Fabric wash and care products are used to keep garments from deteriorating due to normal washing and use. These things are also utilized for cleaning in a variety of industries, including automotive and aviation. The fabric wash and care business is being pushed by population growth and disposable income among middle-class customers in emerging countries.

Laundry care products, also known as, washing and fabric care products are utilized to clean furniture and clothing. Cleaning chemicals are necessary to maintain the cloth supple and clean. Detergent, soaps, fabric softeners, bleach, and other fabric wash products are available on the market. Different styles of clothing require different sorts of maintenance, such as dry cleaning or hand washing, to keep them looking their best. Fabric goods can be utilized on a variety of clothes for different seasons. Acrylic, denim, cotton, linen, microfiber, polyester, nylon, rayon, velvet, silk, lycra, and wool are among the materials suited for fabric cleaning. As the population rises and middle-class clients' income levels rise, the market demand for fabric care and washing has increased. Customers are willing to spend a larger portion of their disposable cash to keep their clothes clean. As a result, they invest more in the highest-quality fabric care and cleaning supplies. Another factor driving the need for fabric wash and care is the increased production of equivalent items in China and other Asian countries.

One has to wash their clothing every day and it is an essential part of daily routine. A decent detergent is essential for optimum health. Germs and other dangerous elements come into contact with the clothes when people touch various surfaces. Those contaminants are washed away with detergent. Some detergents give the clothes a pleasant scent. Customers can easily choose the right detergent for their needs from the many varieties available on the market. Different kinds of detergents are available

COVID-19 Impact Analysis

The COVID-19 pandemic caused disarray in the world. The spread of the virus prompted governments to implement lockdowns and restrictions on movement for people all throughout the world. The virus also resulted in millions of deaths. However, despite supply chain bottlenecks, many industry participants recorded higher sales during the pandemic as a result of increased demand for cleaning supplies. People have been highly concerned about their cleanliness since the outbreak of COVID-19. Sales of sanitizers, disinfectants, and laundry detergent increased during the mass hysteria induced by the outbreak of this pandemic. People also entered into a scarcity mentality due to the lockdowns and started buying laundry products in bulk for hoarding.

Market Growth Factors

Increasing Demand Due to Rising Disposable Income

A growing concern among individuals about health and sanitary living, free of germs, bacteria, dust, and filth, has resulted in an increase in per capita spending on household cleaning goods, particularly laundry detergents. In recent years, scent has become increasingly important in household cleaning goods as consumers want products with a strong pleasant odor, forcing vendors to differentiate their products. Furthermore, factors such as an increase in household expenditure and growth in the real estate industry due to an increase in residential units have raised the demand for laundry detergent products.

Growing Popularity of Organic Detergents

Organic detergents and cleansers have regularly outperformed chemical detergents and cleaners. They are preferred over chemical-based substances because they contain ingredients derived from plants. Even freshly washed clothes may feel sticky if the detergent is chemical-based. When natural detergents are used to wash garments, this is not the case. Another advantage of using organic detergents is that they consume fewer products. Clothes are in constant contact with the skin throughout the day. If harsh or chemical-based cleaning agents are used, there is a potential that some residue will remain in the clothes and come into contact with the skin.

Marketing Restraining Factor:

Surfactants and Artificial Colorants

Surfactants in synthetic detergents eventually biodegrade to low toxicity levels, but the process is gradual and hence causes environmental issues. Synthetic detergents contain a variety of surfactants, but Alkylphenol ethoxylates are a major problem for fish and other aquatic life, according to the Environmental Protection Agency. This surfactant accumulates in rivers and streams, poisoning fish by affecting the endocrine system, which controls growth, reproduction, and metabolism. As people are getting more environmentally conscious, these factors are likely to impede the growth of the laundry care market in the upcoming years.

Product Type Outlook

Based on Product Type, the market is segmented into Laundry Detergents, Fabric Softeners & Conditioners, Laundry Aides, and Others. Fabric conditioners and softeners, which help keep textiles soft, are anticipated to see greater demand as the demand for high-end clothes rises. Concerns over the use of chemicals like quaternary ammonium compounds, which can cause skin problems, are driving the need for biodegradable items. Manufacturers are likely to spend more on R&D and the launch of innovative products as a result of this aspect. The segment expanded due to the rising demand for quality clothing that is clean. Fabric softeners and conditioners are expected to rise in popularity in the coming years as the young population's preference for high-end products grows.

Distribution Channel Outlook

Based on Distribution Channel, the market is segmented into Offline and Online. The offline segment acquired the highest revenue share in the laundry care market in 2021. Specialty stores, hypermarkets, supermarkets, and independent retail stores all fall within the offline category. In the coming years, the expansion of the organized retail sector in developing economies such as India, Malaysia, and China is predicted to boost demand for laundry care products. In the coming years, the increased availability of product kinds in supermarkets and other offline distribution channels is predicted to support the offline distribution channel's growth. As a result, all of these factors are likely to increase this segment's growth throughout the forecast period.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific acquired the highest revenue share in the laundry care market in 2021. Since the bulk of laundry care products is used in this region, Asia Pacific has such a high revenue share. Furthermore, rising disposable income and an expanding population are propelling this sector forward. Expanding economies such as India and China, a growing working population, and higher spending on cleaning and laundry goods are expected to drive the market throughout the projection period. China is a significant shareholder in the Asia Pacific due to the presence of a big population seeking quick dry-cleaning and laundry care goods to preserve personal hygiene.

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; The Procter and Gamble Company is the major forerunner in the Laundry Care Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Procter and Gamble Company, Unilever PLC, Kao Corporation, Henkel AG & Company, KGaA, The Clorox Company, Reckitt Benckiser Group PLC, The Colgate-Palmolive Company, Church & Dwight Co., Inc., Godrej Consumer Products Ltd., and S. C. Johnson & Son, Inc.

» Partnerships, Collaborations and Agreements:

- Jul-2021: Unilever PLC and Arzeda Unilever entered into a partnership with Arzeda, an industry-leading Protein Design Company. Under the partnership, both companies aimed to implement the newest advances in digital biology to discover and design new enzymes. The partnership affected various companies in the cleaning and laundry global market, including Unilever's OMO (Persil), Sunlight, and Surf.

- Jun-2021: The Procter and Gamble Company and NASA Procter and Gamble joined hands with National Aeronautics Space Agency (NASA), an independent agency of the U.S. federal government responsible for the civilian space program, aeronautics research, and space research. Under the collaboration, Procter and Gamble helped facilitate the washing of clothes in the International Space Station (ISS). In addition, both organizations planned to make a fully degradable detergent that is expected to clean clothes without wasting water.

- Apr-2021: Reckitt Benckiser Group PLC and Oxwash Reckitt entered into a partnership with Oxwash, a space-age laundry and dry-cleaning startup. Under the partnership, Oxwash was allowed to utilize the new Vanish sustainable formula called Vanish 0% in its London state-of-the-art washing facilities, also known as lagoons, to provide old clothes a new life, stopping tonnes of clothes from ending up in landfills.

- Apr-2021: Kao Corporation and ChemPoint teamed up with ChemPoint, a chemical distribution company. As per the collaboration, Kao made ChemPoint its US distributor for its surfactant portfolio for the personal care, laundry, and cleaning industries. Under the collaboration, Kao expanded its distribution network and ChemPoint stayed true to its strategy to provide customers with leading surfactant solutions for personal care, home care and industrial cleaning.

» Product Launches and Product Expansions:

- Apr-2022: Kao Corporation released a couple of dry shampoos. The products were launched under their haircare brand Merit as a reaction to the increasing demand for dry shampoos that can be used on the go, including a shampoo sheet concept first developed for use in space. Kao explained that the knowledge gathered from using these products in space is expected to inform the company of more Earth-bound applications.

- Aug-2021 Godrej Consumer Products Limited, a subsidiary of Godrej Group, launched Godrej Ezee Detergent Pods, Godrej Protekt All-in-1 Dishwasher Tablets, and Goodknight Anti Mosquito Bed Nets, the first two are single-use laundry capsules and the third falls under the homecare product category. The products were launched under Godrej's digital-first brands as Godrej hoped to capitalize on the increasing shift of packaged consumer goods to e-commerce.

- Apr-2021: Godrej Consumer Products Limited, a subsidiary of Godrej Group, expanded its detergent product line by releasing Godrej Ezee 2-in-1 liquid detergent + fabric conditioner for regular clothes. This product was designed to give the benefit of both a detergent and a conditioner in one single product and thus help consumers save money.

- Nov-2020: Procter and Gamble released Ariel 3in1 PODs, pre-dosed washing capsules that are filled with concentrate liquid detergent. The product was launched under Ariel, a brand of P&G. The release of the product announced the creation of a new segment within the laundry category from P&G India.

- Oct-2020: Unilever expanded its product line by adding a clean and green laundry product. The products were released under Unilevers' various laundry brands like Omo, Persil, Skip, Breeze, Ala, Surf Excel, and Rinso. The formulation of the product contains plant-based stain removers as the company began efforts to substitute fossil fuel-derived ingredients (black carbon) with other sources like plant-based ingredients (green carbon).

- Aug-2020: Reckitt Benckiser group released Botanical Origin, a plant-based cleaning brand. Under the brand, the company launched a line of effective and affordable products

- Apr-2020: Procter & Gamble expanded its Eco-Box product line by now including more fabric care brands in smarter packaging. The Eco-Box now included Tide Original, Downy, Gain, Tide purclean, Tide Free & Gentle, and Dreft.

» Acquisition, Joint Venture and Merger:

- Jul-2021: Henkel completed the acquisition of Swania SAS, a France-based household care providing company. The acquisition enabled Henkel to solidify its position in the detergents and cleaning products market committed to limiting the impact on the environment.

- Jan-2021: Unilever formed a joint venture with Innova Partnerships called Penrhos Bio. Penrhos Bio was formed to commercialize a technology that is expected to make self-cleaning surfaces a reality. Unilever had been researching this presently patented technology for 10 years and it is developed from natural chemicals in seaweed biology and can potentially be used in a variety of situations. The technology can be utilized for stopping fungal growth in washing machines and dishwashers to self-cleaning banknotes.

Scope of the Study

Market Segments Covered in the Report:

By Product Type

- Laundry Detergents

- Fabric Softeners & Conditioners

- Laundry Aides

- Others

By Distribution Channel

- Offline

- Online

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- The Procter and Gamble Company

- Unilever PLC

- Kao Corporation

- Henkel AG & Company, KGaA

- The Clorox Company

- Reckitt Benckiser Group PLC

- The Colgate-Palmolive Company

- Church & Dwight Co., Inc.

- Godrej Consumer Products Ltd.

- S. C. Johnson & Son, Inc.

Unique Offerings from KBV Research

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- The Procter and Gamble Company

- Unilever PLC

- Kao Corporation

- Henkel AG & Company, KGaA

- The Clorox Company

- Reckitt Benckiser Group PLC

- The Colgate-Palmolive Company

- Church & Dwight Co., Inc.

- Godrej Consumer Products Ltd.

- S. C. Johnson & Son, Inc.

Table Information

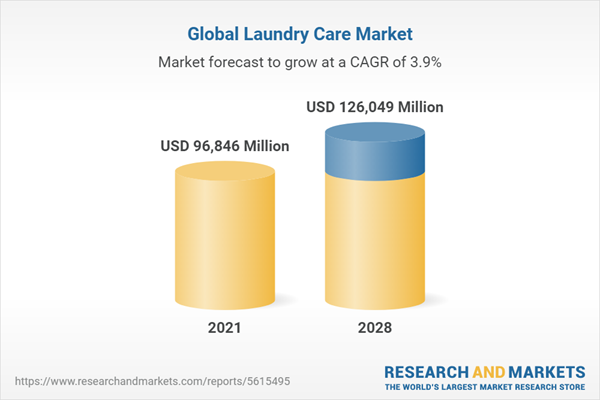

| Report Attribute | Details |

|---|---|

| No. of Pages | 171 |

| Published | May 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 96846 Million |

| Forecasted Market Value ( USD | $ 126049 Million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |