Dental Matrix Systems Market Growth & Trends

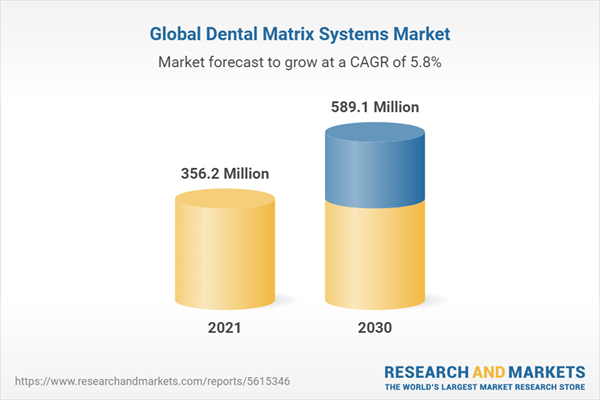

The global dental matrix systems market size is expected to reach USD 589.1 million by 2030, according to a new report. It is expected to expand at a CAGR of 5.8% from 2022 to 2030. A dental matrix system is used for three things, recreating the interproximal contact and the natural tooth shape, sealing the gingival walls and proximal of the prep, and overcoming the thickness of the matrix band. Dental matrix systems are built to establish a temporary interproximal wall of a tooth surface for the restoration procedure.

Restorative dentistry is one of the growing markets in the healthcare domain across the world. The market is mostly driven by factors such as the growing dental restorative procedures, rising incidence of dental problems, and increased demand for cosmetic dentistry. Furthermore, rising dental tourism and the growing adoption of digital dentistry in emerging markets are anticipated to boost the market growth during the forecast period.

According to the National Institute of Dental Research, the most prevalent and common dental disease in both, adults and children is tooth decay. Nearly 92% of the population, between the ages of 20 to 64, have dental caries. The rising incidence of oral and dental problems is a major driver contributing to the growth of the market. With the rising disposable incomes in developing economies, the willingness to afford expensive dental procedures has also increased among the population, specifically among the aging population.

Poor diet and sedentary lifestyle, especially amongst children, which leads to tooth decay, are driving the market. Furthermore, according to the American Dental Association (ADA), as of 2018, there are 199,486 dentists are working in the U.S. In addition, the Bureau of Labor Statistics mentions that dental cosmetic procedures are projected to increase by 19% from 2016 to 2026. This rising number of dental practitioners and clinics is also expected to contribute to the market growth.

The COVID-19 pandemic has significantly affected the market. Due to the lockdown and global restrictions being imposed in most of the countries initially, many dental treatments and procedures were halted. The COVID-19 pandemic has caused a significant disruption in the supply chain of the overall medical industry. The outbreak had resulted in a decrease in the number of dental procedures performed each year, resulting in an overall decline in the market.

Dental Matrix Systems Market Report Highlights

- The sectional dental matrix systems type segment dominated the market in 2021. This is due to the fact that sectional matrix techniques offer more predictable solutions to achieve contact areas

- North America dominated the global market in 2021 with a revenue share of over 35.0% owing to the increasing number of dental professionals and dental service providers and rising technological advancements in the field of dentistry in the region

- Asia Pacific is expected to register the highest CAGR of 6.9% over the forecast period owing to the rising awareness regarding dental problems and associated diseases, a growing patient population, and rapid technological advancements

Table of Contents

Chapter 1 Methodology and Scope1.1 Market Segmentation & Scope

1.1.1 Type

1.1.2 End-Use

1.1.3 Regional Scope

1.1.4 Estimates and Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details of Primary Research

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.7 List of Secondary Sources

1.8 List of Primary Sources

1.9 List of Abbreviations

1.10 Objectives

1.10.1 Objective - 1:

1.10.2 Objective - 2:

1.10.3 Objective - 3:

1.10.4 Objective - 4:

Chapter 2 Executive Summary

2.1 Market Outlook

Chapter 3 Dental Matrix Systems Market: Variables, Trends, & Scope

3.1 Market Segmentation and Scope

3.2 Market Dynamics

3.2.1 Market Driver Analysis

3.2.2.1 Increasing Number of Patients Having Dental Problems

3.2.2.2 Advent of Technological Advancements Pertaining to Dental Procedure

3.2.2.3 Rise in Behavioral Risk Factors Like Smoking and Diabetes

3.2.4 Market Restraint Analysis

3.2.4.1 High Cost of Surgical Treatment

3.3 Penetration & Growth Prospect Mapping

3.4 Dental Matrix Systems: Market Analysis Tools

3.4.1 Industry Analysis - Porter’S

3.4.2 PESTEL Analysis

Chapter 4 Dental Matrix Systems Market: Type Segment Analysis

4.1 Dental Matrix Systems: Type Market Share Analysis, 2021 & 2030

4.2 Circumferential Matrix Systems

4.2.1 Circumferential Matrix Systems Market Estimates and Forecasts, 2018 - 2030 (Usd Million)

4.2.2 Sectional Matrix Systems

4.2.2.1 Sectional Matrix Systems Market Estimates and Forecasts, 2018 - 2030 (Usd Million)

Chapter 5 Dental Matrix Systems Market: End-Use Segment Analysis

5.1 Dental Matrix Systems: End-Use Market Share Analysis, 2021 & 2030

5.2 Hospitals and Dental Clinics

5.2.1 Hospitals and Dental Clinics Market Estimates and Forecasts, 2018 - 2030 (Usd Million)

5.3 Dental Laboratories

5.3.1 Dental Laboratories Market Estimates and Forecasts, 2018 - 2030 (Usd Million)

5.4 Dental Academic and Research Institutes

5.4.1 Others Market Estimates and Forecasts, 2018 - 2030 (Usd Million)

Chapter 6 Dental Matrix Systems Market: Regional Analysis

6.1 Dental Matrix Systems: Regional Market Share Analysis, 2021 & 2030

6.2 North America

6.2.1 North America Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.2.2 U.S.

6.2.2.1 U.S. Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.2.3 Canada

6.2.3.1 Canada Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.3 Europe

6.3.1 Europe Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.3.2 U.K.

6.3.2.1 U.K. Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.3.3 Germany

6.3.3.1 Germany Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.3.4 France

6.3.4.1 France Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.3.5 Italy

6.3.5.1 Italy Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.3.6 Spain

6.3.6.1 Spain Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.4 Asia-Pacific

6.4.1 Asia-Pacific Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.4.2 China

6.4.2.1 China Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.4.3 India

6.4.3.1 India Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.4.4 Japan

6.4.4.1 Japan Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.4.5 South Korea

6.4.5.1 South Korea Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.4.6 Australia

6.4.6.1 Australia Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.5 Latin America

6.5.1 Latin America Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.5.2 Brazil

6.5.2.1 Brazil Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.5.3 Mexico

6.5.3.1 Mexico Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.5.4 Argentina

6.5.4.1 Argentina Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.6 Mea

6.6.1 MEA Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.6.2 South Africa

6.6.2.1 South Africa Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.6.3 Saudi Arabia

6.6.3.1 Saudi Arabia Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

6.6.4 Mea

6.6.4.1 MEA Dental Matrix Systems Market, 2018 - 2030 (Usd Million)

Chapter 7 Company Profiles

7.1. Dentsply Sirona

7.1.1 Company Overview

7.1.2 Financial Performance

7.1.3 Product Benchmarking

7.1.4 Strategic Initiatives

7.2 Scott's Dental Supply

7.2.1 Company Overview

7.2.2 Financial Performance

7.2.3 Product Benchmarking

7.2.4 Strategic Initiatives

7.3 Polydentia

7.3.1 Company Overview

7.3.2 Financial Performance

7.3.3 Product Benchmarking

7.3.4 Strategic Initiatives

7.4 Garrison Dental Solutions

7.4.1 Company Overview

7.4.2 Financial Performance

7.4.3 Strategic Initiatives

7.5 Kerr Dental

7.5.1 Company Overview

7.5.2 Financial Performance

7.5.3 Product Benchmarking

7.5.4 Strategic Initiatives

7.6 Hiossen Implant

7.6.1 Company Overview

7.6.2 Financial Performance

7.6.3 Product Benchmarking

7.6.4 Strategic Initiatives

7.7 Dr. Walser Dental GmbH

7.7.1 Company Overview

7.7.2 Financial Performance

7.7.3 Product Benchmarking

7.7.4 Strategic Initiatives

7.8 Clinician's Choice Dental Products Inc.

7.8.1 Company Overview

7.8.2 Financial Performance

7.8.3 Product Benchmarking

7.8.4 Strategic InitiativesList of Tables

Table 1 List of secondary sources

Table 2 List of Abbreviations

Table 3 Strategic collaborations by key players

List of Charts

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Commodity flow analysis

Fig. 9 Dental matrix systems market snapshot (2021)

Fig. 10 Dental matrix systems market segmentation

Fig. 11 Market driver relevance analysis (Current & future impact)

Fig. 12 Market restraint relevance analysis (Current & future impact)

Fig. 13 Penetration & growth prospect mapping

Fig. 14 Porter’s five forces analysis

Fig. 15 SWOT analysis, by factor (political & legal, economic and technological)

Fig. 16 Dental matrix systems market type outlook: Segment dashboard

Fig. 17 Dental matrix systems market: type movement analysis

Fig. 18 Circumferential matrix systems market, 2018 - 2030 (USD Million)

Fig. 19 Sectional matrix systems market, 2018 - 2030 (USD Million)

Fig. 20 Dental matrix systems market end-use outlook: Segment dashboard

Fig. 21 Dental matrix systems market: End-use movement analysis

Fig. 22 Hospitals and dental clinics market, 2018 - 2030 (USD Million)

Fig. 23 Dental laboratories market, 2018 - 2030 (USD Million)

Fig. 24 Dental academic and research institutes market, 2018 - 2030 (USD Million)

Fig. 25 Regional market: Key takeaways

Fig. 26 Regional outlook: 2021 & 2030

Fig. 27 North America market, 2018 - 2030 (USD Million)

Fig. 28 U.S. market, 2018 - 2030 (USD Million)

Fig. 29 Canada market, 2018 - 2030 (USD Million)

Fig. 30 Europe market, 2018 - 2030

Fig. 31 U.K. market, 2018 - 2030 (USD Million)

Fig. 32 Germany market, 2018 - 2030 (USD Million)

Fig. 33 France market, 2018 - 2030 (USD Million)

Fig. 34 Italy market, 2018 - 2030 (USD Million)

Fig. 33 Spain market, 2018 - 2030 (USD Million)

Fig. 34 Asia Pacific market, 2018 - 2030 (USD Million)

Fig. 35 China market, 2018 - 2030 (USD Million)

Fig. 36 India market, 2018 - 2030 (USD Million)

Fig. 37 Japan market, 2018 - 2030 (USD Million)

Fig. 38 South Korea market, 2018 - 2030 (USD Million

Fig. 39 Australia market, 2018 - 2030 (USD Million

Fig. 40 Latin America market, 2018 - 2030 (USD Million)

Fig. 41 Brazil market, 2018 - 2030 (USD Million)

Fig. 42 Mexico market, 2018 - 2030 (USD Million)

Fig. 43 Argentina market, 2018 - 2030 (USD Million)

Fig. 44 MEA market, 2018 - 2030 (USD Million)

Fig. 45 South Africa market, 2018 - 2030 (USD Million)

Fig. 46 Saudi Arabia market, 2018 - 2030 (USD Million)

Fig. 47 UAE market, 2018 - 2030 (USD Million)

Companies Mentioned

- Dentsply Sirona

- Scott's Dental Supply

- Polydentia

- Garrison Dental Solutions

- Kerr Dental

- Hiossen Implant

- Dr. Walser Dental Gmbh

- Clinician's Choice Dental Products Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | May 2022 |

| Forecast Period | 2021 - 2030 |

| Estimated Market Value in 2021 | 356.2 Million |

| Forecasted Market Value by 2030 | 589.1 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |