential for detecting disease-specific biomarkers and tailoring treatments accordingly. Additionally, the adoption of biologics and biosimilars has further intensified the need for precise protein analysis.Rising AI adoption

Increasing AI adoption is streamlining data analysis, improving pattern recognition, and accelerating biomarker discovery. As per the publisher, the global AI market size was valued at USD 115.62 Billion in 2024. Proteomics generates massive, complex datasets that require advanced computational tools for accurate interpretation. AI algorithms, particularly ML, help identify subtle protein expression patterns linked to specific diseases, enabling faster and more precise diagnostics and drug development. AI also enhances predictive modeling in personalized medicine by integrating proteomic data with other biological datasets. This technological synergy reduces research timelines and boosts efficiency in both academic and pharmaceutical research. Furthermore, AI-oriented automation minimizes human error and lowers operational costs. As organizations are integrating AI into their proteomics workflows, innovations in disease detection and treatment continue to advance rapidly. According to the proteomics market report, this technological trend plays an important role in shaping the future of the industry.Key Growth Drivers of Proteomics Market:

Partnerships between academic institutes and biotech companies

Increasing alliances between academic institutes and biotech companies are significantly bolstering the proteomics market growth by combining research innovations with commercial execution. Academic institutions offer deep scientific knowledge and cutting-edge discoveries, while biotech firms provide resources, infrastructure, and expertise to translate these findings into market-ready applications. Such partnerships accelerate the development of novel proteomic technologies, diagnostic tools, and therapeutics. Joint ventures help bridge the gap between basic research and real-world clinical needs, leading to faster innovation cycles. These collaborations often attract funding from both public and private sectors, enabling large-scale proteomic studies and advanced biomarker identification. The shared access to talent, equipment, and databases is further strengthening research output and commercial potential.Emergence of single-cell proteomics

The emergence of single-cell proteomics is allowing researchers to analyze proteins at an individual cell level, offering insights into cellular heterogeneity and disease mechanisms. Unlike bulk analysis, which averages signals from numerous cells, single-cell techniques capture the unique proteomic profile of each cell, enabling deeper understanding of cell behavior, immune responses, and cancer progression. This level of granularity is crucial for developing personalized medicine, as it helps identify rare cell types or subpopulations involved in disease. The growing utilization of high-resolution mass spectrometry and microfluidic platforms has made single-cell proteomics more feasible and scalable. As researchers and pharmaceutical companies are adopting this approach, it is opening new avenues for biomarker discovery and therapeutic targeting.Technological advancements in NGS

Technological advancements in NGS are enhancing multi-omics integration and expanding the depth of biological insights. While NGS is primarily used for genomic and transcriptomic analysis, its synergy with proteomics allows a more complete understanding of cellular function. Researchers can correlate gene expression data with protein expression and modifications, leading to improved biomarker identification and disease modeling. Innovations, such as single-cell sequencing and spatial transcriptomics, are enabling high-resolution mapping of gene and protein networks within tissues. These technologies make it easier to design proteomic experiments informed by genomic context, enhancing accuracy and relevance. The widespread availability of NGS also fosters data-driven research strategies, driving the demand for complementary proteomics tools. As NGS platforms are evolving, they continue to support and broaden applications in the proteomics market.Proteomics Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on analysis type, component type, technology, application, and end-user.Breakup by Analysis Type:

- Structural Proteomics

- Functional Proteomics

- Protein Expression Proteomics

Structural proteomics is concerned with detailed analysis of protein interactions, structures, and functions. This field is required for studying disease mechanism and drug development. Advanced instruments and techniques boost growth, facilitating high-resolution structural comprehensions. Leading research institutions and companies are globally investing in structural proteomics to develop innovative therapeutic solutions.

Functional proteomics emphasizes on recognizing protein interactions and functions within a biological context. This discipline leverages advanced techniques to examine the dynamics of protein modifications, activities, and networks. In the global proteomics market, functional proteomics plays a crucial role by spurring innovations in personalized medicine, drug discovery, and disease diagnostics. By offering discernments into protein pathways and mechanisms, it encourages the development of targeted therapies and biomarker identification, substantially improving the efficacy and accuracy of medical treatments.

Protein expression proteomics examines the qualitative and quantitative aspects of protein formation within cells. It includes high-throughput techniques to compare and profile protein expression levels across various treatments or conditions. In the global proteomics market outlook, this subfield is pivotal for comprehending disease mechanisms, identifying biomarkers, and innovating novel therapeutic strategies. The proficiency of monitoring protein expression changes in response to numerous stimuli facilitates the development of enhanced and effective personalized medical initiatives and early detection of diseases.

Breakup by Component Type:

- Core Proteomics Services

- Bioinformatics Software and Related Services

Core proteomics services include the protein identification, quantification, and analysis by leveraging advanced techniques such as chromatography and mass spectrometry. These services permit researchers to interpret complex protein interactions and functions, streamlining discoveries in therapeutic targets, disease mechanisms, and biomarker identification. Specialization in data acquisition, interpretation, and sample preparation is crucial for accurate results.

Bioinformatics software and related services provide crucial tools for data visualization and analysis. These services feature algorithms for protein structural prediction, sequence alignment, and functional annotation. Incorporating bioinformatics with proteomics propels research by reconfiguring raw data into meaningful biological insights, endorsing advancements in drug development and personalized medicine. For instance, in October 2023, Ionpath, a high-definition spatial proteomics developer, launched user-friendly bioinformatics tools named MIBIplus and MIBIsight that offers controlled data interpretation by using mass spectrometry to study various proteins associated with immune-oncology.

Breakup by Technology:

- Spectroscopy

- Chromatography

- Electrophoresis

- Protein Microarrays

- X-Ray Crystallography

- Surface Plasmon Resonance

- Others

Protein microarrays represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the technology. This includes spectroscopy, chromatography, electrophoresis, protein microarrays, X-ray crystallography, surface plasmon resonance, and others. According to the report, protein microarrays represented the largest segment.Protein microarrays demonstrate a high-throughput platform in proteomics market, allowing simultaneous analysis of numerous protein samples. By immobilizing proteins on solid surfaces, these arrays foster rapid quantification and detection, promoting therapeutic development, biomarker discovery and diagnostics within the global proteomics market. For instance, in February 2024, Infinity Bio launched new technology, based on MIPSA technology, that leverages protein microarray method to analyze antibody-antigen binding. Maryland-based PTX Capital and Blackbird BioVentures granted USD 4 million fund to Infinity for the development of this technology, allowing the production of large arrays of proteins or peptides in a highly programmed manner. It also aids in combining full-length proteins and peptides in a single reaction, which allows researchers to study antibodies interaction with the 3D structure of full proteins and collect information on the specific peptide sequences that function as antibody epitopes.

Breakup by Application:

- Protein Expression Profiling

- Proteome Mining

- Post-translational Modifications

Protein expression profiling is a pivotal technique permitting the quantification and identification of proteins within a specific biological sample. This process offers valuable analysis of disease mechanisms and cellular functions, promoting the development of personalized medicine and targeted therapeutics by locating specific protein markers associated with numerous conditions.

Proteome mining is an inclusive approach that encompasses the systematic assessment of the entire proteome to discover novel proteins and apprehend their functions. This method propels advancements in drug development and biomarker discovery, presenting an in-depth understanding of potential therapeutic targets and biological processes for numerous diseases.

Post-translational modification (PTM) analysis targets the chemical modifications post the synthesis of proteins. These modifications greatly influence protein stability, function, and interactions. In the global proteomics market, PTM analysis aids in elucidating complex regulatory mechanisms, promoting the development of innovative diagnostics and treatments.

Breakup by End-User:

- Clinical Diagnostic Laboratories

- Research Organizations (Drug Discovery)

- Others

Research organizations dominate the market

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes clinical diagnostic laboratories, research organizations (drug discovery), and others. According to the report, research organizations represented the largest segment.By utilizing proteomic data, research organizations uncover new drug targets, expound disease mechanisms, and boost the development of effective treatments, consequently spurring advancements in biotechnological and pharmaceutical sectors. For instance, in July 2024, Olink Holding AB, a leading proteomics company, launched its network of Olink Certified Service Providers that will represent service labs and contract research organization (CROs) worldwide.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest proteomics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market, holding the largest share of the proteomics market revenue.The market in North America is undergoing notable growth, principally driven by significant investments in research and development, and upgraded healthcare infrastructure. Furthermore, the increasing incidents of chronic diseases and intensifying focus on personalized medicine is boosting the market growth. In additional, robust support by government and funding initiatives escalate the utilization of proteomics technology in academic and clinical research. For instance, in September 2023, Multiomics CRO Psomagen launched its Spatial Biology services for 10X Genomics Xenium in North America. Psomagen's Xenium Service integrates various omics platforms, including proteomics, genomics, and transcriptomics.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the proteomics industry include Agilent Technologies Inc., Bio-RAD Laboratories Inc., Bruker Corporation, Creative Proteomics, Danaher Corporation, GE Healthcare Inc., Horiba Ltd., Luminex Corporation, Merck Group, Perkinelmer Inc., Promega Corporation, Thermo Fisher Scientific Inc., Waters Corporation, etc.

- The competitive landscape of the global proteomics market is represented by the presence of major companies that are actively competing to strengthen their market position through strategic collaborations and technological advancements. For instance, in April 2024, Biognosys and Alamar Biosciences announced that they have entered into a strategic partnership for joint scientific research in biofluid-based proteomics. This partnership brings together Biognosys' expertise in data independent acquisition mass spectrometry (DIA-MS) and Alamar's cutting-edge immunoassays. Market players are currently emphasizing on research and development investment and expansion of their product portfolios to lead this swiftly evolving sector. Acquisitions and mergers are also common, aimed at unifying resources and expertise. The market is currently experiencing intense competition, fueled by escalating demand for advanced diagnostic tools and precision medicine, mandating continuous innovation.

Key Questions Answered in This Report

1. How big is the global proteomics market?2. What is the expected growth rate of the global proteomics market during 2025-2033?

3. What are the key factors driving the global proteomics market?

4. What has been the impact of COVID-19 on the global proteomics market?

5. What is the breakup of the global proteomics market based on the technology?

6. What is the breakup of the global proteomics market based on the end-user?

7. What are the key regions in the global proteomics market?

8. Who are the key players/companies in the global proteomics market?

Table of Contents

Companies Mentioned

- Agilent Technologies Inc.

- Bio-RAD Laboratories Inc.

- Bruker Corporation

- Creative Proteomics

- Danaher Corporation

- GE Healthcare Inc.

- Horiba Ltd.

- Luminex Corporation

- Merck Group

- Perkinelmer Inc.

- Promega Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

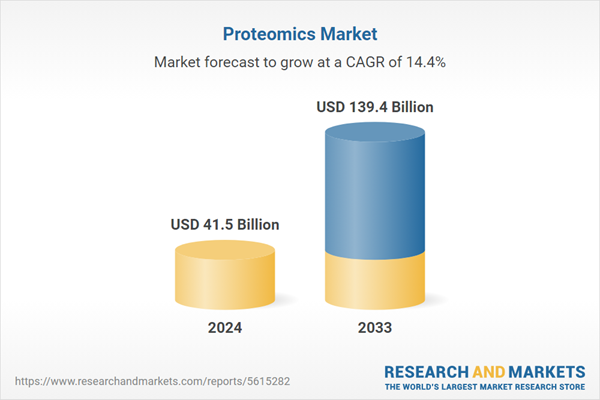

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 41.5 Billion |

| Forecasted Market Value ( USD | $ 139.4 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |